As per HSBC Anti-Money Laundering Policies, the initial payment must happen after HSBC complete Customer Due Diligence. Available payment methods include:

如客人未能於遞交投保申請時同時繳交首期保費,請於後補支票或相關繳費證明時,附上「補充保險申請書資料表格」並提供相關繳費資料。

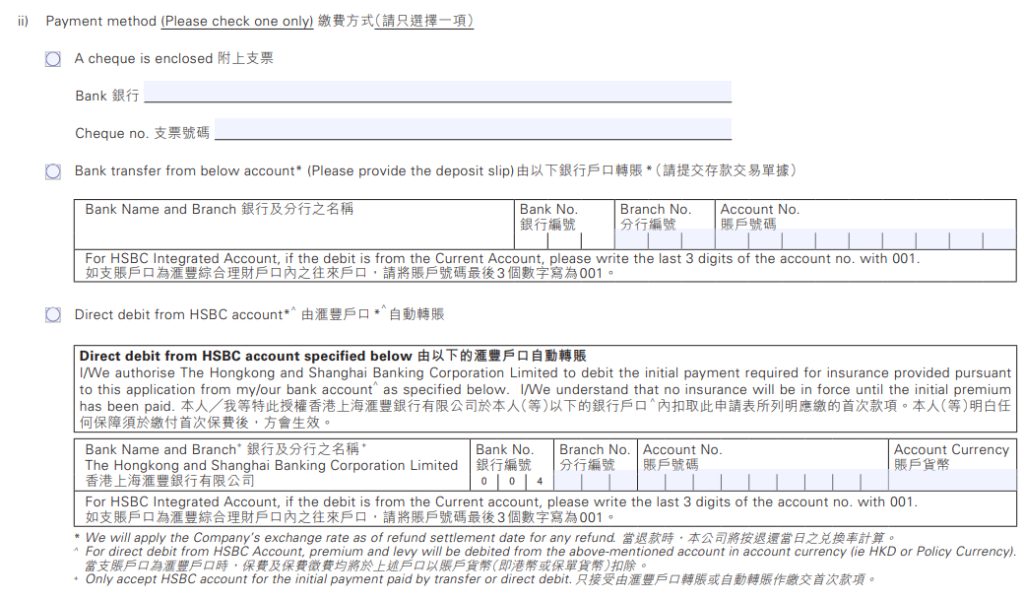

你可參考「匯萃保障相連保險計劃申請表」第五頁「繳費方法」,把相關繳費方法的資料全部寫於「補充保險申請書資料表格」。

例子1: 客人需後補繳交支票,「補充保險申請書資料表格」填寫資料如下:

客人確認首期保費的繳費方法是支票。

銀行: HSBC

支票號碼: 00001

例子2: 客人經銀行戶口轉賬首期保費後,需遞交繳費證明及「補充保險申請書資料表格」,填寫資料如下:

客人確認首期保費的繳費方法是經銀行戶口轉賬。

銀行及分行名稱: 恆生銀行 / 筲箕灣分行

銀行編號: 024 / 分行編號; 013 / 賬戶號碼: 3-012385 (Updated: 16 Aug 2023)

1. Crossed Cheque

- Payable to “HSBC Life (International) Limited”

- Please put down insured’s name and policy no. (if available) at the back of the cheque

- Please make a copy of the cheque on a blank A4 paper and submit the cheque and the cheque copy together with the application documents

- HSBC will deposit it after underwriting greenlight is granted

2. Cashier order/demand draft

- Payable to “HSBC Life (International) Ltd” after underwriting greenlight is given. By bank-in to HSBC bank account: 511-339822-001(HKD) / 511-339822-201(USD) with policy number marked in “Narrative”

- Please provide i) purchase proof of cashier/demand draft with payor’s name shown and ii) deposit slip or any related bank-in proof to HSBC Life

3. Bank Transfer

- Payable to “HSBC Life (International) Ltd.” By bank transfer to HSBC bank account: 511-339822-001(HKD) / 511-339822-201(USD) with policy number marked in “Narrative”

