Note:

1. Initial premium / payment is NOT mandatory. The principal will issue pending for reminding of premium settlement after underwriting decision.

2. For major changes of policy service requests (e.g. “Unscheduled Contribution”, “Premium on Deposit”) which are categorized by “Risk Type” and the “Risk Type” is calculated by total premium or payment amount. The details of document requirements of each “Risk Type”, please refer to Appendix 1 of Memo No.LALAD180615.

3. Payor must either be applicant / policy owner, insured or beneficiary of the application / policy. Payor other than applicant / policy owner, insured or beneficiary of the application / policy will be classified as 3rd party payment. No 3rd party payment is allowed. (Updated: 16 Jul 2018)

4. Please state the policy number on the payment slip to avoid further pending requirements. (Updated: 3 May 2021)

Payment Frequency: Monthly, Annual

Initial Premium: At least 2 Months'Premium for monthly payment mode.

Payment Method (For Chubb Life Insurance Hong Kong Limited.)

1. Cheque

Cheques should be crossed (A/C Payee Only) and made payable to 'Chubb Life Insurance Hong Kong Limited’ with the policy number and the name of the Insured on the back of the cheque. (Updated: 13 Dec 2023)

2. Bank Transfer/Bank's Deposit

The premium can be credited to Chubb Life Insurance Hong Kong Limited account by the Automated Teller Machine (ATM) or at a branch of the Hong Kong and Shanghai Banking Corporation Ltd. (HSBC).

*Please send the original bank-in slip to Chubb after making the deposit. (Updated: 13 Dec 2023)

| For policies previously underwritten by Cigna Worldwide Life Insurance Company Limited, e.g. Invest Plus Life Insurance and Platinum Choice | ||

| HSBC (HKD) | 808-194971-001 | 808-194971-002 |

| HSBC (USD) | 808-194971-201 | 741-185250-201 |

3. Cash Payment at our Cashier Office

35/F, Chubb Tower, Windsor House, 311 Gloucester Road, Causeway Bay

With immediate effect from 24 Jul 2019, the cash payment limit at Chubb’s Cashier is increased to HKD100, 000 per policy per day.

| Payment Amount | Requirements |

| Each payment ≥ HKD120,000 (or USD15,384 equivalent)

Max. aggregate annual amount* to be accepted = HKD400,000 (or USD51,282 equivalent) *Calendar year from 1 Jan to 31 Dec of the year |

Payment proof needed to confirm origin of payment, such as:

|

4. For TT Payment

Remittance can be made to the following bank accounts.

Bank: The Hong Kong and Shanghai Banking Corporation Ltd.

Payee Name: Chubb Life Insurance Hong Kong Limited

Bank Address: No. 1 Queen's Road, Central, Hong Kong

Bank Code: 004

Swift Code: HSBCHKHHHKH

| Bank Account Number: | For policies previously underwritten by Cigna Worldwide Life Insurance Company Limited, e.g. Invest Plus Life Insurance and Platinum Choice | |

| HSBC (HKD) | 808-194971-001 | 808-194971-002 |

| HSBC (USD) | 808-194971-201 | 741-185250-201 |

*All remittances should be provided with the policy number, policyowner name and premium amount in remittance application. The bank charges is borne by the payor.

5. PPS

Payment can be transferred directly to pay the premium from the designated bank account, using any tone phone or via the internet, 24 hours a day.

Chubb Life Insurance Hong Kong Limited merchant code is ''9139''.

*For previous Chubb Life Insurance Company Ltd customer

application submit before 30 June 2023, the merchant code is 「9212」

application submit after 1 July 2023, the merchant code is 「 9139」

Premium Payment via the Internet: visit www.ppshk.com

Payment Bill Registration using a Touch Tone Phone: dial 18011 (English)

Premium Payment using a Touch Tone Phone: dial 18031 (English)

PPS Service Hotline: (852) 2311 9876

6. Autopay

Can be made by bank account or credit card. Please contact Customer Service Center at (852) 2992-7120 for more details.

