Broker Code: 906068

Product List

For more detail, please kindly refer to product list table (Updated: 14 May 2025)

Important Notice

1. New Business and Underwriting Procedures (Updated: 15 Apr 2021)

2. All the new application should be submitted to Manulife by the submission dates below (whichever is earliest)

- Please submit to Manulife within 30 calendar days from the application sign date.

- For MCV client, the entry proof must be verified by MSC/ MBC Manulife staff or taking photo with M-mobile within the entry permit validity period.

- For applying all medical plans include all VHIS, ManuGuard and Disability Income Protector (basic plan only), please submit to Manulife within 5 working days from the application sign date. (Updated: 02 Aug 2022)

3. Witness cannot be the beneficiary; for consultant own case, it is advised to seek another consultant as witness.

4. In joint owner’s application, each policy owner must complete a separate Individual Tax Residency Self-Certification Form ( CRS ) ([I8])

5. Relationship between Proposed Insured and Policyowner

| Proposed Insured | Policyowner | Additional requirements |

| Child < age 18

Student < age 25 |

Parent | NIL |

| Husband/ Wife | Wife / Husband | NIL |

| Parent | Adult Child | Only if parent is retired, age ≥ 60 and financially justified |

| Grandchild | Grandparent | - Grandparent applying for insurance on a juvenile as a gift does not qualify as insurable interest.

- Justification should be established if the policy is owned by Grandparents by submitting the following requirement when application is submitted:

|

| Same-sex Married Partner | Same-sex Married Partner | 1. Submit copy of Marriage Certificate** AND

2. Complete the “Declaration For Same-sex Married Partner as Policyowner [D8]” form (Code: U60) Remarks ** In case the submitted legal document is not written in Chinese or English, customer may need to provide an English translation by professional institution at their own cost. (Updated: 06 Jul 2022) |

6. Beneficiary Guideline (Updated: 11 Jul 2019)

Expanded to cover three additional types of relationship with corresponding required documents in below: [Memo]

| Expanded Beneficiary Relationship | Requirements | |

| 1 | Legal Guardian | Submit copy of Legal Guardianship Proof** |

| 2 | Same-sex Married Partner | Submit copy of Marriage Certificate** |

| 3 | Cohabiting Domestic Partner

(For same and opposite gender) |

Complete the “Declaration of Policyowner For Nominating Cohabiting Domestic Partner as Beneficiary [D9]” form (Code: U58) |

Remarks

** In case the submitted legal document is not written in Chinese or English, customer may need to provide an English translation by professional institution at their own cost. (Updated: 06 Jul 2022)

7. Back-dating of Policy

- It is for reducing the insurance age so that a lower premium rate will be used.

- Put down “Policy Year Date is __________________”

- Policy Year Date to 29th, 30th or 31st is not allowed.

- For some products such as Alpha Regular Investor & Disability Income Protector, the Policy Effective Date is the Application Sign Date, no date back is allowed.

- For MI Plus, ManuJoy and ManuFortune, the Policy Effective Date is Policy Issue Date, no date back is allowed.

- Exceptional case can be approved by NB Manager under special consideration.

No back-dating for:

- More than 6 months prior to the Policy Effective Date (ManuSilver Care / ManuAmber Care: More than 1 month)

- Special quotation is needed for Back-dating Policy Effective Date for more than 6 months.

8. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

|

1 |

Client Data Form |

|

2 |

Client Agreement (CA form) |

|

3 |

Financial Needs Analysis FormSample of ManuGlobal Saver (Updated: 01 Jun 2022)

|

Principal Document

Hong Kong Resident

| 1 |

Application Form - Checklist (Updated: 18 Jul 2017) |

Sample for La Vie 2 / ManuCentury (Updated: 07 Dec 2021) Sample for ManuBright Care 2 (Updated: 07 Dec 2021)

