Broker Code: LY455

Important Note: Please use consultant's individual TR code for applying the new business. (Updated: 08 Apr 2024)

Product List:

| Life Plan | Flexi-ULife Prime Save | PrimeWealth Saver(PWS)[Product closure on 29 Jan 2019] | Flexi-Ulife Prime Saver Insurance Plan (FP) | LifeDeluxe Insurance Plan (LD)(Updated: 29 Jul 2022) | LifeDeluxe for Future (LDF)(Updated: 29 Jul 2022) |

| Critical Illness

|

Critical Illness Supreme 100+ Premium Refundable Plan (LPCI) | PrimeHealth Saver 100+ (PHS)[Product closure on 7 Oct 2023] | Comprehensive Cancer Benefit (CCB) | Prime Health Extra Saver (PHE)(Updated: 6 Aug 2015) | PrimeHealth Extra Care (PHC)[Product closure on 7 Oct 2023] |

| PrimeHealth Saver 1000 [Product closure on 14 Aug 2024] | Prime Health Diabetes Care (PDC)[Product closure on 13 Sep 2025] | PrimeHealth Saver 500+(PS 500+)[Product closure on 31 Dec 2021] | PrimeHealth Cancer Saver [Product closure on 13 Sep 2025] | ||

| PrimeHealth Pro [Product closure on 14 Aug 2024] | PrimeHealth Jr. Care [Product closure on 14 Aug 2024] | PrimeHealth Pro (Essential)(Launch Date: 01 Dec 2023) | YF PrimeHealth Pro (Signature) (Launch Date: 19 Aug 2024) | YF PrimeHealth Pro Jr. Care (Launch Date: 19 Aug 2024) | |

| CritiCare Continuation Diabetes Insurance Plan (Launch Date: 28 Aug 2025) | CritiCare Continuation Cardio Insurance Plan (Launch Date: 28 Aug 2025) | CritiCare Continuation Cancer Insurance Plan (Launch Date: 28 Aug 2025) | |||

| Retirement Plan

|

Target Annuity Saver (TAS)[Product closure on 31 March 2015] | Target Lifetime Annuity Saver (TLA) [Product closure on 30 Sep 2018] | Guaranteed-Lifetime Immediate Annuity (GIA)[Product closure on 31 Jul 2018] | MY Lifetime Annuity (MLA) [Product closure on 18 May 2023] | MY Lifetime Immediate Annuity (MIA)(Launch Date: 23 Jul 2018) |

| Generations Saver (GS) (Launch Date: 23 Jul 2018) | MY Deferred Annuity (MDA) [Product closure on 4 Jul 2022] | MY Deferred Annuity 2 [Product closure on 16 Dec 2024] | |||

| Endowment | Infinity Saver (IS) (Product closure on 13 Mar 2020) | Infinity Saver 2 (IS2) (Product closure on 19 Apr 2021) | Guaranteed Return Saver (GRS) (Product closure on 27 Aug 2020) | Infinity Saver 3 (Product closure on 04 Jan 2024) | Infinity Wealth Builder (Product closure on 01 Jun 2022) |

| Infinity Saver 3 (2-year pay) (Product closure on 31 Mar 2023) | Beyond Infinity Savings Insurance Plan (Launch Date: 17 Nov 2025) | ||||

| Saving Plan |

Target Education Saver (TES)[Product closure on 31 March 2015] | Target Education Smart Saver (TSS)[Product closure on 30 Sep 2018] | Infinity Wealth Builder 2 (Launch Date: 10 May 2022) | MY Flexi Generations Saver (Launch Date: 28 July 2023) | InfinityEnrich Wealth Builder [Product closure on 1 Nov 2023] |

| Prosperous Infinity Saver (Launch Date: 2 Feb 2024) | InfinityEnrich Wealth Builder 2 (Launch Date: 16 Oct 2024) | 5-Year GoalAhead Saver [Product closure on 19 Jun 2025] | |||

| Accident & Disability | Refundable Accident Protector (RAP)[Product closure on 18 May 2023] | 360 Global Accident Protector (Launch Date: 13 Mar 2023) | 100% Reward For You Accident Protector (Launch Date: 29 Aug 2023) | ||

| Medical |

VIP Worldwide MediCare (Launch Date: 9 Dec 2019) | Prestige MediCare (Launch Date: 8 Jan 2020) | TaxVantage Medical Plan (Launch Date: 19 Mar 2020) | TaxVantage Plus Medical Plan [Product closure on 01 Sep 2025] | TaxVantage Prestige Medical Plan(Launch Date: 29 Mar 2022) |

| E+ Medicare & Supplementary Major Medical Benefit (Rider)

