Note: Initial premium / payment is NOT mandatory. The principal will issue pending for reminding of premium settlement after underwriting decision.

For the payment method, please refer to Payment Method Guideline. (Appendix I /Appendix II) (Updated: 18 Jun 2019)

Payment Frequency:

1) Monthly

2) Quarterly

3) Semi-annual

4) Annual

5) Single Premium (not applicable to Credit Card payment) - Subject to the availability of individual product

Payment Method

(1) All transactions of premium paid to Prudential are required to submit a new form of Broker Payment Instruction Worksheet ([B2])

(2) New Payment Channel – HSBC Internet Banking & JCB For Payments (Effective from 17 April 2018) (Updated: 4 May 2018)

(3) New Payment Channel – OCBC Wing Hang and New Payment Arrangement of China CITIC Bank. For documents mentioned, please refer to [Notification for the payment of OCBC Wing Hang] ([N2])/[OCBC Deposit Slip]/[OCBC Transfer Slip]/[Premium Payment Booking Form]

Notes for (3):

- Make sure to fill the consultant’s OnePlatform registered email address under “Broker Firm Email Address” of Premium Payment Booking Form, then the booking confirmation email will be sent to consultant’s email directly. (Updated: 5 Nov 2019)

- With effective from 20 Aug 2018, informed by China CITIC Bank International, the cash payment limit of each policy will be enhanced from HKD $100,000 to HKD $120,000, other payment rules will remain unchanged. (Updated: 27 Aug 2018)

- Further to the launch of payment service at OCBC Wing Hang Bank in May, Prudential has enhanced arrangement effective 3 September 2018, more details please refer to Prudential - Payment Service Enhancement - OCBC Wing Hang Bank Payment (Effective 3 September 2018) Kwun Tong Branch will be merged into Hoi Yuen Road Branch with effect from December 6, 2021 (Monday).(Updated: 26 Nov 2021)

- Notice from OCBC Wing Hang Bank, its Tsimshatsui East branch has been merged to Tsimshatsui on 21 October 2019. Please note that Tsimshatsui East branch at the current location will cease their operation with effect from 19 October 2019. OCBC branches will accept the payment of life insurance policies in USD and RMB. Kwun Tong Branch will be merged into Hoi Yuen Road Branch with effect from December 6, 2021 (Monday). More details please refer to Prudential - Payment Service Enhancement - OCBC Wing Hang Bank Payment. (Updated: 26 Nov 2021)

For Initial Premium (Updated: 5 Dec 2014)

- 2 months premium payment for monthly payment mode

1) Cheque - Payable to “Prudential Hong Kong Limited" (Updated: 4 Mar 2015)

