CTF Life : New Application (Traditional Life Insurance)

Broker Code:9419-9419000-0371645 (Non-Columbus)

9116-9116000-0371599 (Columbus)

FTLife will be renamed as Chow Tai Fook Life Insurance (CTF Life) on 22 July 2024, The new business, policy service, and claims' e-forms will be updated to FTLife B.O.S.S. (provider portal) on 22 July 2024. Please download the form from B.O.S.S directly if you cannot find in OnePortal. Starting from 22 July 2024, please submit the new version forms. CTF Life will not accept any old version forms after 21 August 2024.

Product List:

| Traditional Life Insurance | Term Life 100 | Signature Life | Fortune Saver Insurance Plan[Product Closure on 4 May 2020] |

| Platinum Term Plan | |||

| Whole Life | “Joyful Life” Insurance Plan (Launch Date: 22 Oct 2019) |

Fortune Saver Insurance Plan II [Product Closure on 23 Aug 2021] |

@MyLove Insurance Plan I [Product Closure on 9 Jan 2021] |

| @MyLove Insurance Plan II (Launch Date: 2 Jun 2020) |

“On Your Mind” Insurance Plan (Supreme Version)(Launch Date: 14 Sep 2020) | “On Your Mind” Insurance Plan (Smart Version) (Launch Date: 14 Sep 2020) | |

| Fortune Saver Insurance Plan 3 [Product Closure on 1 Oct 2023] | Ever Shine Savings Insurance Plan

(Launch Date: 22 Aug 2025) |

||

| Endowment | Elite Choice[Product Closure on 31 Dec 2016] | Fortune 100 | Regent Insurance Plan[Product Closure on 19 Mar 2018] |

| Regent Premier Insurance Plan(Product Closure) | |||

| Regent Insurance Plan 2 (Premier Version)(Launch Date: 01 Mar 2018) | |||

| Wealth Infinity Insurance Plan [Product Closure on 1 Oct 2023] | Regent Insurance Plan 2 (Global Premier) (Launch Date: 17 May 2019) | "RewardPro" Insurance Plan (Launch Date: 11 Mar 2020) | |

| Regent Elite Insurance Plan (Premier)[Product Closure on 27 Sep 2021] | Regent Prime Insurance Plan (Premier)[Product Closure on 27 Sep 2021] | Regent Insurance Plan 2 (Global Premier) (8-year version) (Launch Date: 25 Mar 2022) | |

| Regent Prime Insurance Plan II Premier [Product Closure on 01 Apr 2025] | Regent Elite Insurance Plan II Premier [Product Closure on 01 Apr 2025] | ||

| Critical Illness |

Smiley Kids | HealthCare 100[Product Closure on 2 Nov 2017] | HealthCare 168 Critical Illness Protector[Product Closure on 5 Nov 2018] |

| Health @ Ease (Launch Date: 13 April 2017) | |||

| "HealthCare 168" Critical Illness Protector 2[Product Closure on 9 Jan 2021] | 10-Year Renewable CI Protector(Launch Date: 12 Nov 2020) | "HealthCare 168 Plus" Critical Illness Protector(Launch Date:17 Nov 2020) | |

| ComboPro Insurance Plan (Product Closure on 31 Aug 2023) | "Protect starter" Critical Illness Protector (Launch Date: 02 Sep 2022) | “FamCare 198” Critical Illness Protector(Launch Date: 07 Mar 2024) | |

| “FamCare 198” Critical Illness Protector - Pregnancy Baby Protection (Launch Date: 07 Mar 2024) | |||

| Universal Life | “Wealth Achiever” Universal Life Plan [Product Closure on 17 Dec 2016] | “Wealth Achiever” Universal Life Protection Plan[Product Closure on 26 Feb 2019] | “Wealth Achiever” Universal Life Plan II(Launch Date: 14 Nov 2018) |

| Gorgeous (Launch Date: 15 Mar 2019) | Gorgeous Universal Life Protection Plan (Launch Date: 30 Sep 2022) | ||

| Hospitalization | “MediSave” Medical Account(Launch Date: 15 Sep 2017) | MediGold Plus Insurance Plan [Product Closure on 16 Jan 2023] | |

| Retirement / Annuity | “IncomePro” Annuity Plan [Product Closure on 01 Apr 2025] | Prosperous Deferred Annuity Plan 2(Launch Date: 27 Jan 2021) | Prosperous Deferred Annuity Plan[Product Closure on 25 Jan 2021] |

