Broker Code: 060210

- Consultant is required to write down his / her individual code on the application when submitting new business application.

- Special arrangement until further notice: Sun Life accept broker code "060210" written on the application if consultant does not have individual code at this moment)

NF2F Update: Hong Kong Insurance Authority(IA) announced that the non-face-to-face sales process has ceased after 30 April 2023, a one month transitional period (e.g. 1 May to 31 May 2023, subject to provider) will therefore be provided to allow sufficient time for provider to complete the underwriting process. (Updated: 03 May 2023)

Product List:

Traditional Life Insurance Life Achiever 15 [Shelved on 31 Aug 2014 (Sign Date)] Life Enhancer [Shelved on 31 Aug 2014 (Sign Date)] Life Saving Plus [Shelved on 31 Aug 2014 (Sign Date)] Life Super (Shelved on 30 Aug 2019) Life Super Plus (Shelved on 30 Aug 2019) 1- Year Term 5-Year Term Life Brilliance (Updated: 26 Aug 2014) Prosperity (Shelved on 1 Apr 2021) Generations (Shelved on 1 Apr 2021) Critical Illness

SunHealth Critical Illness II (Shelved on 27 Apr 2016) SunHealth Ultra Care (Shelved on 30 Apr 2019) SunHealth Maxi Care (Shelved on 30 Apr 2019) SunHealth Omni CareRider: Cover Plus (Launch Date: 12 Feb 2019) Critical Medical Care Insurance Plan II (Launch Date: 08 May 2020) SunHealth LovePromise (Launch Date: 11 Mar 2022) SunWell Series (Launch Date: 23 May 2024) Saving Plan

Ruby Endowment Plan 3/8 SunDragon RMB Endowment Plan (Shelved on 31 Dec 2012) Asset Builder (Non-BV) Growth Builder [Product closure on 31 Dec 2016 (Sign Date)] Growth Plus [Product closure on 31 Dec 2016 (Sign Date)] SunDiamond Income Plan Warmth Retirement Plan (Shelved on 30 Apr 2019) Hope Educator Sun Educator (Shelved on 30 Apr 2019) Commitment (Closed on 15 Dec 2023) Stellar (Closed on 4 Aug 2023) Stellar (Added 6 & 12-year Premium Payment Term) (Closed on 4 Aug 2023) SunJoy (Closed on 01 Jul 2025) SunGift (Closed on 01 Jul 2025) Stellar Multi-Currency Plan (Closed on 01 Jul 2025) SunJoy Global (Closed on 01 Jul 2025) SunGift Global (Closed on 01 Jul 2025) SunJoy Global Insurance Plan II (Launch Date: 7 Jul 2025) SunGift Global Insurance Plan II (Launch Date: 7 Jul 2025) Stellar Multi-Currency Insurance Plan II (Launch Date: 8 Jul 2025) Medical Plan Hospital Income Insurance Plan (Re-Launch Date: 25 Jan 2021) SunHealth Medical Care SunHealth Medical Premier / Essential (Launch Date: 7 July 2017) WeHealth (Launch Date: 11 Apr 2019) WeHealth Plus (Launch Date: 14 May 2019) WeHealth Prestige (Launch Date: 16 Feb 2022) WeHealth Preferred (Launch Date: 14 Apr 2022) Accident SunCare Accident Protection Plan (Closed on 25 Nov 2024) Stand-by-you Accident Protection Plan (Launch Date: 20 Feb 2025) Universal Life Bright UL Wealth Builder Bright UL Eternal Builder Annuity FlexiRetire Annuity Plan RetireFree Immediate Annuity Insurance / RetireFree Booster Rider Insurance (Launch Date: 05 Sep 2025) Coupon SunPromise Income Plan (Closed on 25 Dec 2021) Vision (Launch Date: 12 Jun 2019) Retirement Foresight Deferred Annuity Plan (Launch Date: 16 Sep 2019) Whole Life Venus (Closed on 1 Dec 2020) Generations II (Launch Date: 28 Apr 2021) Vital (Launch Date: 13 Aug 2021) Venus II (Launch Date: 31 Aug 2021) Endowment Victory (Closed on 01 Jul 2025) RoyalFortune Savings Insurance Plan (Launch Date: 27 Jun 2025) Life Protection

SunProtect (Launch Date: 18 Aug 2023) SunGuardian (Launch Date: 25 Aug 2023) SunGuardian (Care Version) (Launch Date: 25 Aug 2023) MultiGuardian (Launch Date: 11 Apr 2025)

Important Notice

For corporate application, please refer to Customer Due Diligence on Corporate Clients for detailed requirements of OnePlatform. (Updated: 02 Jul 2020)

1. Applications must be submitted within 30 calendar days from the application sign date (Updated: 13 Oct 2022). Sun Life may request explanation from the consultant for late submission. For applications submitted 2 weeks after the application sign date, the applicant must complete the Declaration of Continued Good Health Form ([D9]) .However, Sun Life Underwriting department reserve the right to obtain the Personal Certificate of Insurability. For all MSV case should be submitted to Sun Life within 30 calendar days from the application sign date.(Updated: 02 May 2023)

2. New Business Submission Checklist (Except SunFuture) (Updated: 05 Sep 2025)

3. New Business and Underwriting Manual [Eng] [Chi] (Updated: 05 Sep 2025)

4. Technical Guide (Updated :1 Dec 2017)

5. Only HKD and USD currency policy will be accepted. For Life Brilliance, policy currency is accepted HKD / USD / RMB (Updated: 26 Aug 2014)

6. Outstanding requirements will be pending for maximum one month. Request for extension will be subject to approval.

7. Payor must be the Owner, Insured, or Policy Owner’s family member. If payment is made by the owner’s family member, please declare relationship or submit Payment Abstract Form.

