Important Notice

1. Most documents should be submitted to NB within 26 calendar days after sign date of client.

2. All the form details must be filled in ENGLISH.

3. For Vista 2, Maturity date counted from clients next birthday.

4. For Vista, Single premium investment, 7% initial charge will be deducted from the investment amount.

5. For Vista 3, partial withdrawals can only be made anytime for Single lump sum premium. (Updated: 7 Jan 2013).

For regular contribution, partial withdrawal is not allowed within the initial contribution period.

(Updated: 4 Nov 2015)

6. Please kindly refer the details for Vista 3 "Increment after Decrement" as attached - Increment after decrement

For example: (Updated: 7 Dec 2011)

(6.1) For increments NOT exceeding the historical highest amount --> NO ICP and bonus on the increment.

(6.2) For increment exceeding the historical highest amount, e.g., $4000 --> $3000 --> $5500 Zurich will process the highlighted increment with 2 slices as below automatically as Zurich should treat the customers fairly. Below is the sample of the top up form for your reference. In addition, Zurich will also issue two top-up confirmation letter to the clients. 1st slice : $3000 --> $4000 without ICP & bonus 2nd slice: $4000 --> $5500 with ICP & bonus. The effective month of the second slice increment is normally later than the first slice.

(6.3) Top-up application form page 3 sample

7. Illustration is not required for change of top-up unless there is change of benefit/ life cover e.g. Futura. (Updated: 2 Feb 2018)

8. For consultant own case, please be reminded that the submitted FNA, IFS or Suitability Assessment are required to be signed and conducted by another consultant.

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

1. Client Data Form

2. Client Agreement (CA form)

3. Financial Needs Analysis Form

For joint owners case, TWO separated Financial Need Analysis forms to be signed and completed by policyholders.

Principal Document

1. Application Form

- Please note client’s email address & mobile number must be provided on the request form. (Updated: 22 Aug 2017)

- For Regular Premium [Vista & Futura II] - Premium change / reinstatement form ([R1])

- For Lump Sum [Futura III, IWA & Vista] - Additional single contribution (HK00016) ([A1])

- If the source of wealth comes from the spouse, please provide the spouse name and complete the origin of wealth information with the spouse’s information.

2. Financial Needs Analysis Form (HK00434)[F1] As OnePlatform FNA is a must form for top up and it is also accepted by Zurich, so it’s not a must to submit Zurich FNA form at the same time.(Updated: 5 May 2021)

3. Certified HKID Copy (It is optional if HKID submitted to Zurich before) (Updated: 18 Jul 2013)

4. Certified Address Proof (It is optional if address proof submitted to Zurich before)

- Client needs to fulfill both principal and OWM address proof requirement

- For details, please refer to OWM address proof requirement AND Zurich - Address Proof Requirement.

5. Important facts statement & Applicant's Declaration for top up application

- [Vista 2]([I8]) / [Vista 3] ([I9])

- [IWA] ([I10])

- [Futura II] ([I11])

- [Futura III] ([I12])

Regarding the remaining term in IFS for top up application - Vista 3, remaining term will be rounded up.

Please kindly refer to the below ZIO dump screen showing the remaining term. (Updated: 7 Aug 2013)

6. Risk Profile Questionnaire ([R3]

[Product Mapping Table] (The product mapping table is for reference only. Please only recommend products which are on shelf at the time you make the recommendations.) (Updated: 29 Apr 2020)

7. Suitability Assessment Declaration ([S1])

For security reason, do not copy and send the back page of credit card to SOD/Zurich.

For Bank Standing order, Zurich only accepted BSO from Hang Seng Bank and HSBC. Client needs to fill Standing Order Instruction Amendment form or client can amend the BSO instruction directly with the bank and submit a copy of the amended instruction to Zurich for record. For Hang Seng Bank, you have to use Hang Seng standing instruction form.

To ensure timely premiums payment by cheque, kindly remind and make sure your customers write the ONLY correct payee name in full, which is: Zurich International Life Limited. Please note that any Chinese payee names are NOT acceptable. If the payee name is abbreviated or incomplete, it may defer your customers’ premium payment and affect their policies. (updated: 18 Jul 2013)

General China Cases – Application should be submitted to SOD within 5 working days (Updated: 16 Aug 2016)

1. Please submit the following documents as Proof of Address:

-- Original Utilities Bills

-- Original Credit Card statement / Bank statement

-- Certified copy of the Driving License

-- Certified copy of Chinese Alien Employment Permit

2. Declaration for resident of mainland China (for top up application) ([D4]) is required.

Income proof is required for the high risk case and please refer to Origin of wealth guideline for details. (Updated: 25 Oct, 2012) -- Please provide Original Bank statement as Income Proof

(** Employer letter is not recommended as it is required to be reviewed on case by case basis and there is no guarantee for acceptance. Requirements for employer letter remains the same, i.e. original company letterhead paper, company stamp, signed by some in a position of authority, e.g. director, HR manager, and their name and capacity clearly stated)

*** With effect from 1 March 2013, the country category for China on origin of wealth guideline has been changed from 3 to 2. Besides, Zurich can only accept an original bank statement as documentary evidence of the declared origin of wealth.