| Medical | “WiseCare” Medical Insurance Plan (Launch Date: 12 Apr 2019) | “BetterCare” Medical Insurance Plan [Product Closure on 23 Nov 2025] | "TopCare"Medical Insurance Plan(Launch Date: 23 Sep 2019) |

| “FlexiCare” Medical Insurance Plan(Launch Date:23 May 2022) | MediChamp Insurance Plan (Launch Date:03 Feb 2023) | ChampCare Medical Insurance Plan (Launch Date: 11 Feb 2025) | |

| Accident & Disability | Complementary Personal Accident Plan(Launch Date: 21 Nov 2018) | “Be With You” Personal Accident Plan(Launch Date: 20 May 2020) | Super Care Personal Accident Plan II (Product Closure on 31 Jan 2024) |

| Savings |

“Your Choice” Insurance Plan (Launch Date: 10 Aug 2022) | Everglow 128 Insurance Plan (Launch Date: 23 Nov 2022) | Value Plus Insurance Plan & Value Plus Insurance Plan (attached with Value Enhance Option)(Product Closure on 01 Apr 2025) |

| MYWealth Savings Insurance Plan (Premier) Closure on 01 Jan 2025) | Prime Treasure Savings Insurance Plan (Launch Date: 26 Jul 2024) | MyWealth Savings Insurance Plan 2 (Premier) (Launch Date: 27 Sep 2024) | |

| Regent Leap Savings Insurance Plan (Launch Date: 29 Sep 2025) |

Important Notice

1. Application forms and related documents must be submitted to CTF Life within 30 calendar days for Hong Kong/non-HK residents from the application form signing date AND it can be completed either in English or Chinese, and also the completed application documents should be submitted to SOD 2 working days before noon for meeting CTF Life’s deadline for processing. Amendment on sign date of any application document is not acceptable. For PRC clients, the application documents must be submitted to CTF Life within 7 working days (including the application sign date) from the application sign date / or verification date, whichever is the earlier. (Updated: 27 Nov 2018)

2. Copy of identification documents and entry proof MUST be verified and certified by advisor with sign date, signature, name and position of advisors on every copy. For joint case, if any one of the application documents is signed by both consultants, all of other documents of the same application MUST be signed by both consultants as well; otherwise, the application will be rejected.

3. Policy currency may be in USD or HKD (depends on the product features). Once the policy currency is chosen, it cannot be altered.

4. CTF Life will count client's age in last birthday. Back dating is allowed for Maximum 6 months from Policy Effective Date(depends on the product features).

5. Amendment on sign date of any application document is not acceptable

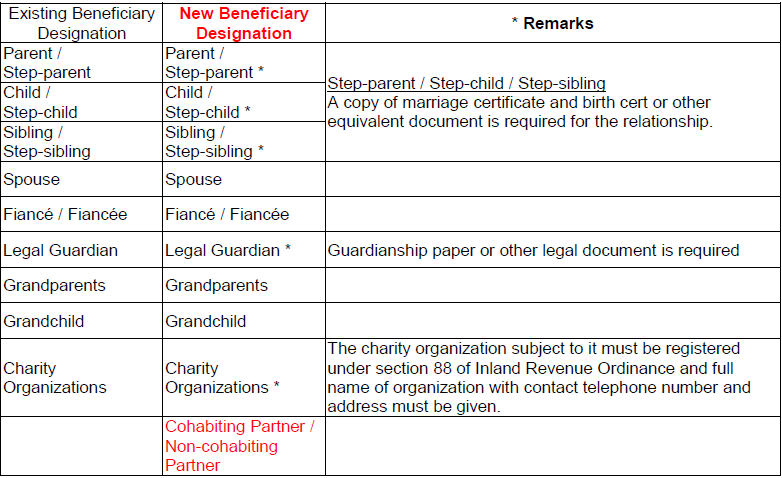

6. CTF Life will accept beneficiary as stated on the application who has insurable interest in case of death of the insured. “Insurable interest” exists when damages or losses to the insured will bring financial losses to the beneficiary of the insurance policy. The list of beneficiary designation has been updated as following: Beneficiary designation (Updated: 18 Jul 2018)

- If more than one beneficiary is designated, death proceeds of this policy will be paid to each beneficiary in equal shares unless otherwise specified herein

7. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

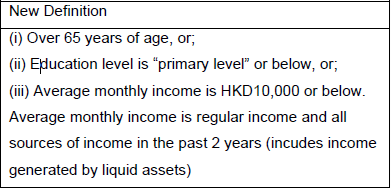

8. With effective from 15 January 2024, there is an update on Vulnerable Customer (VC) definition. If client is a vulnerable customer under CTF Life new definition, please fill in and sign OWM FNA P.12.(Updated: 11 Jan 2024)

Checklist

(Internal Document and Principal Document are required to be submitted)

Internal Document

1. Client Data Form

2. Client Agreement (CA form)

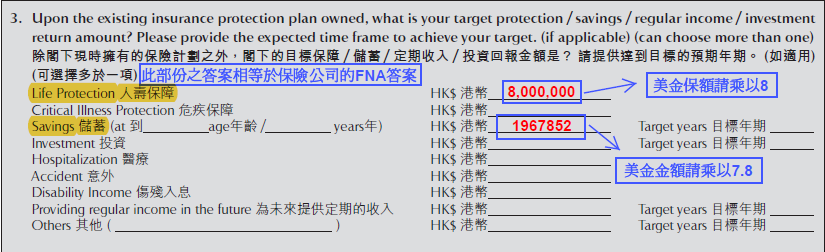

3. Financial Needs Analysis Form

- Sample of Regent Insurance Plan 2 (Global Premier) (8-year version) (Updated: 25 Mar 2022)

- Sample of “FlexiCare” Medical Insurance Plan (Updated: 23 May 2022)

- Sample of “Your Choice” Insurance Plan (Updated: 10 Aug 2022)

- Sample of "Protect starter" Critical Illness Protector (Updated: 27 Oct 2022)

- Sample of Gorgeous Universal Life Protection Plan (Updated: 27 Oct 2022)

- Sample of Everglow 128 Insurance Plan (Updated: 23 Nov 2022)

- Sample of MediChamp Insurance Plan (Updated: 21 Feb 2023)

- Sample of Regent Series (Updated: 01 Aug 2023)

- Sample of "HealthCare 168 Plus" Critical Illness Protector (Updated: 28 Jul 2023)

- Sample of “FamCare 198” Critical Illness Protectorr_“FamCare 198” Critical Illness Protector - Pregnancy Baby Protection (Updated: 07 Mar 2024)

- Sample of Prime Treasure Savings Insurance Plan (Updated: 26 Jul 2024)

- Sample of MyWealth Savings Insurance Plan 2 (Premier) (Updated: 27 Sep 2024)

- Sample of ChampCare Medical Insurance Plan (Updated: 11 Feb 2025)

- Sample of Ever Shine Savings Insurance Plan (Updated: 22 Aug 2025)

- Sample of Regent Leap Savings Insurance Plan (Updated: 29 Sep 2025)

Principal Document (NB Submission Checklist) (Updated: 31 Jul 2025)

1. CTF Life - Insurance Application Form [F3] (Updated: 26 May 2025)

- Gorgeous [Sample] (Updated: 20 Mar 2019)

- VHIS (WiseCare, BetterCare and TopCare) [Sample] (Updated: 19 Sep 2019)

- Regent Series [Sample] (Updated: 04 Jul 2023)

- "HealthCare 168 Plus" Critical Illness Protector [Sample] (Updated: 28 Jul 2023)

- Insurable Interest Declaration (Required if the Insured is the siblings / siblings of spouse / grandparents / parents or grandparent of spouse of the applicant) (Sample)

- VHIS Plan Conversion

- VHIS (WiseCare, BetterCare and TopCare) [Sample]

- Application Form 2019 VHIS Upgrade Program (Please send request to [email protected] by providing CTF Life the policy number)

- Plan Change

- Application Form 2019 VHIS Upgrade Program (Please send request to [email protected] by providing CTF Life the policy number)

- Change Form (with Heath Questionnaire) ([C6]) (Applicable for upgrading the Type of Room at the same time)

- “Be With You” Personal Accident Plan (Updated: 11 Sep 2020)

- Answer of application form Part 2 Medical Information, Part 3 Simplified Health Questions and Part 4 Health Declaration is not required

- Submit “Form [S16]Supplementary Statement Form for the Application of Insurance (Applicable to all Personal Accident Plans) " together with Life Insurance Application Form

- If client add Accidental Death and Dismemberment Rider and Glorious Comprehensive Accident Indemnity Rider after policy issued, need to submit “Change Form (with Heath Questionnaire)” with “Form [S16]Supplementary Statement Form for the Application of Insurance (Applicable to all Personal Accident Plans)"

