**AIA do not accept our NB submission since 09 Mar 2024**

(Updated: 11 Mar 2024)

Broker Code: 61462

NF2F Update: Hong Kong Insurance Authority(IA) announced that the non-face-to-face sales process has ceased after 30 April 2023, a one month transitional period (e.g. 1 May to 31 May 2023, subject to provider) will therefore be provided to allow sufficient time for provider to complete the underwriting process. (Updated: 03 May 2023)

Product List

For more detail, please kindly refer to Product List Table (Updated: 7 Feb 2024)

Important Notice

1.Consultants must register PD Corner Access ID (individual login) before signing applications and POS forms; otherwise, AIA will not process the application. To apply access ID, please refer to OnePortal>User Guide of Portal - AIA.

2. New Business Submission Checklist - Traditional Life Products (Updated: 6 Apr 2018)

3. Operation Rules and Guidelines for Broker [Part 1] (Updated: 2 Jun 2020) & Operation Rules and Guidelines for Broker [Part 2] (Updated: 24 Dec 2019)

4. Application forms and related documents must be submitted to OnePortal within 10 calendar days after sign date of client except PRC clients. For PRC client, Application forms and related documents must be submitted to OnePortal within 5 calendar days.

5. To obtain policy number before your submission, you may visit IFA & Broker Corner > e-Service > Request Policy No.) Appendix for Residency Rating Summary (Updated: 2 Jun 2020)

6. Policyowner - Below are the eligible policyowner

Husband/wife can be the policyowner of his/her spouse

Child (adult) can be the policyowner of his/her parents^

For juvenile cases, parent or grandparent^ must be the policyowner^

^For ILAS policies, adult child and grandchild as insured are NOT applicable. (Updated: 10 Jan 2020)

7. Nationality & Residence Table for CEO Medical 5 /CEO Pearl Medical 5 and CEO Essence 2 / CEO Essence Pearl 2 [ENG]/[CHI] (Updated: 26 Feb 2018)

8. Guidelines related to Nationality (Application by Japanese resident or Japanese passport holders. For details, please refer to Revised Underwriting guidelines for Japanese Residents and / or Japanese passport holders (New Business)) (Updated: 26 Sep 2019)

9. If client wants to date back the policy date, please check the box in Application “Special Request” and put the desired policy effective date. For details, please refer to Ref: A2015038 Policy Date Back Rules & Applicable Products (Updated: 9 April 2015)

10. Effective from 16 September 2019 till 31 December 2019 (for 1st time new business submission only), if customer applies for 2 policies at the same time and related product is Bonus Power Plan 3 and/or Protect Elite Ultra 2, it is only required to fill out and submit one set of application form and related forms. (Updated: 20 Sep 2019)

11. Occupational class: please search by AIA link : https://www3.aia.com.hk/application/iocs/internalLogin.do?UserID=hpsrpfb&Domain=AIA

12. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePortal’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

13. If there is no acknowledgement received after 68 calendar days from policy delivery date, physical copy will be reprinted to customers and HK200 will be received from Technical Representative (Effect from 5 February 2021).

Checklist

(OnePortal Internal Document and Principal Document are required to be submitted)