ManuJoy (This product use simplified Underwriting) ⅰ) The policy Year Date is same as the Policy Issue Date instead of the Policy Sign Date. ⅱ) If prepayment is selected, in case there is any premium rate change due to the change in issue age between the Policy Signa Date and Policy Issue Date, customers need to (1) re-submit the signed Proposal Summary (PS page) with updated issue age or (2) Request date back thru special quote, and submit sufficient premium. The required premium should refer to the re-generated PS page or the special quote.

|

| 2 | Valid copy of Policyowner and Proposed Insured’s Identity Document(s) |

Note: If Policyowner/ Proposed Insured is nonpermanent HKID card holder, please submit valid travel document / national ID card. |

|

3 |

Address proof |

Please see the Memo. (Updated: 05 Jul 2022) |

|

4 |

Nationality Proof (if any) |

This requirement is effective for new insurance application submitted on or after 1 January 2020. If the identity document provided by individual client is different from the declared nationality, a valid national identity card/unexpired passport or document issued by government body will be required. |

| 5 | ||

| 6 | Proposal summary (signed by policy owner); |

|

| 7 |

Financial Need Analysis Form [Chi] [Eng]([F3]) FNA Affordability Check at client level [Memo]([Chi] [Eng]) 1. The sum of the monthly premium of new application for regular premium product and the monthly premium of existing in force policies at Manulife should NOT be greater than 50% of customer’s declared gross income (Rule 1) 2. If Rule 1 exceeds 50%, the exceeding portion of any existing policy’s premium from Rule 1 plus the liquid asset used for paying premium towards the new application should NOT be greater than 50% of customer’s declared total liquid asset (Rule 2) 3. The exceeding portion of any existing policy’s premium from Rule 1 plus the liquid asset used for paying premium towards the new application and all outstanding liabilities (excluding mortgage loan) should NOT be greater than the customer’s declared total liquid asset (Rule 3) (Updated: 25 Jul 2023) |

[Product Mapping Table](The product mapping table is for reference only. Please only recommend products which are on shelf at the time you make the recommendations.) (Updated: 22 Jan 2021)

FNA Sample - LV2 赤霞珠終身壽險計劃 + PWB 傷殘豁免保費保障 (Updated: 29 Apr 2021) FNA Sample - LV2 赤霞珠終身壽險計劃 + PB 保費支付人利益保障 FNA Sample - ManuLeisure 歲稅樂享延期年金 FNA Sample - MBC2 活耀人生危疾保2 + PWB 傷殘豁免保費保障 FNA Sample - MGS2 豐譽傳承保障計劃2 - 定期供款 FNA Sample - MIS2 創富傳承保障計劃 - 定期供款 FNA Sample - PEP15卓越保障計劃 (PEP) (Updated: 29 Apr 2021) FNA Sample - MEP卓越終身保 (整付保費) (Updated: 09 Nov 2021) FNA Sample - MEP 25+CCIB+MT+PWB 摯無憂危疾附加保障 (Updated: 19 Nov 2021) FNA Sample - ManuGlobal Saver (Updated: 01 Jun 2022) FNA Sample - ManuPrimo Care (Updated: 17 Aug 2022) FNA Sample - ManuPrimo Care (BestStart) (Updated: 17 Aug 2022) FNA Sample - Genesis (Regular Premium) (Single Premium) (Updated: 9 May 2024) FNA Sample – 宏健守護危疾入息保障 (IG) + 宏伴護航危疾入息保障 (IS) + 守護無間危疾保系列 (MPC / MPC Best Start) + 心愛一家保 (MLC) + 活耀人生危疾保PRO (MBC PRO) (Updated: 17 Jun 2025) |

|

8 |

Technical Representative (TR) Registration |

|

| 9 |

Residential Questionnaire ([R1]) |

|

| 10 |

Financial Questionnaire ([F1]) |

Details refer to Financial Questionnaire - Section 4 to 7 (Updated: 8 Jul 2021) |

| 11 |

Critical Illness Questionnaire for ManuSilver Care / ManuAmber Care [CHI] / [ENG] ([C6]) |

|

| 12 |

Application For Reinstatement / Statement of Insurability (U36) ([U1]) |

For Payor Benefit (if applicable) |

|

13 |

Memo [I4] |

if applicable (If any answer is “Yes” or “Not yet decided” for policy replacement declaration on the Application Form) |

| 14 | Application Supplement (Form856_BC) [A27] |

|

| 15 | Important Facts Statement - Policy Replacement [I4] (If applicable) (Updated: 11 Mar 2025) |

