Broker Code:0500291

Product List

Traditional Life Insurance International Term Assurance (Shelved on 23 Apr 2020)

Preferred Choice (Shelved on 23 Apr 2020)

***Important Notice*** 1. All the form details must be filled in ENGLISH. Chinese is also acceptable except the parts about personal details and employer information.

2. Maturity date counted from clients next birthday.

3. Zurich only accepts Hong Kong residents and Mainland China (PRC) residents application from OnePlatform.

4. ITA : The additional benefits critical illness and / or permanent and total disability

Preferred Choice:

a. Policy must include at least one core benefit at all times.

b. Joint life cases – benefits selected for life one will automatically applied to life two except WOP.

c. Benefits change is not applicable within the first 12 months of policy issue.

d. Core benefits contribute to the multi-benefit discount; add-on benefits do not contribute to the multi-benefit discount.

5. The certifier CANNOT be the relative of the policy owners or life insured. Please arrange the unrelated third party to certify the documents.

6. (i) ITA - Minimum Levels of Cover and payment

(ii) Preferred Choice – Benefits Amount Limits

Preferred Choice - Minimum Monthly premium

Preferred Choice – Benefit Options

7. Application will be automatically NTU'ed once it has been pending for the outstanding requirement for over 90 days from the application receipt date.

8. Policy start month

(i) ITA

Please note that Zurich will apply the following rule to determine the start month

for a regular premium payment policy.

- Initial premium received on or before the 15th of a month --> 1st of that month

- Initial premium received after the 15th of a month --> 1st of the following monthExample:

Initial Premium Received Start Month 5 June 2014 1 June 2014 15 June 2014 1 June 2014 20 June 2014 1 July 2014 (ii) Preferred Choice

Policy start date will be the risk date or the cash receipt date whichever is the later. It cannot be backdated or be a future date regardless of what type of benefits have been selected.

9. Product Note for ITA & Preferred Chocie

10. For Pre-underwriting service provided by Zurich, Consultant please submit the below via SOD as normal:

* Full set of application

* Original signed Pre underwriting declaration ([P5])

* Mark the policy number on the application form cover (for sum insured HK $3M or above)

11. New Business Guideline (Updated: 19 Dec 2017)

All NB application should be submitted to SOD within 25 calendar days after signed; while PRC cases should be submitted to SOD within 5 working days with effect from 1 Sep 2016.

12. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

13. For consultant own case, please be reminded that the submitted FNA, IFS or Suitability Assessment are required to be signed and conducted by another consultant.

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

- Client Data Form

- Client Agreement (CA form)

- Financial Needs Analysis Form

For joint owners case, TWO separate Financial Need Analysis Forms to be signed and completed by policyholders.

Principal Document

Hong Kong Resident

1. Application form - Agency code: 0500291

Please note client’s email address & mobile number must be provided on the request form. (Updated: 22 Aug 2017)

(i) International Term Assurance Application form [Bilingual version] ([I4])

ITA new business checklist (Updated: 7 Jan 2019)

(ii) Preferred Choice Application Form [Single Life(HK00003) ] OR [Joint Life(HK00004) ] ([P6])

*The policy owners and life insured may delete both the paragraphs 3 and 4 (in italics) of the Declaration section on the application form to indicate their wish to opt-out altogether. E.g. if a customer puts a cross next to paragraph 3 or just deletes 1 word, we would interpret it as an opt-out for use and transfer.

2. Personalized illustration

- All details on illustration must match application, no amendment is allowed on the illustration.

- Personalized illustration can be generated from ZAP (https://zap.zurich.com.hk) (Updated: 25 Sep 2015)

- Zurich to carry out suitability checks for ITA and Preferred Choice, a one-page Suitability Assessment Questionnaire is attached with the ZAP illustration. Please ensure all questions are answered by the customer(s) and the questionnaire is duly signed and dated. **(If customers have selected critical illness protection, ‘Preparation for health care needs’ must be ticked)** (Updated: 11 Apr 2017)

- OnePlatform consultant apply Non-Investment linked policy oneself (i.e. ITA and Preferred Choice):

- For Nil Commission (=premium discount): Illustration with NIL Commission and OnePlatform consultant Supplementary Form ([C7]) which must be signed by the consultant and AD with OnePlatformy Stamp. (Update: 9 Sep 2015)

3. Certified Proof of Address

- Client needs to fulfill both principal and OWM address proof requirement,

- For details, please refer to OWM address proof requirement AND Zurich - Address Proof Requirement

4. Certified Proof of Identity

- Payment Method for "Initial Payment" and "Subsequent Payment"

- Third Party Payment –Third Party Payment Form (HK00111) ([T1]) must be completed. Suitably certified copy of ID and proof of address for the third party must be submitted with proof of relationship. Please refer to MPS10433 Guide to understanding ZILL’s AML requirement for acceptable relationships.