For OnePlatform, there is an enhanced Origin of Wealth procedures that Zurich accepts letter from employer in China as a proof of income if the annualized premium is between USD 50,001 to USD 100,000 while Zurich remain to only accept an original bank statement as a proof of income for an annualized premium above USD 100,000.

The change will apply to applications signed on or after 1 June 2013. For any pending business where Zurich has requested additional documentary evidence on origin of wealth, Zurich will not proceed without that being received.

Documentary evidence of the declared origin of wealth will not be required if a lump sum investment or an annualised regular premium is below USD500,000 and USD50,000 respectively. This change will apply for customers who reside in China and business is negotiated through a Hong Kong distributor. *** (Updated: 5 Jun 2013)

3. Important facts statement for Mainland Policyholder (IFS-MP) ([I15]) – required for application signed on/after 1 Sep 2016

In comply with OCI requirement, all Mainland policyholder are required to complete and submit IFS-MP Form [I15] with effect from 1 September 2016. The summary of the requirement are listed below:

- applicable to all new applications, policy assignment and top up where the policy owners / assignees are holders of Resident Identity Card (PRC);

- IFS-MP needs be conducted once for one policy;

- the customer needs to sign on every page of the form and the one signed by the Mainland customers must be in Simplified Chinese which the font size must not be smaller than 12;

- policy applications from Mainland customers to insurers must be within 7 working days of the signing of the policy application (including the declaration signed by policyholder confirming that the selling process is conducted in Hong Kong);

- for ILAS product, Mainland customers have to sign both IFS-MP and IFS-ILAS; sign date of both IFS must be on or before the application sign date.

FAQ / Supplementary guideline

The minimum requirement for Increment amount

Regular Premium

[Vista 3] The minimum top-up amount per month is HKD240 / USD30 / EUR30 / AUD50

Top-up Single Premium

[Vista 3] : Minimum Top-up single premium is HKD48,000 / USD6,000.

[IWA] : Minimum Top-up single premium is HKD60,000 / USD7,500.

[Futura III] : Minimum Top-up single premium isHKD48,000 / USD6,000/ GBP4,000/ EUR4,800 (Updated: 4 Nov 2015)

| Minimum Increment Amount | ||

| Product | Regular Premium | Signal Premium |

| Vista3 | HKD240 / USD30 / EUR30 / AUD50 | HKD48,000 / USD6,000 |

| IWA | N/A | HKD60,000 / USD7,500 |

| Futura II | HKD48,000 / USD6,000 | |

| Futura III | N/A | HKD48,000 / USD6,000/ GBP4,000/ EUR4,800 |

ICP table

- For Vista 2, please refer to the ICP table for Vista 2

- For Vista 3, please refer to the ICP table for Vista 3

- Please write the no. of remaining months and top-up amount in the (2)(i) of the Disclaimer.

- The no. of remaining months can be calculated by Remaining Term Calculator.

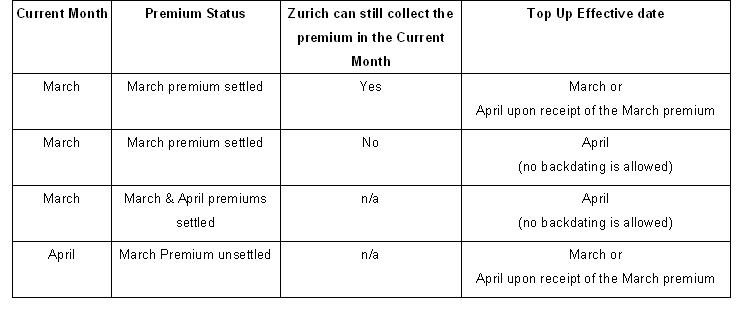

How Zurich to determine the effective date for increment? (Updated: 7 Nov 2011)

Zurich can issue the increment either from the last settled premium or the next unsettled premium due date subject to the client's request and the completion of the top up processing.

Generally speaking, if the application was submitted in the beginning of March and the March premium has been settled, the top up can still be effective from March if Zurich is still able to collect the premium in March. On the other hand, if the next HKDD run is the April primary run then we will issue with effect from April.

For your ease of reference, Zurich quoted some examples below.

** the premium collection can only be arranged upon the receipt of the completed increment documents and requirements. ***

Zurich Customer Hotline: 3405 7150 (for general enquiries ONLY)