OnePortal Internal Document

| 1. | Client Data Form |

| 2. | Client Agreement (CA form) |

| 3. | Financial Needs Analysis Form

** Starting from 5 Feb 2021 (with reference to application sign date), both of OnePortal FNA and Financial Summary (AIA FNA) must be submitted with the application form. Please print the relevant forms by the technical representatives in IFA & Broker Corner (Download path: IFA & Broker Corner > Resource Center > Forms Download) (Updated: 5 Feb 2021) Refer to AIA product mapping (please login AIA website: https://www3.aia.com.hk/IFA/en/index.jsp > Resource Center > FNA Corner > Link to Product Mapping) Sample of On Your Side Plan & On Your Side Plan - First Gift (Updated: 25 Jul 2023) [Product Mapping] (Updated: 11 Apr 2022) Sample of Fortune Promise 2 (Updated: 06 May 2022) Sample of Brighter Tomorrow (Updated: 18 May 2022) Sample of Metro-Trio / Metro-Trio Pearl Medical & Critical Illness Protection Plan (Updated: 27 Oct 2022) Sample of Global Power Multi-Currency Plan 2 (Updated: 06 Apr 2023) Sample of Cancer Guardian 3 / Cancer Guardian Pearl 3 Series (Updated: 01 Nov 2022) Sample of AIA Assemble (Updated: 07 Jun 2023) Sample of Global Power Multi-Currency Plan 3 (Updated: 16 Jan 2024) Sample of PAC Select 3 (Rider) (Updated: 7 Feb 2024) |

Principal Document

Hong Kong Resident

| 1. | Application Form

A) Life and Personal Accident Insurance Application Form ([L3]) Sample Application Form - Secure First Plus (Updated: 5 Feb 2021) Sample Application Form - Admire Life 2 + Rider VHIS (Updated: 5 Feb 2021) Sample Application Form - Protect Elite Ultra 3 (Updated: 5 Feb 2021) Sample Application Form – On You Side Plan (Updated: 19 Sep 2023) Sample of Global Power Multi-Currency Plan 2 (Updated: 19 Dec 2023) B) Accident & Health Insurance Application Form ([A12]) For 105 Premium Refund-AMR, China Assist Protection Plan, Flexi-MediCuard, Grand VIP (HK applicant), Lady Care Pro, Super Adults Shield, Super Health Guard Pro, Super Kids Shield, Super Seniors Shield and Travel Smart only C)For Wealth Preserver 5 and Ultima 2, please refer to High Net Worth (HNW) Underwriting and Operations Technical Guide [Eng] [Chi] (Updated: 5 Mar 2021) and Application Booklet (Updated: 25 Jul 2016) D) Simplified Underwriting Form - On Your Side Plan series First Gift ([S9])

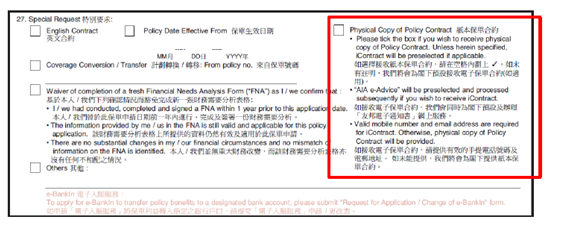

Put down Policy Number, IA number, consultant name, staff code and mobile number in the top of Page.1. AIA will not process the applications if mentioned information uncompleted and will return all the forms to OnePortal. (Updated: 15 Mar 2017) Write 61462 in the broker code boxes Tick “Non-medical” on the top-right corner for non-medical cases (Medical cases refer to those cases that Q34 – Q43 are not required to answered) Mobile number and email address are required when customers fill in the application form. If the information cannot be provided, customers should give explanation in question 27. “AIA e-Advice” will be preselected and processed subsequently upon the acceptance of iContract.

If customer prefers the physical copy of policy contract, please tick the box of “Physical Copy of Policy Contract” under question 27 “Special Request”. Upon policy issue, the policy contract will be delivered to the policyowners via usual channel. Policyowners are required to return the Policy Acknowledgment Receipt (PAR) within 30 days from the policy issue date or acknowledge the receipt of the contract through Customer Corner.