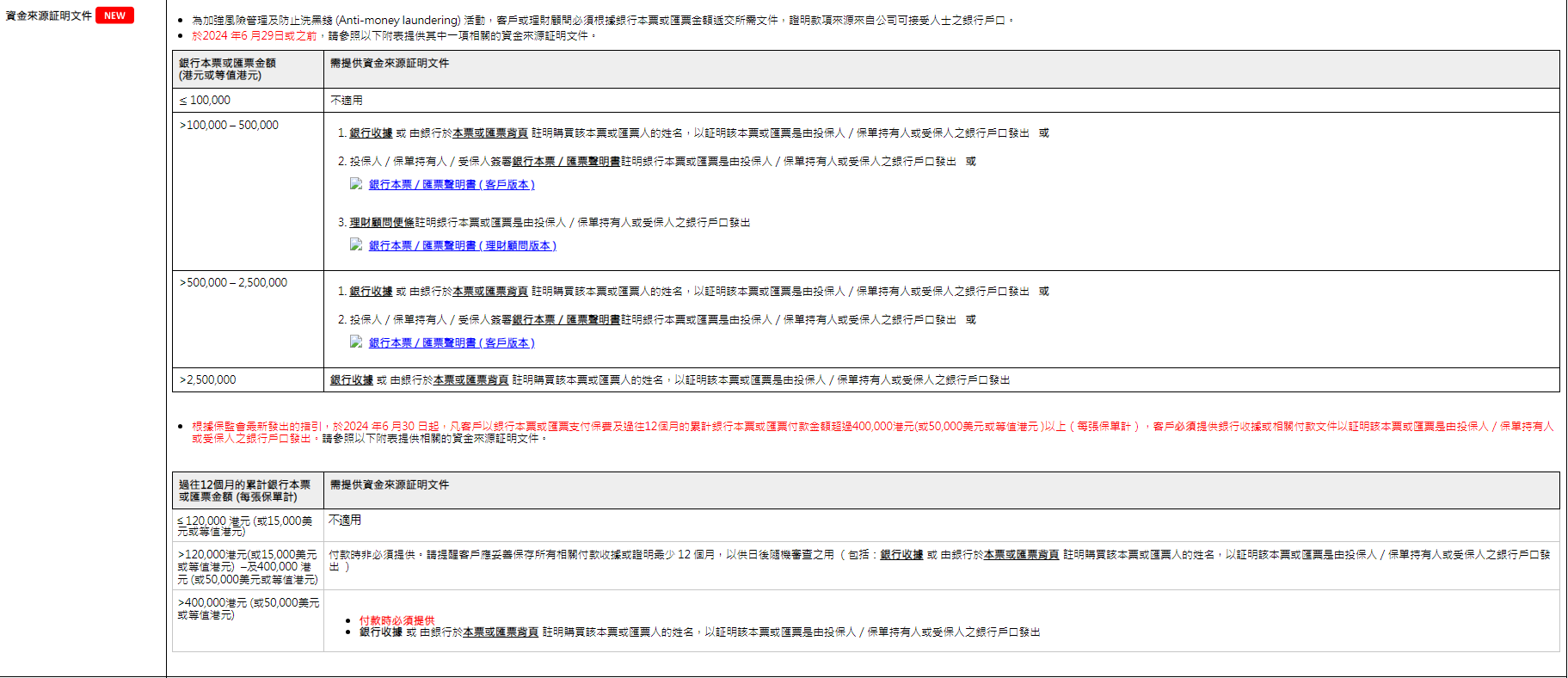

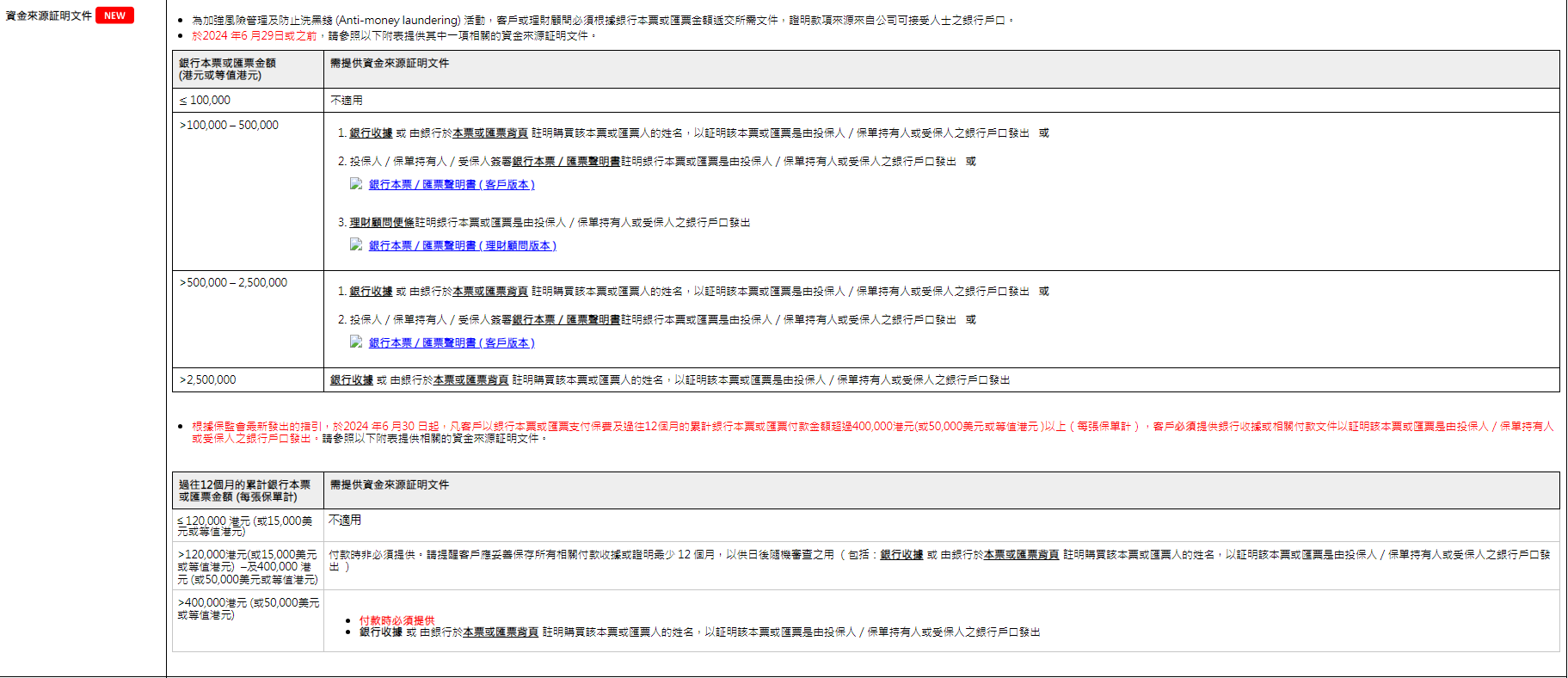

2) Bank Draft (Updated: 27 Jun 2024)

3) Credit Card (applicable for initial payment only but NOT single premium)

- Visa / Master card only

- Credit Card Authorization Agreement

- It is only accept one authorized credit card authorization agreement for each premium payment. Agent's Memo To Life Admin ([A9]) (with reason) is required for more than one agreement (e.g.: If client need to use 2 or above credit card authorization agreement to settle the premium) with consultant signature. (Updated: 16 Apr 2015)

- Multiple credit card authorization will not be accepted (Updated: 16 Apr 2015)

- All printed personal information on client's credit card must be transferred to the Credit Card Authorization Agreement (Updated: 16 Apr 2015)

- Please clearly fill in the required credit card information and verify the cardholder 's signature (Updated: 16 Apr 2015)

- Credit card details are required to be imprinted clearly on the payment slip, such as Name, Card Number and Valid Date on the card (Updated: 19 Oct 2015)

4) Bill payment service via online banking of Bank of China (Hong Kong) (Updated: 25 Feb 2016)

- The daily transaction limit is HKD1 million or equivalent amount of USD or RMB.

- The daily transaction limit refers to all bill payment transactions made via online banking during the day (including the transactions made but not only limit to Prudential). Besides, Bank of China (Hong Kong) can revise the transaction limit from time to time without any advance notification.

- The daily transaction limit of online banking is subject to the setting of each individual bank account. Please contact the bank for enquiry and adjustment of the daily transaction limit.

- For payment settled in USD and RMB, it is only applicable to USD account and RMB account holders.

5) PayThruPost