(Launch Date: 07 Mar 2025) |

|||||

| Whole Life | Preeminence(PWL) (Launch Date: 3 Jul 2020) | ||||

| Term | The Guaranteed Acceptance Policy (Launch Date: 15 Oct 2020) | ||||

| Accident | Comprehensive Accident Benefit Plus [Product closure on 20 January 2023] | ||||

| Annuity | MY Flexi Lifetime Annuity (Launch Date: 28 July 2023) | MY Deferred Annuity 3 (Launch Date: 23 Jan 2025) |

Important Notice

1. Application must be submitted to SOD within 10 calendar days from sign date. For PRC resident, all documents must be submitted to YF Life within 2 working days from sign date. (Updated: 27 Aug 2019)

2. Plan Currency: USD / HKD only (PWS Plan Currency: USD only)

3. Entry Age Limit (last birthday)

| LPCI/ PHS/PHE/PHC | 0-65 for 10 Years Plan / 0-60 for 15 Years Plan / 0-55 for 20 Years Plan |

| CCB | 18-50 as Basic plan / 18-55 as Rider |

| GS | 0-17 |

| MIA | 55-75 |

| MLA | 18-70 |

| RAP | 0-60 for Plan 1 /18-60 for Plan 2,3 or 4 |

| FP | 0-75 |

| PWS | 0-65 |

4. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

5. In order to ensure the proposed policy owner has reviewed and agreed to the contents filled in the policy application documents, the proposed policy owner must sign at the designated area on the forms. In addition, please remind the proposed policy owner for endorsement in appropriate places for the following scenarios:

1) If any content on the form is being amended/revised, the proposed policy owner is required to counter-sign close to the revised part as confirmation;

2) If there is more than one type of handwriting on the form (such as part of handwritten content and part of computer-printed content), the proposed policy owner is required to sign on the lower right corner of each page of the form as confirmation. (Updated: 8 Feb 2021)

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

1. Client Data Form

2. Client Agreement (CA form)

3. Financial Needs Analysis Form

- If the “Sum Insured” &/ “Cash Value / Surrender Value” of the “Insurance Product to be Purchased” compare with the amount stated in FNA Form within +-10%, it matches client’s needs. (Updated: 22 Oct 2024)

- The definition of Vulnerable Customer for YF Life: (Updated: 9 Jan 2025)

➢ Aged 65 or above, or

➢ Education level is “primary level” or below, or

➢ No regular source of income.

- Sample for TaxVantage Prestige Medical Plan (Updated: 30 Mar 2022)

- Sample for Infinity Wealth Builder 2 (Updated: 10 May 2022)

- Sample for LifeDeluxe Insurance Plan (LD) and LifeDeluxe for Future (LDF) (Updated: 29 Jul 2022)

- Sample for 360 Global Accident Protector (Updated: 13 Mar 2023)

- Sample for MY Flexi Generations Saver (Updated: 04 Aug 2023)

- Sample for MY Flexi Lifetime Annuity (Updated: 04 Aug 2023)

- Sample for InfinityEnrich Wealth Builder (Updated: 14 Aug 2023)

- Sample for 100% Reward For You Accident Protector (Updated: 29 Aug 2023)

- Sample for PrimeHealth Pro (Essential) (Updated: 03 Oct 2025)

- Sample for Prosperous Infinity Saver (Updated: 02 Feb 2024)

- Sample for YF PrimeHealth Pro (Signature) / YF PrimeHealth Pro Jr. Care (Updated: 03 Oct 2025)

- Sample for InfinityEnrich Wealth Builder 2 (Updated: 16 Oct 2024)

- Sample for MY Deferred Annuity 3 (Updated: 23 Jan 2025)

- Sample for E+ Medicare & Supplementary Major Medical Benefit (Rider) (Updated: 7 Mar 2025)

- Sample for 5-Year GoalAhead Saver (Updated: 25 Mar 2025)

- Sample for CritiCare Continuation Diabetes Insurance Plan (Updated: 28 Aug 2025)

- Sample for CritiCare Continuation Cardio Insurance Plan (Updated: 28 Aug 2025)

- Sample for CritiCare Continuation Cancer Insurance Plan (Updated: 28 Aug 2025)

- Sample for Beyond Infinity Savings Insurance Plan (Updated: 17 Nov 2025)

Principal Document

Hong Kong Resident

For non-permanent HKID holder and declared permanent residential area in China, it is categorized as PRC client. Client need to perform Identity verification and submit all related documents.