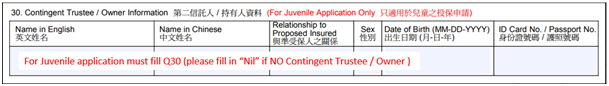

For Question 30, please fill in “Nil” if NO Contingent Trustee / Owner (for juvenile application, insured <18)

|

||||||

| 2. | Financial Summary (FNA) [F1] [Guideline] [Product Mapping Table]

- Important Facts Statement - Premium Financing [I13] (for premium financing case only) [Memo] (Updated: 18 Nov 2022) Product Mapping of Serene Life & Serene Life (Annual Dividends) (Chi/Eng) (Updated: 26 Oct 2021) Sample for AIA-Admire Life 2 + rider VHIS (Updated: 15 Apr 2021) Sample for AIA-Bonus Power Vantage (Updated: 15 Apr 2021) |

||||||

| 3. | Important Facts Statement - Policy Replacement (Chi)(Eng) [I11]

If any answer is “Yes” or “Not yet decided” for policy replacement declaration on the Application Form |

||||||

| 4. | Personalize Illustration (Company Copy), if applicable

Proposal must be signed within 14 calendar days from the proposal print date No illustration is required for NO cash value products (e.g. CEO Medical plan, Super Good Health, Cancer Guardian/ Cancer Guardian Pearl) Except those applies for Vitality Program. From 5 June, 2020 onwards, the proposals of Secure First (with 1-year premium waiver) and Secure First Plus (with 1-year premium waiver) will be added into PGS. Customer signature is required at the last page of the proposal whereby duly-signed proposal is required for application of these products. More details please refer to [Memo]. (Updated: 8 Jun 2020) |

||||||

| 5. | Copy(ies) of Identity document(s) with certified by Consultant – for Proposed Insured and/or Applicant

|

6. Address proof is not required unless it is required by AIA, or OnePortal has to conduct further verification with the client’s identity. (Updated: 24 Oct 2017)

7.e-BankIn and Direct Debit Authorisation For Bank Account Application ([E1]) / Direct Debit Authorisation for Credit Card Account ([D5])

Initial Premium Payment (3 Months premium)

Payment Declaration Form – Bank Draft ([P7]) (if payment by Bank Draft for premium amount from USD30,000-USD150,000 for NB)

Payment Declaration Form - Company Account ([T1]) (if payment by Company remittance/ cheque for amount > USD5,000)

Declaration Form for Cash Payment and Payment Form for New Policy ([D14]) (if cash payment exceeding USD15,000)

9.AIA Representative / Broker Confidential Report ([A6]) – for Non-Income Group policyowner and the insured is another person

10.Source of Wealth Declaration ([S2])

For Non-Income Group (Housewife/ Student/ Retiree/ Unemployed) or Moderate and High Risk Group, details please refer Source of Wealth Checking (Updated: 6 Nov 2018)

For pre-paid premium which is 2 years or above, the total sum of premium will be calculated as Aggregated Single Premium. Please refer to AIA - Revised the Threshold for Source of Wealth Checking. (Updated: 8 Oct 2019)

This form can be waived if Financial Questionnaire is completed

| Super Good Health 2 | Basic Plan and Rider |

| CEO Essential Medical Series 2 | Basic Plan and Rider |

| Cancer Guardian Series | Basic Plan and Rider |

| Superior Critical Illness Plan Pro | Basic Plan and Rider |

| Grand VIP | Basic Plan |

11.Financial Questionnaire ([F2]) and Income proof / Asset proof

Please refer to Broker Category “Ruby” of Financial Underwriting Requirements [ENG]/[CHI] (Updated: 20 Apr 2023) /AML Guideline (Updated: 20 Jan 2017).

12.Broker Letter

Total Life Sum Assured > USD2,000,000

13.Individual AIA Vitality Membership Application Form ([I2])

PGS (Found in Vitality Corner in AIA Website) includes respective “AIA Vitality Series” Plan

Annual AIA Vitality Membership Fee HKD430 paid together with premium

Email address and mobile phone no. must be provide on Application Form or Individual AIA Vitality Membership Application Form

Only apply for below products: (Updated: 29 May 2017)

14.Form and Documents for Grandparent Application (Juvenile case - Grandparent as owner)