- Supplementary Questionnaire for Special Underwriting Program of Rider (Updated: 11 July 2017), Client can apply Waiver of Premium (WOP), Payor Benefit (PB) and Accidental Death & Dismemberment (ADD) riders by simplified underwriting approach,details please refer to LO-809 (Updated: 20 Oct 2015)

2. Replacement Declaration (If yes, please complete IFS-PR **This form is already inserted in the application pack.

3. Applicant Information Financial Needs Analysis Form and RPQ (With effect from 01 Feb 2023, CTF Life accept OnePlatform FNA v4.1) (Updated: 27 Mar 2023)

Financial Needs Analysis (FNA) [F4]

- Sample for Regent Series (Updated: 04 Jan 2023)

- Sample for "HealthCare 168 Plus" Critical Illness Protector (Updated: 04 Jan 2023)

- Sample for “FlexiCare” Medical Insurance Plan (Updated: 23 May 2022)

- Sample of “Your Choice” Insurance Plan (Updated: 10 Aug 2022)

- Sample of "Protect starter" Critical Illness Protector (Updated: 02 Sep 2022)

- Sample of Gorgeous Universal Life Protection Plan (Updated: 30 Sep 2022)

- Sample of Everglow 128 Insurance Plan (Updated: 23 Nov 2022)

- Financial Needs Analysis and IFS - Premium Financing User Guide_Brokerage (Updated: 03 Jan 2023)

- Premium Financing Calculator (Updated: 05 Jan 2023)

- [Product Mapping Table](The product mapping table is for reference only. Please only recommend products which are on shelf at the time you make the recommendations.) (Updated: 27 Jan 2021)

4. Broker's Report ([B3])

- Applicant is required to provide the personal information of financial supporter in case the source of funds/ wealth/ income is from financial supporter such as spouse or parents.

- Client needs to fill in Q1.3 on P.1 if client tick “Financial Supporter” in Q1.2.

- Section “Time availability and preferred contact telephone number for customer” is for ILAS policy only. However, if applicant doesn’t have a preferred contact time, please state “Post Sales Call can be arranged anytime” next to “Preferred Contact Time” on the form.

5. Signed Illustration Document (if applicable)

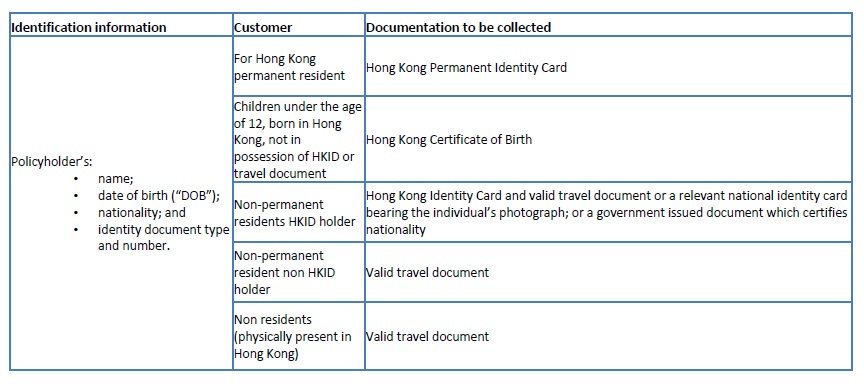

6. Copy of identification document of the Applicant and Proposed Insured

- Please refer to the below FAQ / Supplementary guideline: Guidelines on Anti-Money Laundering & Counter-Terrorist Financing for New Business

- Subsequent Premium is not applicable for Signature Life (Updated: 1 Feb 2016)

8. Address proof

- With effective from 29 February 2024, a valid address proof issued within last 3 months must be submitted (Do not accept e-Statement). For detail requirements and example of valid address proof, please refer to the MEMO and FAQ. (Updated: 10 Jul 2024)

9. Simplified Underwriting Questions for Personal Accident Plans [Eng] [Chi] (Updated: 29 Aug 2019)

10. Supplementary Statement Form for the Application of Insurance(Applicable to On Your Mind Insurance Plan(Supreme Version / Smart Version)) [S21] (if applicable) (Due to the Flexible Death Benefit Settlement Option for “On Your Mind” Insurance Plan New Business has prepared a specialized Supplementary Statement Form LU0327-2009.) [Sample] (Updated: 12 Oct 2020)