1. Application Form(申請表格下載列印時切勿更改版面大小;否則, 合規的版面將需重新提交。) – Application Guideline (Updated: 10 Jun 2020) - New Business Submission Checklist (Updated: 27 Mar 2019)

For product: CCB / PHS / LPCI / RAP / FP / PHE / PWS / PHC / PS1000/PS500+ / PWL/ GS/ MIA

Application Form-Life / Critical Illness / Accident / Disability Income / Medical Insurance (G08) [CHI] [ENG]

- [Sample for PS1000] (Updated: 4 May 2018)

- [Sample for PrimeHealth Jr. Care] (Updated: 03 Dec 2021)

- MLA & GS Application Sample (Updated: 20 Jul 2018)

- MIA Application Sample (Updated: 20 Jul 2018)

Additional forms for Preeminence (PWL) Application (Suggest consultant to contact YFLife – RM before the submission)

→ Supplementary Smoking Habit Information to Preeminence Plan (G03S-PWL) ([S10]) (all PWL plan must submit this form)

→ Supplementary Information to Preeminence Plan (G03-PWL) ([S9]) (for single premium plan only)

→ NOVEL CORONAVIRUS (COVID-19) QUESTIONNAIRE (Q33) (for all PWL new application)

For details of Medical Underwriting Requirements and Financial Underwriting Requirements, please see the “Prestige-ULife & Preeminence NB & Assignment Guide (HK)”

For product: PCS/PDC

- Application Form (G99) [Eng][Chi] (Only applicable to Guaranteed Acceptance and Simplified Underwriting Products) [A11] and Statement of Health – Simplified Health Underwriting Form (G80) [Sample for PrimeHealth Cancer Saver] (Updated: 11 Mar 2020) [Memo] (Updated: 22 Jan 2020)

For product: 100% Reward For You Accident Protector

Supplementary Information to 360 Global Accident Protector (G03-360GAP) ([S11]) – Must Submit (Updated: 29 Aug 2023)

2. Certified copy of identification document [Sample] (Updated: 4 Jul 2019)

A nationality proof is required for non- permanent residents (not applicable for the product - Comprehensive Cancer Benefit)

Certified copy of relationship proof (when owner different from insured)

Payment Slip (G04) ([P1]) – Must be submitted together with payments (Updated: 11 Mar 2016)

Premium Payment Declaration Form (G86) – If cash payments >= HKD 60,000 / USD 7,500 (including Cash Deposit, Cash payments at YF Cashier Counter, Bank Counter Services)

4. Personalized illustration (SIS)

Full set of illustration document is required, the details please refer to MMA SIS guideline

5. Confirmation of Policy Benefits and Premiums (G42) [Broker Version]

[Sample] (Updated: 4 May 2018)

Attached to illustration and included Commission Disclosure Declaration

| 1 | Certified copy of ID, Travel Documents, Entry Proof (Entry Permit or Document of Identity of Passport), Landing slip, relationship proofs (when owner is different from proposed insured)

The consultant is required to submit copies of travel documents of the policy owner and proposed insured On each copy page, the consultant is required to certify each copy of the travel documents, sign and make the following declaration For Consultant: “I confirm that this is a true copy page of the original document and I witnessed the signature of the applicant on this copy.” / “本人確認此乃正本文件之副本並見證投保人簽署作實.” |

MEMO-2019-OB10-IB (Updated: 3 Jul 2019) |

| 2 | Non Hong Kong Resident's Declaration (Q23) ([N1]) | For Japanese applicants, please refer to New Business Administrative Manual [Eng] [Chi] and complete Residency Questionnaire for Japanese as Proposed Insured (Q27J) ([R7]) and Customer Declaration of Residency Status (G03J) ([C15]) (Updated: 7 Apr 2025) |