• ID copy of both Insured’s parents

• Relationship proof between the Insured and grandparent Applicant

• Grandparent as Owner – Trustee Declaration ([G1]) (signed by grandparent Applicant)

• Grandparent as Owner – Authorization Letter ([G2]) (one is signed by grandparent Applicant and another is signed by Insured’s parent)

• Grandparent as Owner – Consent Letter ([G3]) (signed by Insured’s parent) [should NOT be signed before application date]

***Apply to HKID Card Holder and PRC Client

15.Voluntary Health Insurance Scheme (VHIS) Supplementary Form ([V1])

- Required only if the application is a VHIS plan

16. Amendment to Application for Policy for Xtra ([A23])

- Required only if the application is a Xtra Protect

17. Covid-19 Recovery Questionnaire ([C8])

- Applicable for COVID-19 recovered patients to supplement information [Memo] (Updated: 25 May 2022)

18. Effective from 12 November 2022 (based on application date), if it is known that the mobile phone number of the Applicant is the same as that of other policyholders, the Applicant can verify through [Memo]:

- iPoS “Policy Application Online Check” function with One-Time-Password (OTP) to verify; or

- Submit copy of valid identity proof by Hong Kong/Macau mobile service provider (e.g., Mobile phone bill statement); or

- Submit Amendment to Application For Policy – Shared Mobile Number Form [A25] to provide reason of share mobile phone number. (Updated: 15 Nov 2022)

19. Effective from 8 April 2023 (based on application date), if the Applicant’s email address is identical to the email address of another policyowner, the Applicant can verify through [Memo]:

- iPoS “Policy Application Online Check” function with One-Time-Password (OTP) to verify ;or

- Use the iAmendment function with Remote Signature service to confirm Applicant’s email address; or

- Submit Amendment to Application For Policy – Shared Email Address [A26] to provide reason of share email address.(Updated: 17 Apr 2023)

20.For Bonus Power Vantage / Global Power Series:

If the aggregated Single Premium per insured exceeds US$1,000,000 in 6 months (shared with Global Power Multi-Currency Plan and Bonus Power Vantage), the Policy Owner needs to sign and submit the Bonus Power Vantage / Global Power Series – Special Declaration Form [B3]

21. Amendment Form for Politically Exposed Person * For All application with paper form submission [A2]

Non-HK Permanent Resident (Additional Documents)

1. AIA HK shall require the following identity documents of the applicant who holds a HKID card but has not obtained the Hong Kong Permanent Resident status.

- HKID card copy and,

- A valid travel document (e.g. an unexpired international passport, Exit-entry Permit for travelling to and from Hong Kong and Macau for Official Purposes, etc). or

- A relevant national identity card bearing the individual's photograph; or

- Any government or state-issued document which certifies nationality.

2. Amendment Form for Politically Exposed Person * For All application with paper form submission [A2]

For Overseas Client - Exclude PRC Client (Additional Documents)

| Age 18 or above | Passport Copy (Information Page)

Landing slip issued by immigration Dept |

| Juvenile | Birth Certificate copy |

Declaration from Non-Hong Kong Cardholders ([D11])

Amendment Form for Politically Exposed Person * For All application with paper form submission [A2]

PRC ID Holder

For PRC ID Holder case, please refer to the checklist under AIA PRC Business Guideline

- Declaration from Non-Hong Kong Cardholders ([D11])

- AIA Important Fact Statement for Mainland Policyholder ([I3])

- Address Proof if the correspondence address is in Hong Kong

- Age 18 or above :

1) PRC ID Card (both sides) Copy; and

2) Travel Documents: - Passport Copy (Information Page) or Copy of Exit-Entry Permit for Travelling to and from HK & Macau (Information Page) and Visa Permit; and

3) Landing slip issued by Immigration Dept.