8. Basically all traditional life products are available to non-HK residents and all standalone plans / term basic plan are not allowed. However please be aware that SunLife may not accept some high risk countries.

9. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

10.Consultant is required to write down his / her individual code on the application when submitting new business application with effective from 21 Aug 2020. (Updated:13 Aug 2020)

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

1. Client Data Form

2. Client Agreement (CA form)

3. Financial Needs Analysis Form

Remark: If the payment term is over age 65, other source(s) of fund should be selected.

FNA sample (Updated: 21 Jun 2023) ** Starting from 16 Jan 2023 (with reference to application form sign date), OnePlatform FNA will be accepted by Sun Life so Sun Life FNA is not required to submit at the same time. (Updated: 13 Jan 2023)

- Sample of SunJoy & SunGift (Updated: 21 Jun 2023)

- Sample of SunProtect (Updated: 18 Aug 2023)

- Sample of Stellar Multi-Currency Plan (Updated: 22 Aug 2023)

- Sample of SunGuardian & SunGuardian(Care Version) (Updated: 25 Aug 2023)

- Sample of SunJoy Global (Updated: 09 Jan 2024)

- Sample of SunGift Global (Updated: 15 Mar 2024)

- Sample of SunWell Series (Updated: 23 May 2024 )

- Sample of Stand-by-you Accident Protection Plan (Updated: 20 Feb 2025)

- Sample of MultiGuardian (Updated: 14 Apr 2025)

- Sample of RoyalFortune Savings Insurance Plan (Updated: 27 Jun 2025)

- Sample of SunJoy / SunGift Global Insurance Plan II (Updated: 7 Jul 2025)

- Sample of Stellar Multi-Currency Insurance Plan II (Updated: 8 Jul 2025)

- Sample of RetireFree Immediate Annuity Insurance_ RetireFree Booster Rider Insurance (Updated: 05 Sep 2025)

Principal Document

Hong Kong Resident

| 1. | Application Form

[Note: Sun Life accept both original and softcopy application form. If using softcopy application form, please get the policy label in HW 23/F SOD counter before the submission. For HNW business, contact Sun Life RM for help.](Updated: 23 Feb 2024) Sample Application Form - SunJoy (Updated: 19 Sep 2023) Sample Application Form - Foresight Deferred Annuity Plan (Updated: 22 Feb 2024) |

|

| 2. | Sun Life Financial Needs Analysis (Eng) (Chi) ([F4]) | [Product Mapping Table] The product mapping table is for reference only. Please only recommend products which are on shelf at the time you make the recommendations. (Updated: 01 Sep 2022) Remark: If the payment term is over age 65, other source(s) of fund should be selected.

** Starting from 16 Jan 2023 (with reference to application form sign date), OnePlatform FNA will be accepted by Sun Life so Sun Life FNA is not required to submit at the same time. (Updated: 13 Jan 2023) |

| 3. | Important Facts Statement - Policy Replacement ([I8]) | Required if replace policy (Updated: 23 Jun 2014) |

| 4. | Signed illustration

- For BRIGHT Universal Life, Part I page 1 (cover page) and signing page are required. - For Sun Diamond / Educator, Part I page 1-2 proposal are required and signing Page are required. - For SunHealth UltraCare and SunHealth MaxiCare, 5 signing pages are required. - For other basic plan, only Signing Page is required. * Not required for standalone risk protection (include SHMC/HI/SC/term plan) |

Important Notice

Please submit the “Notice of the Insurance (levy) Regulation by the Insurance Authority” [ENG] [CHI] with your application if you cannot see the Levy amount and notice (refer to appendix 1) on the illustration. Levy Calculator can help to calculate the amounts of (Insurance) Levy. For more details, please see the “Levy Training Slides” and “Premium Levy FAQ” [ENG] [CHI] (Updated: 3 Oct 2018) For Prepayment (Life Brilliance ONLY), please refer to [Sample] for reference (Updated: 26 Aug 2014) |

| 5. | Technical Representative Declaration ([T1]) | |

| 6. | HKID card copy | Certified true copy by consultant |

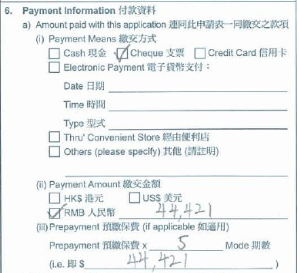

| 7. | Payment Method | |

| 8. | Large Amount Questionnaire ([L2]) | Required if subject to total sum assured |