6. Commission Disclosure Declaration G65 (if G42 not Broker Version) [Sample] (Updated: 4 May 2018)

7. Consultant's Report (G01) ([C3]) [Sample] (Updated: 6 Sep 2019)

8. GL30 Financial Needs Analysis Form (G43) [ENG] / [CHI] ([F2]) As OnePlatform FNA is a must form for new application and it is also accepted by YF Life, so it’s not a must to submit YF Life FNA form at the same time (Updated: 1 Jun 2021)

- FNA Guideline (Updated: 26 Mar 2021)

- If the “Sum Insured” &/ “Cash Value / Surrender Value” of the “Insurance Product to be Purchased” compare with the amount stated in FNA Form within +-10%, it matches client’s needs.(Updated: 22 Oct 2024)

- [Product Mapping Table]

Sample for PrimeHealth Jr. Care (Updated: 03 Dec 2021)

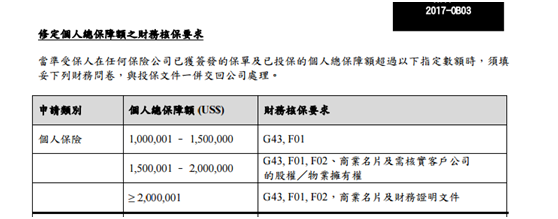

9. Confidential Consultant's Report - Client's Background (F01) ([C7]) – for USS US$1,500,001 -2,000,000

10. Financial Statement of the Proposed Insured / Payor (F02) ([F1]) – for USS US$ excess 2,000,001

11. Address proof is not required unless it is required by YF Life, or OnePlatform has to conduct further verification with the client’s identity. (Updated: 24 Oct 2017)

12. Customer Protection and Important Facts Statement – Policy Replacement [C4] (If any answer is “Yes” or “Not yet decided” for policy replacement declaration on the Application Form) [MEMO]

- If the replaced/ to be replaced policy is under YFLife, only need to complete Section A and Important Facts Statement - Policy Replacement

- If the replaced/ to be replaced policy is NOT under YFLife, need to complete the whole form.(Updated: 21 Apr 2021)

13. COVID-19 RECOVERY QUESTIONNAIRE (Q34)

- Mandatory for COVID-19 recovery patient only (Updated: 24 Aug 2022)

Non-Hong Kong Resident or PRC Resident (Additional documents)

For Non-Hong Kong Resident

For PRC Resident Only (For PRC ID Holder case, please see New Business Administrative Manual Section 3.1) (Updated: 04 Jun 2024 )

Revised Details of PRC Operations Guide (Updated: 8 May 2019)

Revised the procedure of the Internal License for PRC Sales (For Hong Kong Broker Only) (Updated: 10 May 2019)

| 1 | Certified copy of ID, Travel Documents, Entry Proof (Entry Permit or Document of Identity of Passport), Landing slip, relationship proofs (when owner is different from proposed insured)

Identity verification by YF Life Staff (Refer MEMO-2019-OB10-IB ) The consultant is required to submit copies of travel documents of the policy owner and proposed insured On each copy page, the consultant is required to certify each copy of the travel documents, sign and make the following declaration For Consultant: “I confirm that this is a true copy page of the original document and I witnessed the signature of the applicant on this copy.” / “本人確認此乃正本文件之副本並見證投保人簽署作實.” Identity verification by自助認證系統sMMArt-VER (MEMO UWD-2018-MO14-IB) Please note that if PRC clients are unable to present their identity documents during the self-verification process, they are required to submit physical copies to the Company afterwards, and both Consultants and clients are required to make the appropriate declarations on the copies according to the Company guidelines. |

MEMO-2019-OB10-IB (Updated: 3 Jul 2019)

Refer to OnePlatform’s requirement, Certified copy of ID, Travel Documents, Entry Proof is required document even if Identity verification by自助認證系統sMMArt-VER |

| 2 | Non Hong Kong Resident's Declaration (Q23) ([N1]) | |

| 3.1 | Identity verification by自助認證系統sMMArt-VER

New function for sMMArt-Ver: System-generated Policy Number (MEMO IB-2018-0021-AA-HK) Before conduct business with PRC clients, consultants have to attend a class and obtain a license from YF Life first. For identity verification, it should be done by YF Life staff or 自助認證系統sMMArt-VER. Handling fee details for Verification Services provided by Appointed Location UWD-2016-MO07-IB-HK (Updated: 26 May 2017) To reset password, please send request to [email protected],2 days before the PRC verification. |