Juvenile : Birth Certificate copy or "戶口證明"

Acknowledgement to Application of Policy (For MCV customer) [A21]

1) applying CEO Pearl series or Cancer Guardian Pearl series; or

2) Insured is HK-born juvenile or HKID cardholder and Applicant is MCV parent to apply the related plans

Amendment Form for Politically Exposed Person * For All application with paper form submission [A2]

Medical requirement / FAQ

- Medical Underwriting Guide (Chinese version) (English version) (Updated: 1 Nov 2019)

- For Routine Medical Requirement [ENG]/[CHI], please refer to the Broker Category “Diamond” (“D”). Please refer to Blood Profile for reference. (Updated: 27 Apr 2018)

- Non-Medical Limits and Guaranteed Issue Offer (GIO) Simplified Issue [ENG]/[CHI] (Updated: 26 Feb 2018)

- Non-Medical Limit of Wealth Series. (Updated: 12 June 2017)

- GLOSSARY FOR COMMON (Updated: 26 Feb 2018)

- FAQ-Communication with Medical Professionals Regarding Simple Surgeries (Updated: 22 Feb 2017)

- Supplementary Medical Underwriting Guidelines for Cancer Guardian Series / Cancer Guardian Pearl Series (Updated: 16 Apr 2015)

- Ref A2017313 - Metro-Trio Medical & Critical Illness Protection Series FAQ (Updated: 27 Nov 2017)

- Ref A2020332 - 3-Step Guide for simple surgeries and Medical Coverage for diagnostic imaging tests done at outpatient settings / List of simple surgeries (Updated: 03 Sep 2020)

Financial requirement / FAQ

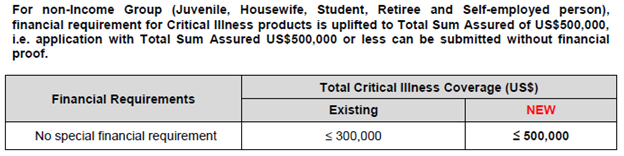

- Underwriting Rules for non-income group (Housewives, Juveniles, Students, Retirees and Unemployed),please refer to Financial Underwriting Requirements [ENG]/[CHI] (Updated: 20 Apr 2023)

- With effective from 01 April 2018, underwriting rules for non-Income Group is revised as follow:

- Frenquently Asked Question on Anti-Money Laundering and Counter-Terrorist Financing (FAQ)

- New Operation Requirements For Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance (Hong Kong Only) - [Examples] (Updated: 27 May 2015) - Basic Documentation Requirements (Updated: 3 Jun 2015)

- Financial Underwriting Requirements [ENG]/[CHI] (Updated: 20 Apr 2023)(Broker Category is the highest “Diamond” for OnePortal) (Updated: 18 Oct 2017)

- AML Guideline [Risk Based assessment for Individual Insurance]

Supplementary guideline / FAQ

General Guidelines

- For details of underwriting pending requirements, please refer to New Business - Most Common Underwriting Pending Requirements. (Updated: 21 Aug 2017)

- POS Guidelines[ENG]/[CHI] (Updated: 26 Feb 2018)

- High Net Worth POS Guidebook (Updated: 20 Dec 2018)

- Standard Illustration for Non Unit-linked Life Policies' for Traditional plans (i.e. company copy) & FAQ (Updated: 27 Oct 2014)

- IA Levy Frequently Asked Questions (Updated: 21 Dec 2017)

- Ref: A2017340 Guidance Note 16 ("GN16") – Financial Needs Analysis (“FNA”) Affordability Checking, Appendix I (Updated: 28 Dec 2017)

- PD Corner User Guideilne (Updated: 1 Feb 2018)

- For iVerify, please refer to Guide for iVerify - Optical Character Recognition (Updated: 16 Jul 2018) and the Subject: (Ref: A2018059) Reminder on iVerify (Updated: 9 Mar 2018)

- AIA Vitality Series Insurance Plan Operational Guideline (Updated: 14 May 2021)

AIA Customer Hotline: 22328888