Important Notice

| 1 | Withdrawal Guide (Updated: 20 Dec 2018) |

| 2 | Exit Charge applies to the Initial Account. An exit charge will be 100% if the withdrawal made within the first 12 months of each Initial Account. The exit charge will be reduced year after year. Please refer to the product brochure. |

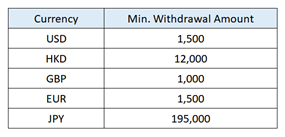

| 3 | The minimum withdrawal amount is as follow: |

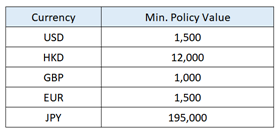

| 4 | The minimum policy value requirement after withdrawal applied is as follow. The policy value immediately after withdrawal must not be less than the minimum policy value in effect at that time. |

| 5 | For joint ownership case, please indicate the payee’s name on the Form. |

| 6 | Please indicate the account name (i.e. Initial account or Accumulation Account) and the account number (e.g. Investment Account 01/02/03/04…) on the Form. For details, please refer to the Withdrawal Guide. |

| 7 | Withdrawal should be made from Accumulation Account first, then on last-in-first-out basis from Initial Account. |

| 8 | Choose to withdraw by either Withdrawal Amount or Percentage only. Percentage must be in a whole number. |

| 9 | If withdrawal by Withdrawal Amount, please check the latest fund value before application. Heng An Standard Life will reject the application if the fund value on received date is less than the requested withdrawal value. |

| 10 | Please state ‘maximum’ on the requested Withdrawal Amount of alteration form on behalf of client’s preference is maximum withdrawal. |

| 11 | Please submit withdrawal request after the completion of other fund related transactions (e.g. switching of investment choices); otherwise, Heng An Standard Life may reject the withdrawal request. |

| 12 | If withdrawal from specific fund, please ensure the fund is still on the investment portfolio. |

| 13 | For HKD and USD policy, the withdrawal value will be paid by cheque. |

| 14 | For Telegraphic Transfer, an issuing bank charge of HK$300 will be deducted from the withdrawal amount. Please provide the bank account information on the Form. |

| 15 | Submit identity / passport document copy of the policy owner / assignee if not submitted previously. |

| 16 | Address proof is not required unless it is required by Heng An Standard Life, or OnePlatform has to conduct further verification with the client's identity. |

| 17 | All copies of original documents submitted to Heng An Standard Life must be properly certified by suitable certifiers as set out in the Anti-Money Laundering and Counter- Terrorist Financing (Financial Institutions) Ordinance. An acceptable certification should have the following features:

- The copy document is signed and dated by the suitable certifier; |

| 18 | For non-HK residence case, both the policy owner / assignee and consultant are required to sign on the certified true copy of the supporting documents. |

| 19 | How to calculate Maximum Withdrawal Value? - Maximum withdrawal value (without Exit Charge) = Accumulation Account Value - Maximum withdrawal value (with Exit Charge) = Initial Account Value - Minimum Policy Value - Exit Charge + Accumulation Account Value Illustrative Example for Harvest 101: Policy Owner makes a withdrawal at 05 Sep 2012 |

Checklist

1. Policy Alteration Form - Form A (please kindly refer to Form [P1]) - Withdrawal Guide (Updated: 20 Dec 2018) Please provide all of requested personal information. Any incomplete personal information may result in a delay or rejection in processing your request. (Updated: 5 Jun 2024)

1) Provide information about the policy: (i) Policy number; (ii) Name of Policy Owner(s); and (iii) Name of Life Insured(s)

2) Complete Section 4 Partial Withdrawal and Selecting the payment method or Section 5 Regular Withdrawal

- please tick the box of Partial withdrawal and state the Account Name and Account No.

- please tick either the box of "Withdrawal Amount" (please state the amount and withdrawal currency same as policy currency; client could put "Maximum Amount" if applicable) OR "Percentage" (please indicate the reference code of investment option and percentage / amount)

- complete Payment Method for Partial Withdrawal / Surrender

2. HK ID card / passport document copy of the policy owner / beneficial owner / assignee(s) if it has not been submitted (Updated: 29 Jul 2013)

3. Complete and return separate "Self-Certification Form" (Please kindly refer to Form [S5] / [S6] / [S7]) when apply for Partial Withdrawal, Regular Withdrawal. (If applicable)

4. CS eform

Payment Methods

Client may specify the payment currency

For policy currency = HKD or USD, the amount will be paid by cheque.

For other currency or specific request by client, the amount will be made in TT, which is subject to a charge of HKD300 to be deducted from the withdrawal amount. Please note that bank charges may also be applied by the receiving bank and SL will not be responsible for the bank charges. For TT to bank account, please ensure all bank information are fully filled. If payment currency differs from the policy currency, the relevant amount will be paid at the exchange rate determined by SLA.

Heng An Standard Life Customer Hotline: 21690300