7. For single credit card transaction (Updated: 12 Jun 2019)

One Off Payment-Credit Card Payment Authorization Form ([O1]) [Sample]

- Payment using AMEX card other than initial premium, administration fee of 1.8% would be charged.

8. Cashier Order (Updated: 7 Aug 2024)

| Payment Amount | Requirements |

| For payment ≥ HKD400,000 (or USD51,282 equivalent) including:

1) Cashier order submitted / mailed to Chubb Office AND 2) cashier order with payment deposited to Chubb Company bank account |

Payment proof needed to confirm origin of payment, such as:

|

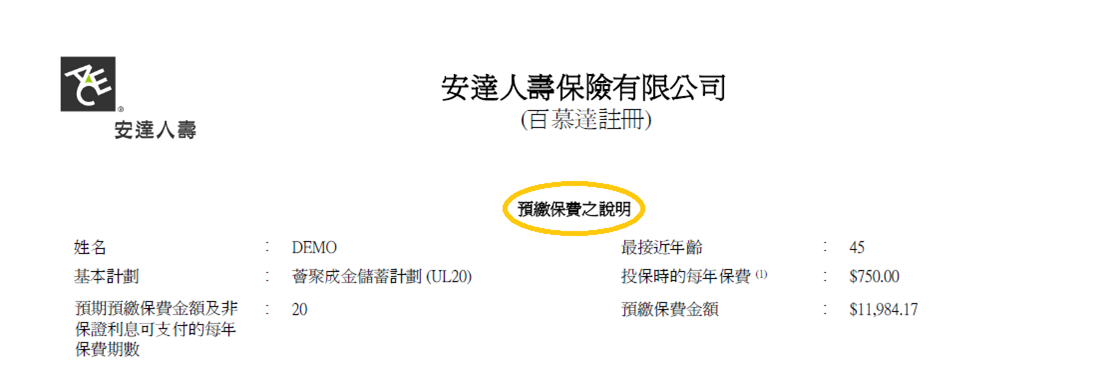

Pre-payment (Updated: 26 Aug 2014)

can be up to 20 years

pre-payment interest is 2.5% (NOT guaranteed)

| Payment Method | Single Premium Plan | Regular Premium Plans |

| Deposit (bank-in slip) | Y | Y |

| Client personal cheque

payable to "Chubb Life Insurance Company Ltd."; issued by owner / insured / beneficiary |

Y | Y |

| Bank Draft | Y | Y |

| Bank Transfer (with slip) | Y | Y |

| T/T Payment (with T/T copy) | Y | Y |

| Credit Card (VISA/Master only)

for initial premium payment only |

N | Y |

| China Union Pay Debit Card (Not accepted from 29 Oct 2016)

for PRC client only, client needs to come to Chubb Life (ACE) Tower at 35/F, Office, Office, Windsor House, Causeway Bay) |

N | Y |

| BEA/ BOC Credit Card Interest-free Instalment Programme | N | Y |

| Hang Seng Credit Card Interest-Free Instalment Plan

For planned annual premium equals US$1,500/ HK$12,000 or above |

N | Y |

| Subsequence Payment | Regular Premium Plans | |

| Annual payment mode | Monthly payment mode | |

| Deposit (bank-in slip) | Y | N |

| Client personal cheque

payable to "Chubb Life Insurance Company Ltd."; issued by owner / insured / beneficiary |

Y | N |

| Bank Draft | Y | N |

| Bank Transfer (with slip) | Y | N |

| T/T Payment (with T/T copy) | Y | N |

| Direct Debit Account

for the bank accounts in HK only 2019 Bank Account & Credit Card Autopay premium collection Schedule (Updated:10 Jan 2019) |

Y | Y |

| Credit Card (VISA/Master only) | N | N |

| China Union Pay Debit Card (Not accepted from 29 Oct 2016) | N | N |