- Please provide deposit slip or any related payment proof

- Do NOT bank in before underwriting greenlight. Consultants should notify clients to make bank transfer after receiving HSBC’s underwriting greenlight.(Unless client is HSBC customer, see Scenario 1 & 2 ).(Updated: 10 Jan 2024)

HSBC Customer (only accept HSBC bank account holders, HSBC credit card holders are excluded):

Scenario 1: Make transfer by HSBC bank account

Client can settle initial premium and no need to wait for underwriting greenlight. Consultant just need to fill-in the payment details in application form and submit the payment proof together with the NB application.

Scenario 2: Make transfer by non-HSBC bank account

Client can settle initial premium and no need to wait for underwriting greenlight. Client needs to show the original valid bank account proof note to consultant and consultant need to submit a broker memo for declaring the verification of original valid bank account proof.

Broker memo MUST write the following wordings: “I, TR full name (IA license number) have witnessed the valid supporting proof provided by customer full name on attestation date (DD/MM/YYYY) and confirmed that he/she is HSBC bank account holder.”

Note:

Valid HSBC bank account proof:

• Bank statement issued by bank within latest 3 months

• Bank letter issued by bank within latest 3 months

• Bank passbook showing latest transactions within latest 3 months

• Screen capture on bank account from online/mobile banking

4. FPS (Faster Payment System)

- QR Code for payment via Faster Payment System to “HSBC Life (International) Limited”

- Only applicable to HKD payment

- Please input the amount to be paid in HKD

- Payment in the subsequent days can be done if daily limit exceeded

- FPS Payor Name must match the payor declared at application form

- Please provide screenshot or FPS confirmation email as payment proof

5. Direct Debit from bank account

- Direct Debit from HSBC bank account is applicable to both initial and subsequent premium payment

- Direct Debit from non-HSBC bank account is only applicable to subsequent premium payment

- Bank Name, Branch, Bank no., Branch no., Account no., Account currency and Account Holder’s signature are required

- There may be bank charges for each unsuccessful transaction, subject to the arrangement of individual bank

6. Standing Instruction

- Only applicable to subsequent premium payment

- Only applicable to non-HKD policy

Please use exchange rate of USD1=HKD7.88 for conversion

Third Party Premium Payor (Updated: 29 Feb 2024)

The payor must be one of the following:

Policyholder, Policyholder’s parent, legal spouse, sibling, children, grandparent, grandchild, legal guardian, ultimate beneficial owner*, sole proprietor, partner*, settlor, parent company** or subsidiary**.

* Own more than 50% shares (If more than 50% shares are collectively owned by multiple family members under the same family, written declaration signed by the policyholder on their relationship is required)

** Direct relationship and the parent company own more than 50% shares

If annual premium payment of this policy is equal to or greater than USD120,000 (or other currency equivalent), please submit the following payor’s identity proof and relationship proof as applicable:

Identification Proof

Individual as the Premium Payor other than Policyholder or Proposed Insured

• Certified copy of Permanent or non-permanent HKID Card. For non-HKID cardholders, a certified copy of Passport with entry proof to HK on the date of signing initial Application Form. Mainland Chinese nationals or residents are also required to provide certified copy of PRC ID/passport/travel permit

Corporation as the Premium Payor

• Certified copy of Certificate of Incorporation

• Certified copy of HK Business Registration Certificate (for company not registered in HK, then a certified copy of equivalent business registration document if applicable)

• Certified copy of Company Search dated within 6 months on the Policyholder (for company not registered in HK, then certified copy of Certificate of Incumbency dated within 6 months)

Relationship Proof

• Certified copy of Birth Certificate

• Certified copy of Marriage Certificate

• Certified copy of Certificate of Incorporation

• Certified copy of NAR1 – Annual Report

• Certified copy of Power of Attorney proof with relationship which issued by lawyer

• Certified copy of declaration certified by Home Affairs Department or Notary Public

(Updated: 9 Aug 2023)