11. Notice of Assignment (Shanghai Commercial Bank) is provided by the bank.Important Facts Statement – Premium Financing [I20] and Authorization Letter (Shanghai Commercial Bank)[A13] are required for premium financing of Fortune Saver Insurance Plan 3 is arranged by Shanghai Commercial Bank (SHCB). (Updated: 23 Aug 2021)

12. Important Facts Statement – Premium Financing [I20] (Updated: 17 Feb 2025) and Authorization Letter (non-Shanghai Commercial Bank)[A12] are required for premium financing of Fortune Saver Insurance Plan 3 is arranged by other banks. (Updated: 03 Jan 2023)

Non HK Resident (Additional Documents)

Definition of Non-HK Permanent Resident:

Details please refer to Section 5.1 Residency Definition from New Business Underwriting Manual

1. Copy of identification document of the Applicant and Proposed Insured

(*Please refer to the below FAQ / Supplementary guideline: “Guidelines on Anti-Money Laundering & Counter-Terrorist Financing for New Business)

- Copy of a current and valid Hong Kong Identity Card AND Passport / Travel Document

- Applicant and insured need to submit the page of the passport/travel document/visa:

(i) For applicant and insured adult, the passport/travel document/visa pages with following information are required as entry proof: (i) Applicant’s and insured’s personal particulars; AND (ii) Hong Kong Immigration entry chop to confirm [Date of arrival] and [Date of “permitted to remain”] in Hong Kongor the computer generated landing slip including the information of Applicant’s/Insured’s Name, Passport No., and the period of abode in HK ; and

(ii) All pages must carry the same passport/travel/visa document number in order to prove that they are from same document. Otherwise, FULL passport/travel/visa document from the applicant and the insured is required.

(iii) IFA must sign and date on all the pages with a declaration to certify that they are true copies from the passport/ travel/ visa document

from resident country

PRC Case (Additional Documents) [MCV Operation Manual] (Updated: 08 Feb 2023)

1. Copy of identification document of the Applicant and Proposed Insured

(*Please refer to the below FAQ / Supplementary guideline:“Guidelines on Anti-Money Laundering & Counter-Terrorist Financing for New Business)

- Entry Proof (if applicable):

- Copy of the passport/travel document/visa page of Applicant’s and insured’s personal particulars; and

- Copy of the computer generated landing slip with client’s name, travel document number, arrival date, conditions and limit of stay in Hong Kong; and

- Copy of the passport / travel document page with departure chop of resident country of the client. The purpose of this document is to ensure the selling process and signing of new application are both completed within Hong Kong, so no entry chop should be enclosed.; and

- Copy of all pages must carry the same passport/travel/visa document number in order to prove that they are from same document. Otherwise, FULL passport/travel/visa document from the applicant and the insured is required.

For Juvenile: Entry proof is not required. Subject to IFA's declaration with Manager’s signature that he/she has interviewed the child before the application time and found the insured is physically fit.

- Birth Certificate or Juvenile ID Card; and

- Child clinic/hospital records (for age less than 4).

2. For MSV details, please kindly refer to Mainland Sales Verification-OnePlatform.

3. Important Facts Statement for Mainlander Policyholder(IFS-MP) [I8](Applicable for Traditional & ILAS products) - Applicable for Traditional & ILAS product (Assignment & New Application).

*The “Important Facts Statement – Mainlanders” (IFS-MP) must be provided upon the submission of all insurance applications starting from 1st September 2016 (Effective Date), please refer to appendix for details.

4. The People’s Republic of China Addendum (this “Addendum”) PICS_PRC [T1]

*Transition period for the “Addendum” started from 23 Sep 2023 – 31 Dec 2023. With effective on 1 Jan 2024, the “Addendum must be provided upon the submission of all insurance applications. (Updated: 4 Oct 2023)

Owner other than proposed insured (Additional Documents)

Requirement for Spouse (Husband/Wife) or Parent as policy owner

1. Relationship Proof between Policy Owner and Life Assured

2. For Life Assured is Juvenile under the age of 12, born in Hong Kong, not in possession of a Hong Kong Identity Card or valid travel document: Copy of a valid Hong Kong Certificate of Birth

Requirement for Grandparent as policy owner:

1. Evidence to prove the relationship between the proposed Insured Juvenile, the Parents and the Applicant

- Birth certificate of the proposed insured juvenile and Birth certificate of the parents of the insured juvenile; or

- Registration Certificate; or

- Residence booklet

2. Declaration of Trust ([D1])

Please refer to NB-906 [Eng] [New Business Underwriting Manual]

For the life insured is Juvenile.

