Important Notice

1. Most documents should be submitted within 26 calendar days after sign date of client.

2. If the policy is held in trust, then the settler of the trust should sign the form.

3. If the initial contribution period is not completed and the policy is lapsed, all the outstanding premiums have to be paid by a cheque / bank draft/TT (submission of “proof of source fund” is needed where applicable).(Updated: 4 Nov 2015)

4. If a bonus is reclaimed when policy made suspended, lapse or paid-up, all the reclaimed bonus will not be paid back to the client even though the policy is reinstated.

5. For Vista 2 reinstatement cases:

There is no charge incurred for reinstatement. However, if a policy is paid up within the first five years, a paid up charge of HK$1,600 will be deducted from the account value. The paid up charge will not be paid back even though the policy is reinstated.

6. For Vista 3, no charge is required for reinstatement.

7. Zurich will reinstate a lapsed policy subject to the following criteria being met:

(a) The validity period for reinstatement from lapse is 12 months from the last missed premium (updated : 12 Oct 2016)

(b) All outstanding premiums are paid in one go

(c) It is the first request for reinstatement from lapse

(d) The requirements of the Zurich Business Acceptance Policy are met. (updated : 18 Jan 2011) (For details please refer PSTAR 722 Recommencing or reinstating Vista policies and MSPD4050 Important message (ENG)

(e). To preserve any value at the lapse date, policies will now be invested into the relevant Money Market fund in line with the policy currency. If there is no appropriate Money Market fund, any value will be invested in the USD Money Market Fund. New investment instruction MUST be advised when client reinstate the policy from lapse. (For details please refer to PSTAR 772A Recommencing or or reinstating Vista Policies) (updated: 7 March 2011)

(f). If the client is China resident, the reinstatement form must be signed in HK and proof of entry is required.

8. For policy to be reinstated from suspension or paid up, it’s not request for the PRC clients to sign the reinstatement documents in HK or submit an entry proof. (Updated: 23 Jun 2017)

9. The free accidental death benefit will cease once the policy becomes suspend/lapse and it cannot be reinstated from suspense or lapse. (Updated: 4 Nov 2015)

10. For benefit case, a Health and lifestyle questionnaire is needed.

Checklist

1. Premium change / reinstatement form ([R1])

- Please note client’s email address & mobile number must be provided on the request form. (Updated: 22 Aug 2017)

2. CS eform

3. Certified HKID Copy (It is optional if submitted previously and it is still valid. It is also subject to Zurich’s record if it should be submitted again.)

4. Certified residential address proof (Updated: 17 Jan 2014) (It is optional if submitted previously and it is still valid. It is also subject to Zurich’s record if it should be submitted again.)

Client needs to fulfill both principal and OWM address proof requirement, for details, please refer to:

OWM address proof requirement AND Zurich - Address Proof Requirement.

For customers residing in Hong Kong but not holding a permanent Hong Kong Identity Card, both

(1) suitably certified true copies of the originals of the passport (pages bearing photo, signature and the entry chop)

If client unable to provide either one of the suitably certified true copies of the originals of the full passport and national identification card, the client can provide the following to provie their nationalities: (Updated: 6 Jun 2012)

*Original of the client's signed declaration- state the reason why the client is not able to provide national ID nor Chinese passport (which are the primary document for verification); plus

*a valid Permit for Proceeding to Hong Kong and Macao (commonly know as 'One-way Permit')《前往港澳通行証》(慣稱「單程通行證」) or

*a valid Document of Identity 《簽證身份書》(commonly know as "DI") for visa purpose.

AND,

(2) Non-permanent Hong Kong Identity card bearing photograph are needed.

5. Cheque / bank draft / TT payment for all missing premiums for lapse reinstatement. (Updated: 4 Nov 2015)

To ensure timely premiums payment by cheque / bank draft, kindly remind and make sure your customers write the ONLY correct payee name in full, which is: Zurich International Life Limited. Please note that any Chinese payee names are NOT acceptable. If the payee name is abbreviated or incomplete, it may defer your customers’ premium payment and affect their policies. (updated: 18 Jul 2013)

6. Cheque payment for 1 month for reinstatement from suspense or paid up.

To ensure timely premiums payment by cheque / bank draft, kindly remind and make sure your customers write the ONLY correct payee name in full, which is: Zurich International Life Limited. Please note that any Chinese payee names are NOT acceptable. If the payee name is abbreviated or incomplete, it may defer your customers’ premium payment and affect their policies.If Method of Payment is not valid or is not provided, Zurich will NOT reinstate the policy and will raise the requirement for funds and Method of Payment confirmation. The reinstatement request will be cancelled if payment/ method of payment is not received by the Zurich within the stated time frame raised on the servicing pipeline. (updated: 5 Aug 2016)

7. New payment method instruction

1. DDA payment

Charge :

No extra charge by Zurich

Direct Debit set up charged by different banks.