- When making payment, customer has to present a complete and undetached “Premium Notice”, “Premium Reminder Notice”, “Premium Overdue Notice” or “Proposal Outstanding Premium Notice” (a new document being rolled out) to post office staff for verifying payor’s information and printing receipt. Payor must be the proposer / policyholder/ life assured. If the payment is made before the cut-off time of the post office (i.e. before 6 p.m., Monday to Saturday), the payment record will be reflected in the policy account in the next working day.

- FAQ (Updated: 18 Jun 2019)

6)Cash(Refer to renewal payment item 8)

For Renewal Premium

1) Change of Payment Mode and Direct Debit Authorization Form - Bank Account ([C4])

For monthly payment mode

The debit date will be on 6th of each month.

If any failure or rejected cases, 2nd round of direct payments will be made on 20th of each month

If the date falls on Saturday, Sunday or a public holiday, the debit date will be postponed by one business day.

2) Cheque

Payable to “Prudential Hong Kong Limited" (Updated: 4 Mar 2015)

3) Bank Draft

4) Change of Payment Mode and Direct Debit Authorization Form - Credit Card ([C2])

Accept Visa / Master Card issued by Standard Chartered Bank only.

DINERS / AMERICAN EXPRESS are not acceptable

5) Bill payment service via online banking of Bank of China (Hong Kong) (Updated: 25 Feb 2016)

- The daily transaction limit is HKD1 million or equivalent amount of USD or RMB.

- The daily transaction limit refers to all bill payment transactions made via online banking during the day (including the transactions made but not only limit to Prudential). Besides, Bank of China (Hong Kong) can revise the transaction limit from time to time without any advance notification.

- The daily transaction limit of online banking is subject to the setting of each individual bank account. Please contact the bank for enquiry and adjustment of the daily transaction limit.