- Entry proof is not required

- Subject to IFA's declaration with Manager’s signature that he/she has interviewed the child before the application time and found the insured is physically fit on Broker Report [Refer to Sample]

Join Owner is Not Accept by CTF Life

Summary of Identification information

Medical requirement

For Medical requirement, please refer Section 4(Sapphire Tier) from New Business Underwriting Manual.

- Procedure For Medical Appointment Arrangement

1. IFA Concierge will inform OnePlatform CSD by sending Underwriting Notification (UN) with stating the requested medical exam item(s).

2. Advisor receives the UN and completes the form “Medical Requirement Requisition Form ([M5])” in accordance with the medical item(s) which is/are stated on the UN.

3. Advisor arranges appointment with an appropriate doctor/laboratory from CTF Life’s panel doctor and/or laboratory. Full list of doctor’s name and address is available in the Medical Exam List.

4. Advisor should clearly mention the client’s information such as specific date & time, client’s name, sex, medical exam/laboratory test item(s).

5. Advisor delivers the completed “Medical Requirement Requisition Form ([M5])” to client and informs the client to arrive the appointed clinic/laboratory for the medical exam on time.

6. During the medical exam, doctor will fill up the Personal Health Statement for the client. The client should acknowledge all the information is true and signs on the Personal Health Statement. Clinic will directly mail the completed Personal Health Statement and/or medical report to our New Business Department for further underwriting procedure.

- Questionnaires:

1. Avocation Questionnaire ([A2])

2. Aviation Questionnaire ([A3])

3. Martial Arts Questionnaire ([M4])

4. Mountaineering Questionnaire ([M2])

5. Motor/Motor-cycle Racing Questionnaire ([M3])

6. Power Boat Questionnaire ([P4])

7. Sports Diving Questionnaire ([S7])

- List of Grade 3A Hospitals and Specially Selected Hospital in Mainland China

For the list of grade 3A hospitals and specially selected hospital in Mainland China, please refer to LO-879 [ENG] [CHI] and [Hospital Address in Simplified Chinese]. (Updated: 3 April 2018)

- Service of the CTF Life The GALAWEALTH

In order to maintain the service of the CTF Life The GALAWEALTH to response to the elevated medical cost, service provider continues to offer the following service with effective from 14 Aug 2017:

(1) Medical Examination (2) Free Medical Consultation (3) Tour guide of CTF Life Prestiage Centre

For details please refer to VIP-938 Services of CTF Life Prestiage Centre

Financial requirement (Updated: 6 May 2025)

For Financial Proof Underwriting Requirement, please refer Section 3.2 from New Business Underwriting Manual. (Updated: 6 May 2025)

Customers’ Background Report [C15]

Residential Underwriting

Country of Iran & Democratic People’s Republic of Korea will not be accepted.

FAQ / Supplementary guideline

- Underwriting Guidelines for Platinum Term Plan (Updated: 31 Jul 2025)

- Guidelines on Anti-Money Laundering & Counter-Terrorist Financing for New Business (Updated: 20 Jun 2019)

- NB-965 Revise Underwriting Guidelines for Critical Illness Product [Chinese] / [English] (Updated: 8 Nov 2017)

- 理賠常見問題 (Updated: 02 Mar 2022)

- For Foreign Account Tax Compliance Act, please refer to CTF Life FATCA FAQ (Updated: 2 July 2014)

- Tailor-made illustration is valid for one month only from the printed date of client (If the print date & Proposal valid date cannot be shown, the illustration will not be accepted), Illustration> www.ctflife.com.hk > Login B.O.S.S. as consultant, please refer to Premium Financing Procedure (Please refer page 22-34) (Updated: 21 Oct 2020)

- For Signature Life with Premium Financing, please refer to Premium Financing Procedure

- LO-797 Change of Smoking Class (Updated: 2 Nov 2015)

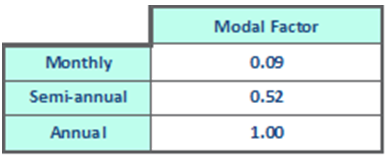

- Premium Modal Factor (Updated: 2 Feb 2015)

- Operational Manual for New Remuneration Structure for Participating Policy Holder Qualifies as a Professional Investor (Eng / Chi)

CTF Life Customer Hotline: 28668898