| 9. | Direct Debit Authorization (DDA) and Credit card DDA (CDDA) | Required if monthly Mode or autopay Selected (Updated: 23 Sep 2015) |

| 10. | Address proof is not required | Not required unless it is required by Sun Life, or OnePlatform has to conduct further verification with the client’s identity. |

| 11. | 聲明、確認及同意書 (自願醫保計劃保單)[CHI] [ENG] (Updated: 15 Jan 2024) | [For VHIS products e.g. WeHealth series] Required if the insurable interest is other than below:

a. Policyowner: Husband / Wife Insured: Husband / Wife b. Policyowner: Father / Mother Insured: Child under age 18 |

| 12. | Application Supplement for VHIS policy ([A5]) | [For VHIS products e.g. WeHealth series] Required if the insurable interest is other than below:

a. Policyowner: Husband / Wife Insured: Husband / Wife B. Policyowner: Father / Mother Insured: Child under age 18 |

| 13. | Application Supplement (For Vision) ([A6]) | [For Vision Only, if applicable] |

| 14. | Application Supplement for Foresight Deferred Annuity Plan ([A7]) | [For Foresight Deferred Annuity Plan Only, if applicable] |

| 15. | Important Facts Statement - Premium Financing [Eng] [Chi] [I9] | |

| 16 | Application Supplement for Premium Financing [A8] | For premium financing case only (Updated: 13 Jan 2023)

[Sample] |

Non-Hong Kong Permanent Resident (Additional documents)

| 1. | Passport copy to verify the Nationality |

Non-Hong Kong Resident (Additional documents)

| 1. | Entry Proof | Photocopy of personal particular page of the client’s passport including the page with the current entry stamp stamped in.

Important Note: (1) Identity Proof (2) Travel document Proof (3) Entry Proof |

PRC Resident (Additional documents)

(1) Identity Proof

(2) Travel document Proof

(3) Entry Proof

For PRC client, identity verification is required. Details refer to Guideline for PRC Residents (Updated: 15 Aug 2025)

| 1. | Entry Proof | Photocopy of personal particular page of the client’s passport including the page with the current entry stamp stamped in.

(1) Identity Proof (2) Travel document Proof (3) Entry Proof |

| 2. | Application Supplementary Form for Critical Illness Plan (PRC Resident) ([S1]) | Required if applying Critical Illness Plan (For PRC applicants) |

| 3. | Important Facts Statement for Mainland Policyholder (“IFS-MP”) ([I6]) |

Please note, the IFS-MP is not a replacement of PRC Resident Declaration, Mainland Policyholder is required to sign both forms. (Updated: 31 Aug 2016) |

Financial Underwriting Requirements (Updated: 20 Dec 2016)

Requirements for Large Amount Payment

(1). For payment of UnionPay or Credit Card with aggregate amount in 12 months over HKD10,000,000 or equivalent, evidence of source of fund and Customer Due Diligence must be completed prior to process payment.

(2). Requirement for aggregate amount within 12 months for all payment means and usage of payment:

| Threshold | Evidence of Source of Fund : Last 3 months’ bank statement of the account paid to SLHK | Large Amount Questionnaire sign by the Policy Owner | Consultant report on the background of the Policy Owner | Audited financial report if Policy Owner is a company owner |

| >HKD10,000,000 or equivalent | √ | X | X | X |

| ≥HKD80,000,000/ USD10,000,000/ RMB40,000,000 | √ | √ | √ | √ |

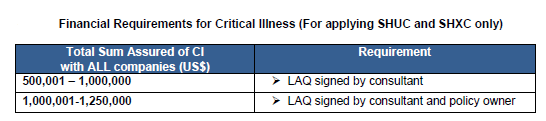

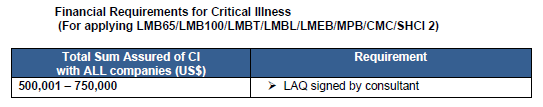

Financial Requirements for Critical Illness (Updated: 20 May 2016)

Special Cases

Payment Declaration Form ([P1])

Completion of Payment Declaration Form is required for the following criteria:

| Per Policy Owner aggregate amount within 12 months | Payment method / means | ||

| Third party payer | a) Cash* (including Cashier, 7-11 convenience store and deposit into Sun Life bank accounts); or

b) Cashier Order, Bank Draft; or c) PPS, internet banking, inter-bank account transfer, ATM transfer |

Cheque, Credit Card or TT confirmed payer is Policy Owner | |

| ≤ HKD200,000 or equivalent | √ | X | X |

| > HKD200,000 or equivalent | √ | √ | X |

| >HKD10,000,000 or equivalent | √ | √ | √ |

Note*: the total maximum cash amount HKD 70,000 within a short period of time remains unchanged, this requirements refer to the aggregate amount within 12 months only.

Manual:

Underwriting Handbook for Common Impairments (Updated: 12 Nov 2024)

Occupation Manual (Updated: 17 Jan 2025)

Sun Life Customer Hotline:21038118 →press “1” → press “2”