- For payment settled in USD and RMB, it is only applicable to USD account and RMB account holders.

6) Online payment UPOP – UnionPay Online Payment (Updated: 1 Aug 2016)

- Policyowner can simply logon myPrudential life insurance account, connect to UPOP via myPrudential and pay renewal premium online with registered UnionPay card for their life insurance policy.

- All transactions are paid in HKD only. Customer will be charged an administration fee of 1.2% of premium payment amount for each successful online payment transaction.

- Upper limit of each transaction is HKD 38,000 (inclusive of administration fee).

- register by 1. Complete online registration of UnionPay card on myPrudential; or 2. Submit the completed registration form "Registration Form for Pay Premium Online with UnionPay Debit Card / Credit Card via my Prudential" ([R1]) (Form code: (UPOP) LAPA/PRMUPO) For details, please see Notice 1, Notice 2 and Consultant Guide

7) PayThruPost

- When making payment, customer has to present a complete and undetached “Premium Notice”, “Premium Reminder Notice”, “Premium Overdue Notice” or “Proposal Outstanding Premium Notice” (a new document being rolled out) to post office staff for verifying payor’s information and printing receipt. Payor must be the proposer / policyholder/ life assured. If the payment is made before the cut-off time of the post office (i.e. before 6 p.m., Monday to Saturday), the payment record will be reflected in the policy account in the next working day.

- FAQ (Updated: 18 Jun 2019)

8) Cash(Premium Payment Methods at Cashier) (Updated: 07 Oct 2021)

1.‘’Premium Payment via Financial Consultant Authorization Request Form’’

If customer who is the policyowner not residing in Hong Kong, he / she can apply for authorizing the Insurance Broker or relevant Technical Representative to pay premium payment. The Insurance Broker or relevant Technical Representative may submit the completed “Premium Payment via Financial Consultant Authorization Request Form [P3] ” to Cashier via email for approval by the company, the email address is indicated on the form

Upon the pre-approval, Cashier staff will contact the authorized Insurance Broker or relevant Technical Representative

We only accept the authorized Insurance Broker or relevant Technical Representative to make the payment made by Cashier’s Order/Bank Draft or Telegraphic Transfer. Upon the pre-approval by Company, the authorized Insurance Broker or relevant Technical Representative may submit Cashier’s Order/Bank Draft or Telegraphic Transfer together with the supporting document of source of funds

Upon the approval of payment, the authorized Insurance Broker or relevant Technical Representative may then inform customers to pay back and provide the supporting document of source of funds#

Remarks:

*The authorization shall not have effect until the request is approved by the Company. Approval must be obtained before any premium payment transaction made by the authorized Insurance Broker or relevant Technical Representative. The authorized Insurance Broker or relevant Technical Representative must not collect any funds from policyowners before the request is approved.

#Premium must be submitted to the Company immediately and no later than 48 hours after receipt form policyowners. Any undue delay of premium submission would be considered as non-compliance and thus subject to disciplinary action as appropriate.

2.The Insurance Broker or relevant Technical Representative may make cash payment on behalf of customers for New Business within 3 working days of each month (with the maximum limit of HKD7,800 / USD1,000 per NB policy)

May pay the initial premium in cash for customers within the last 3 working days of each month, with the maximum limit of HKD7,800 or USD1,000 per NB policy.

3.Cash payment limit for Policyowner:

Maximum limit is HKD120,000 / USD15,000 per policy per model premium

Third Party Payment

Third Party Payment Declaration Form ([T1])

If applicable (Acceptable Relationship: Spouse/Parent/Children/Sister/Brother/ Grandparent)

For payment equivalent to or above HKD200,000, a copy of ID / Passport / travel document of the account holder must be submitted. (Updated: 25 Feb 2016)

Note:

One application should only follow one payment method. One cheque is for one application or one Credit Card Agreement Authorization is for one application form. (Sample updated: 1 Sept 2014)

Not allow split payment on one application. Multi-cheque and multi-credit card payments for one single application / policy are not acceptable.

Examples:

- One application form with one credit card authorization agreement attached.

- Three application forms with three cheques or three credit card authorization agreements attached.

Lump Sum Payment: (Updated: 16 Aug 2016)

For client who would like to pay lump sum premium by Credit Card, administration fee will be charged on broker. Broker cheque and Broker cheque request form is required.

Prudential Customer Hotline: 22811333