Non-Hong Kong Resident or PRC Resident (Additional documents)

For Non-HK Resident

| 1 | Valid copy of Policyowner and Proposed Insured’s travel document | |

| 2 | Valid copy of Policyowner and Proposed Insured’s entry proof | For foreign nationals |

| 3 | Survival proof for Insured’s age below 18 if entry proof is unavailable | Life insured with attained age 0-17

a. Health check-up report, to be performed in 3A PRC Hospital, or Life insured with attained age 0-6 b. Full set of vaccination Record, or c. Full set of student handbook with a clear photo, or Life insured with attained age 7-17 d. Student proof, e.g. student ID card copy with clear photo, or e. Written certification issued by education institution with clear photo or transcript f. Recent agent’s memo to confirm agent has witnessed the insured ^ ^Suggested wording: “I (name of agent) certify that I had interviewed the life insured (name of life insured), and that he/she is healthy without apparent physical defects or abnormality” Note:

|

| 4 | Residential Questionnaire ([R1]) |

For PRC Resident only

| 1 | Valid copy of Policyowner and Proposed Insured’s travel document | Application sign date must before expiry date |

| 2 | Valid copy of Policyowner and Proposed Insured’s entry proof |

Application sign date must before or on the date of “permitted to remain until” |

| 3 | Survival proof for Insured’s age below 18 if entry proof is unavailable | Life insured with attained age 0-17

a. Health check-up report, to be performed in 3A PRC Hospital, or Life insured with attained age 0-6 b. Full set of vaccination Record, or c. Full set of student handbook with a clear photo, or Life insured with attained age 7-17 d. Student proof, e.g. student ID card copy with clear photo, or e. Written certification issued by education institution with clear photo or transcript f. Recent agent’s memo to confirm agent has witnessed the insured. ^ ^Suggested wording: “I (name of agent) certify that I had interviewed the life insured (name of life insured), and that he/she is healthy without apparent physical defects or abnormality” |

| 4 | Important Facts Statement for Mainland Policyholder ([I6]) | It cannot be opt out and should be signed on or before the application sign date - Below person that need to submit:

|

| 5 | Residential Questionnaire ([R1]) | |

| 6 |

Declaration Form for Insurance Application by Non Hong Kong Resident(s) [MCV001] ([D4]) |

By Non Hong Kong Resident(s) with verification using method (a) or (b) below:

a. By M-mobile MCV client verification in Quick Quotation [M-Mobile MCV client verification – “Quick Quotation” User Guide] (Updated: 10 Mar 2023) -Sign date must be the same as M-mobile date - Must provide the MCV reference number. b. Visit designated Customer Service Centre (MSC or MBC) - Photo with M-mobile is not required - Must complete the part of internal use for verification at service centre and witnessed by Manulife staff Note: The MCV process can be conducted at Manulife Supreme Club(MSC) - Manulife Supreme Club Meeting Room Reservation Form (Updated: 21 Apr 2017) Manulife Supreme Club Address: 尖沙咀廣東道100號彩星集團中心21樓(Apple Shop樓上)

|

| 7 | MCV002 - Declaration on Loss of Landing Slip (if applicable) | via e-Channel entry to HK