Procedure :

Fill in Method of Payment Form ([M2])

2. Credit Card Payment

For security reason, do not copy and send the back page of credit card to SOD/Zurich. (Updated: 6 Dec 2013)

Charge

If the policy is a Vista II and was using credit card as payment method, there will be a 2 % credit card charge once the policy is reinstated.

If payment method is changed from HKDD to credit card payment, there will be a charge apply.

For Vista II, the credit card charge is 2%

For Vista III, the credit card charge is 2%

Procedure

Fill in Method of Payment Form ([M2])

Specify the month of contribution starting to pay by credit card at the top right hand corner. The starting date should be at least 3 weeks later from the submission date

3. Banker's Standing Order (BSO)

Zurich only accepts Bank Standing Order from HSBC and Hang Seng Bank

Charge

No extra charge by Zurich

Procedure (Updated: 4 Nov 2015)

*Please contact HSBC or Hang Seng Bank and use the bank’s own Standing Instruction form for set up.

*Any additional charge made by the bank for collection of premium will be met by the payor.

*Payments from PRC residents can only be accepted from a bank account in Hong Kong.

*Please state the policy number and the full name of the policy owner(s) as the reference to set up the standing order instruction.

*Please note that clients have to set up the standing order instruction by themselves through HSBC or Hang Seng. Once the instruction is set up, please send a certified true copy of the instruction slip to “Policy Data Management Team” at 25-26/F, One Island East, 18 Westlands Road, Island East, Hong Kong.

Lapsed Reinstatement for PRC resident (Updated: 19 May 2015)

To reinstate policy from lapse, the PRC client can request Zurich to collect all the outstanding premiums from the client's existing DDA instead of using personal cheque or bank draft.

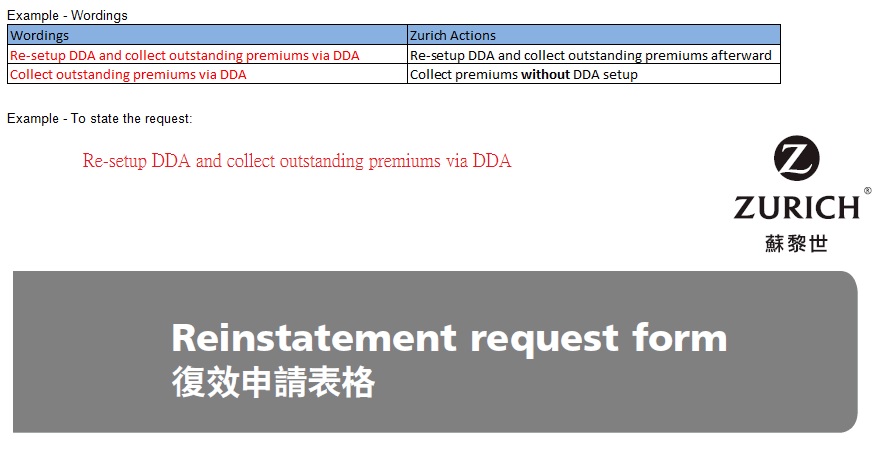

Client has to state this request clearly on the first page of the reinstatement form with specific wordings. (see example below)

(1) Reinstatement form (It must be signed in Hong Kong)

(2) Suitably Certified Proof of Identity of both policyowner and life insured.

(3) Client needs to fulfill both principal and OWM address proof requirement, for details, please refer to OWM address proof requirement AND Zurich - Address Proof Requirement. (Updated: 22 Sep 2015)

(4) Suitably Certified Proof of Entry for both life insured(s) and policy owner(s). (Updated: 25 Mar 2013)

With effect from 19 March 2013, arriving visitors to Hong Kong will be issued with a landing slip instead of an entry stamp at the immigration control points. For details, please refer to the URL of the Immigration Department.

http://www.immd.gov.hk/en/topical/non-stamping-immigration-clearance.html

1. Proof of Entry for passport holders

- Certified true copy of the passport and certified landing slip showing the conditions and limit of stay in Hong Kong, Visitor’s name, Travel document number and arrival date.

- Certified true copy of the passport showing client's name, photograph, date of birth, issued date, expiry date, signature of the client etc.

2. Proof of Entry for PRC mainland residents holding Travel Permit

For clients from mainland China, entry proof is required for both life insured(s) and policy owner(s) (2 March 2012)

Mainland Chinese residents can provide either

(A) Certified true copy of Travel Permit and a landing slip, or

(B) Certified true copy of Travel Permit and Original Hong Kong entry receipt for e-Channel plus Hong Kong Travel Permit with corresponding endorsement of e-Channel enrolment

If documentation (B) is applicable, please also check against below items for entry proof from mainland Chinese clients:

B1. The Hong Kong entry receipt must be an original

B2. The Hong Kong Entry Permit can be a certified true copy

B3. Visitor's name stated on the e-Channel receipt must match with that of the business application form, China ID Card/Passport and also the Hong Kong Entry Permit.