Guideline for 中國內地居民牌照考試 (網上版) and自助認證系統sMMArt-VER |

| 3.2 | Identity verification by YF Life Staff

Before conduct business with PRC clients, consultants have to attend a class and obtain a license from YF Life first. For identity verification, it should be done by YF Life staff or 自助認證系統sMMArt-VER. |

[於YF Life之客戶服務中心由YF Life委派的職員辦理認證程序] |

| 4 | Important Facts Statement for Mainland Policyholder(G26) ([I6]) |

(Additional documents if applicable)

Medical Underwriting Requirements

Flexi-ULife Prime Saver (FP) / PrimeHealth Saver 100+ (PHS) / Critical Illness Supreme 100+ Premium Refundable Plan (LPCI) / Prime Health Extra Saver (PHE)/PrimeHealth Extra Care (PHC)

For non-medical limits table, please refer to New Business Administrative Manual Section 5.2.1. (For PHE, equivalent of 125% of sum insured will be used for calculating for medical underwriting requirements accordingly to Ordinary non-medi limit table)

When purposed insured is selected for medical check,

1. We only accept examination or test carried out by the company’s appointed doctors or laboratories. (Please refer to AES for updated Doctor and Lab list)

2. Consultant needs to make an appointment with the appointed doctor and laboratory

Consultant is required to complete Requisition for Medical Service Card (M03) for booking, consultant can send the M03 directly to doctor / laboratories

Consultant should arrange medical tests for the proposed insured only after the proposed insured has completed an application form and paid the required initial modal premium.

3. If the medical history of proposed insured involves certain hospitals, underwriters may need to obtain Attending Physician Statement (APS) from the hospital concerned. Please submit Authorization for Obtaining an Attending Physician Statement (M02) to us

4. For details of medical costs, please refer to our Underwriting Guideline Section:

5.2.14 Medical costs payable by consultant

5.2.15 Medical costs payable by client

Financial Underwriting Requirements (Updated: 04 Jun 2024)

Refer to the New Business Administrative Manual Section 5.

For details of Financial Proof, please refer to New Business Administrative Manual Section 5.4

FAQ / Supplementary guideline

1. For application of Non-HK resident, please refer to New Business Administrative Manual Section 3.7 [Applicant is a Foreign Resident] & Section 3.9 [Proposed insured requires working overseas].

2. For nationality / residency not listed in manual, please contact YF Life sales staff.

3. 提醒客戶使用指定之繳付保費方式 [POS-2015-MO10-IB-HK] (Updated: 18 Jun 2015)

4. Occupational Classification (Updated: 06 Jan 2026)

5. Revised Admin Guidelines for the Guidance Note 16 (Updated: 28 Jun 2017)

6. New Business and Policy Services Guidelines for Upgrading Hospital Benefits (For Hong Kong only) (Updated: 24 Nov 2017)

7. 有關保險業監管局收取保費徵費之行政規則 2017-OB14-IB-HK (Updated: 3 Jan 2018)

8. Product guide for Prime Health Diabetes Care (PDC) (Updated: 4 May 2018)

9. 提高豁免常規體檢額上限 (短期措施) (Apply to the New Application/Add Rider Application/Reinstatement submitted between 02 Jan 2019 to 26 Jun 2019.) (Updated: 3 Jan 2019)

10. 2019-OB04-IB - 第二保單持有人提名指引 (Updated: 4 Jan 2019)

11. Submission Tips (Updated: 5 Jul 2019)

Special Case

1. For any amendment to application before policy issue, should fill in Amendment to Application (G03) ([A1])

2. If client’s Home Address is the same as Work Address, should fill in Amendment to Application (G03) ([A1]) to clarify.

3. If supplementary benefit is added to the basic plan, should fill in Personal Statement of Proposed Insured Proposed Policy Owner (G31) [ENG] / [CHI] ([P4])

If YF Life has received the medical reports on proposed clients but does not receive their application form and G42-PICS within the next 14 working days (the sign date of the above mentioned documents must be on or before the date of client undergo medical exam, otherwise, the document will not be accepted), YF Life will follow the PCPD's guidelines to erase and destroy their medical reports.