- If the MCV customer lost his/ her landing slip and should be co-signed by ASC /MBC /MSC staff at MFC/ MT/ TH - Forms should be obtained at the centres only - The application form should be signed on the same date |

| 8 |

MCV003 - MCV Customer Declaration/ Authorization Form ([M7]) (if applicable) |

- For cash payment submitted ≥ HKD20,000 by MCV customer only

- It should be signed by the policyowner |

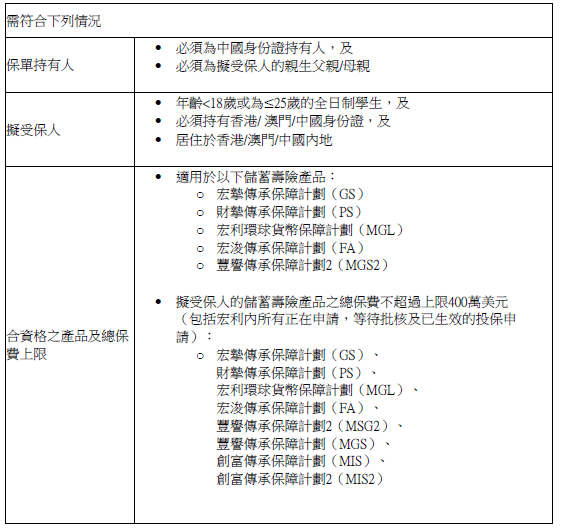

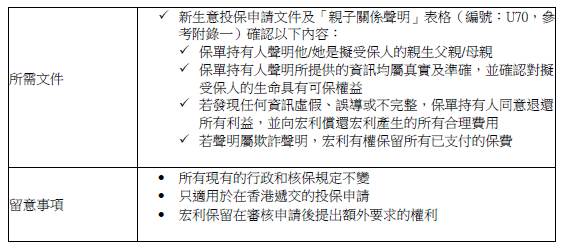

| 9 | If client is unable to provide the relationship proof between Proposed Insured and Policyowner, Manulife would accept a “Declaration of Parent-Child Relationship” as valid relationship proof if the conditions outlined are fulfilled: (Updated: 10 Apr 2025)

|

For Japanese applicant only (Updated: 14 April 2016)

Japanese applicants must meet the following criteria to be allowed to effect insurance in Hong Kong and certify points (2) & (3) below in writing on the application form or by Application Supplement ([A5]). The requirements apply directly to the spouse if the spouse is also an Applicant or Proposed Insured.

(1) The client must have residency status in another jurisdiction (in Hong Kong, a HKID Card would be proof of this), and

(2) The client must have lived abroad for a period of at least three years, and

(3) The client must have given up his Japanese residency (jumin-hyo) #.

#New - If (3) is not available, clients must certify to Manulife in writing on the application form or by Application Supplement ([A5]) that they are not residents of Japan and intend to remain as non-residents.

Financial requirement

- Subject to Underwriting; for cases with sum insured US 1,500,000 or above, please contact 2510-3267 for details.

- Details refer to Operations Manual - Section 4 to 7 (Updated: 8 Nov 2024)

Medical Requirement / Medical Examination

1. Details refer to Operations Manual - Section 10

2. Once Manulife requests the client to take a medical examination after underwriting process, consultant please submit the Examination Service Fax Order Form ([M1]) by fax directly to Medifast for arranging a test appointment

3. Doctor's List for Medical Examination, Medical Questionnaire & Blood Pressure test (Updated: 04 Oct 2021)

4. Laboratory Test Requisition Form ( [L1] )

5. Underwriting Compass (Updated: 04 Aug 2025)

Supplementary guideline / Underwriting guideline

1. Individual Financial Occupation Manual (Updated: 03 Aug 2022)

2. Manulife VHIS Product Manual (Updated: 08 Nov 2022)

3. VHIS Migration Reference Manual (Updated: 8 Jul 2020)

4. Underwriting & Administration Guide (For Universal Life and Insurance Products for High Net Worth Individuals) (Updated: 04 Aug 2025)

FAQ

Q: Client lost the medical card.

A: Please fill up the Loss of Manulife Outpatient Benefit Card Declaration and Replacement Card Application Form ([L3]) . There is an instruction where to mail the form to and client needs to pay HKD30.

Manulife Customer Hotline: 21081188 / 25103941