B4. Travel document number stated on the e-Channel receipt must match the permit number as stated on the Hong Kong Entry Permit.

B5. Hong Kong Entry Permit must be valid and endorsed with the e-Channel enrolment.

B6. Application and reinstatement form sign date must be within the period from the arrival date to the permitted deadline as stated on the e-Channel receipt. (Updated: 4 Nov 2015)

Travel Permit (Applicants of mainland China resident)

Certified true copy of the Travel Permit showing client's name, photograph, date of birth, issued date, expiry date, etc

and certified true copy of a landing slip showing the conditions and limit of stay in Hong Kong, Visitor’s name, Travel document number and arrival date. Certified true copy of Travel Permit is required for both life insured(s) and policy owner(s). (20 April 2010)

(5) A named Cheque payment for all missing premiums

To ensure timely premiums payment by cheque / bank draft, kindly remind and make sure your customers write the ONLY correct payee name in full, which is: Zurich International Life Limited. Please note that any Chinese payee names are NOT acceptable. If the payee name is abbreviated or incomplete, it may defer your customers’ premium payment and affect their policies. (updated: 18 Jul 2013)

(6) A Method of Payment Form

*** With effect from 1 March 2013, the country category for China on origin of wealth guideline has been changed from 3 to 2. Besides, Zurich can only accept an original bank statement as documentary evidence of the declared origin of wealth.

For OnePlatform, there is an enhanced Origin of Wealth procedures that Zurich accepts letter from employer in China as a proof of income if the annualized premium is between USD 50,001 to USD 100,000 while Zurich remain to only accept an original bank statement as a proof of income for an annualized premium above USD 100,000.

The change will apply to applications signed on or after 1 June 2013. For any pending business where Zurich has requested additional documentary evidence on origin of wealth, Zurich will not proceed without that being received.

Documentary evidence of the declared origin of wealth will not be required if a lump sum investment or an annualized regular premium is below USD500,000 and USD50,000 respectively. This change will apply for customers who reside in China and business is negotiated through a Hong Kong distributor. *** (Updated: 5 Jun 2013) If the amount is above this threshold, a signed Origin of Wealth is needed.

Zurich Dormant Case (Updated: 16 June 2017)

- To handle reinstatement of dormant case, please refer to “FAQs – Zurich Dormant Policy [English] [Chinese]” (Updated: 28 Sept 2017)

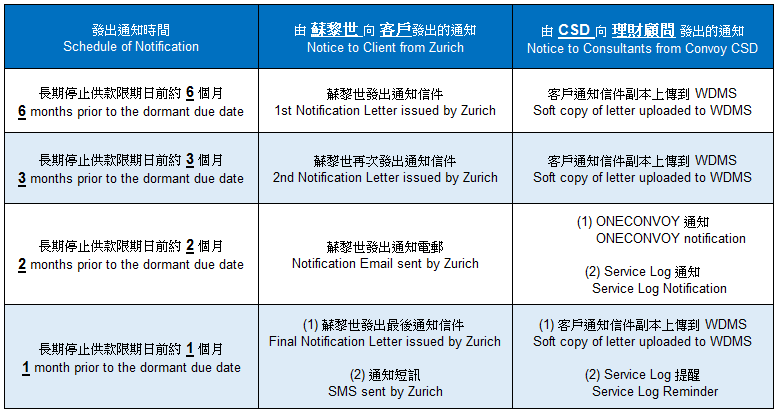

- Summary of Notification (Effective from Jun 2017*):

* Before Jun 2017, Zurich sends one notification letter (6 months prior to the dormancy due date) and one SMS reminder (1 month prior to the dormancy due date) to the client directly.

Note:

As Zurich remind OnePlatform again in early Aug 2018 that the non-refundable dormancy charge will be deducted from the value of the policy after dormancy, and concession for dormancy charge reversal will no longer be considered by Zurich.

Please click here for details . (Updated: 5 Sep 2018)

- Client Notification Letter/SMS Sample (Old – before Jun 2017):

- “Don’t let your savings get away” (6 months prior to the dormancy due date)

- Client Notification SMS Sample

- Client Notification Letter Sample (New – Effective from Jun 2017):

- “Important notice” [Eng] [Chi] (6 months prior to the dormancy due date)

- “2nd reminder” [Eng] [Chi] (3 months prior to the dormancy due date)

- “Final reminder” [Eng] [Chi] (1 month prior to the dormancy due date)

- Client Notification Email Sample (New – Effective from Aug 2017) (Updated: 28 July 2017)

- The policy list of dormancy can be found in OnePortal > News> Zurich (Provider). (Updated: 10 May 2022)

Zurich Customer Hotline: 3405 7150 (for general enquiries ONLY)