Note: Initial premium / payment is NOT mandatory. The principal will issue pending for reminding of premium settlement after underwriting decision.

Please refer to Updated Payment Channels (Updated: 8 Jan 2025)

Online Change of Payment Mode/Method (Updated:26 Jul 2022)

For PRC customers, RMB cheques and bank draft drawn in Hong Kong is also accepted for policies in HKD / USD currency for ALL product. (Updated: 28 Oct 2014)

For Skyline

Payment Method

-

Personal Cheque

-

Bank draft (with receipt)

Payment (for all products except Skyline)

-

Initial payment (preferred 3 months premium; at least 2 months required)

For the below products, there will be additional cost for payment of initial premium with VISA and MasterCard with effect from 1 July 2015, please refer to the memo for more details: (Updated: 12 Jun 2015)

- Single premium products;

- ManuJoy;

- Top-up premium of ILAS;

- Pre-payment of future premium

- Renewal payment (Updated: 17 May 2022)

| *For credit card slip, please don't fill the authorization code and date because all amend area should need client's countersign (i.e. amend the date) (Updated: 3 Nov 2017)

*PPS Merchandiser Code of Manulife: 9138 For more information regarding PPS, please call 24-Hour PPS Hotline : 900 00 222 329 |

||

| *Jetco Merchandiser Code of Manulife: 9119 | ||

| *For CUP, pre-approval is required; please contact 2510-3267 for approval process | ||

| *For Cash payment in convenience store, maximum limit: HKD5,000 - {Notice} (Updated: 24 Jun 2016) | ||

| *For China UnionPay Online, Renewal modal premium of up to HKD38,000(2) or equivalent (Applicable to ManuTerm Plan, Personal Accident Plan, ManuGuard, Medical Plan, ManuMaster Healthcare Series, ManuShine Healthcare Series*,Disability Income Protector), please refer to IFP Bulletin [ENG] [CHI]. (Updated: 6 Dec 2016) |

Direct Debit Authorization (DDA) (Updated: 18 May 2017)

Autopay Debit Days

Autopay debit dates for first time Direct Debit Authorization (DDA) set up are as follows:

| Policy Year Date | Debit Date |

| 1st - 19th | 3rd |

| 20th - 28th | 14th |

Third Party Payment

1. Third party payment is not accepted if the third party payor does not have any apparent connection with the policy owner. The rule is applicable to all types of payments including but not confined to payments by cash, cheque/draft, credit card, casher's order and bank auto pay.

2. Third party is defined as any person other than the policy owner. life insured, beneficiary or the payer under the payor Benefit.

Regardless of payment amount, all bank draft/cashier's order must be accompanied with

Receipt of bank draft/cashier's order issued by the bank with the name of payer printed on it, or Endorsement by the bank at the back of the bank draft/cashier's order showing the identity (name) of the payor.

3. For payment with cheque, draft or cashier's order, please fill in the bank name and cheque/draft number in the space provided.

4. For third party payment in cheque or credit card, i.e. ther current account or credit cardholder is neither the policyowner nor (proposed) insured, please tick the checkbox beneath "Client Information" section and state the third party information, specifically, Name", "Relationship with policyowner" and "Reason(s) for payment on policyowner's behalf" in the space provided.

Payment Tips:

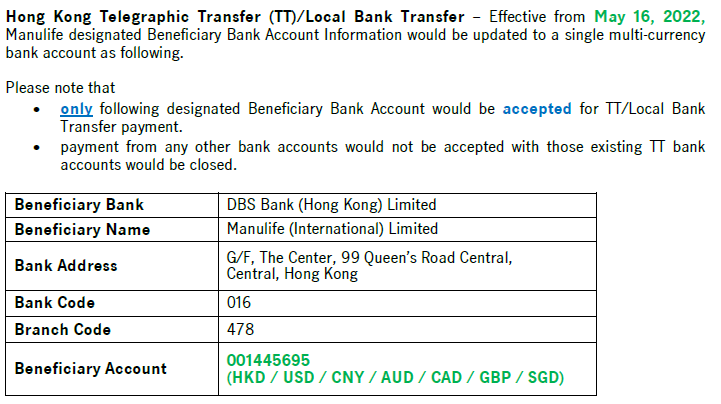

- Telegraphic Transfer (T/T) Premium Collection Payment Instructions in Different HK Banks (Updated: 16 Oct 2024)

Manulife Customer Hotline: 21081188 / 25103941