- Proof for initial premium (if needed)

- If DDA is a joint-named account, please write the both account holders’ name and ID number on the DDA page. And DDA bank a/c number should be 7-9 digits excluding bank code and branch code.

6. Lives / Additional lives insured Application Form ([L2]) – This form should be submitted if Life Insured is different from the policy owner. Both policy owners’ signatures are required for Joint owners policy.

7. Customer Protection Declaration Form ([C5]) – This form should be submitted if client declares “Yes” in the Replacement Declaration on the Application Form.

8. Origin of wealth guidelines and questionnaire (HK00143) ([O1]) – Please refer to this guideline and complete this form for high risk customers, income proof is needed.

9. Financial Needs Analysis Form (HK00434)[F1] – [Product Mapping Table] As OnePlatform FNA is a must form for new application and it is also accepted by Zurich, so it’s not a must to submit Zurich FNA form at the same time.

10. Supplemental Document - Declaration for Data Protection for Zurich International Life Limited (HK00274) ([S5] ) (If new application form version 01/19 is used, no need to submit this form.)

PRC Resident (Additional documents)

1. Entry proof

PRC residents must submit the following documents as entry proof. For details, please refer to points to note

- the certified true copy of Travel Permit 《通行證》;

- landing slip

A proof of entry is required for further submission of the following outstanding requirements for Mainland China new business unless the outstanding requirement submitted was signed and dated within 7 days from entry to Hong Kong. (Update: 7 Sep 2015)

- Supplementary/forms/documents which require client's signature, for example, signed illustration, questionnaires, declarations, Customer Protection Declaration, etc

- Any certified true copy documents, for example, proof of address, proof of identity, Financial Needs Analysis (FNA), etc

2. Declaration for residents of mainland China ([D3])

3. Declaration for intermediaries in relation to business conducted with residents of mainland China ([D2]) (China applicants only)

4. Important facts statement for Mainland Policyholder (IFS-MP) ([I15]) – required for application signed on/after 1 Sep 2016

(Additional documents if applicable)

1. Financial requirement

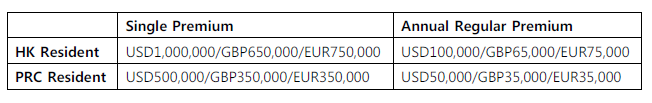

Income proof is needed to support the information given in the Origin of Wealth if the premium exceeds the amount below:

Please note: the premium indicated above include any contributions to existing policies.

Please note: the premium indicated above include any contributions to existing policies.

For Detail, please refer to Origin of wealth guidelines and questionnaire (HK00143) ([O1])

2. Important facts statement for Mainland Policyholder Requirement

Point to note:

- applicable to all new applications, policy assignment and top up where the policy owners / assignees are holders of Resident Identity Card (PRC);

- IFS-MP needs be conducted once for one policy;

- the customer needs to sign on every page of the form and the one signed by the Mainland customers must be in Simplified Chinese which the font size must not be smaller than 12;

- policy applications from Mainland customers to insurers must be within 7 working days of the signing of the policy application (including the declaration signed by policyholder confirming that the selling process is conducted in Hong Kong);

- for ILAS product, Mainland customers have to sign both IFS-MP and IFS-ILAS; sign date of both IFS must be on or before the application sign date.

FAQ / Supplementary guideline

- Zurich Q & A

- For Details of Foreign Account Tax Compliance Act, please refer to Zurich FATCA FAQ

- A customer guide for anti-money laundering requirements for details.

- Preferred Choice new business checklist (Updated: 7 Jan 2019)

- For more details, please refer to ITA Technical Factsheet (Updated: 11 Apr 2017)

- For ITA temporary life cover terms and condition, please refer to here

Special Case

For the following cases, New Application Supplementary Form is needed.

- If client's residential address is the same as his office address, please submit the New Application Supplementary Form for stating the reason for that.

- If the country of residential address of client is different from the address of employer (includes places among Hong Kong, Mainland and Macau), please submit the New Application Supplementary Form to explain the details.

For Beneficiary, Zurich suggest appointing beneficiary after policy issue.

Zurich Customer Hotline:3405 7150 (for general enquiries ONLY)