Broker Code: 56000083

Product List:

| Universal Life | Premio ([Product closure on 29 Aug 2017]) |

| ROP Term Life | Venti Advance ([Product closure on 6 Apr 2018]) |

| LionPainter ([Product closure on 31 Mar 2020]) | |

| Term Life |

G-Pro ([Product closure on 31 Jan 2017]) |

| Supreme Gold | |

| LionPainter Flexi (Launch date 5 Mar 2020) | |

| Lion Master Term Life Plan (Launch date 30 Dec 2025) | |

| Critical Illness |

Ruby Critical Illness Plan([Product shelved on 31 Oct 2018]) |

| LionGuardian ([Product shelved on 1 Apr 2021]) | |

| LionGuardian PlusOne (Launch date 08 Feb 2021) | |

| LionGuardian Beyond (Launch date 12 Apr 2021) | |

| LionAlong (Launch date 08 Nov 2023) | |

| Endowment | LionBooster ([Product closure on 30 Apr 2019]) |

| LionBooster 2 ([Product shelved on 5 May 2020]) | |

| LionTycoon (Launched on 21 Sep 2020) | |

| LionTycoon Beyond ([Product shelved on 1 Feb 2023]) | |

| Retirement | Generali - LionPromise ([Product closure on 30 Jun 2020]) |

| LionPromise Pro (Launched on 19 Aug 2020) | |

| LionHarvest Pro Deferred Annuity ([Product closure on 4 Dec 2024]) | |

| Qualifying Deferred Annuity Policy |

LionHarvest Deferred Annuity ([Product closure on 1 Dec 2020]) |

| LionHarvest Prime Deferred Annuity (Launch Date: 10 Jan 2025) | |

| Savings |

LionPrima (Launch Date: 17 Jan 2023) |

| LionTycoon Beyond 2 (Launch Date: 20 Jan 2023) | |

| LionAchiever (Product closure on 01 Jul 2025) | |

| LionPatron (Launch Date: 20 Nov 2024) | |

| LionAchiever Elite (Launch Date: 04 Jun 2025) |

Important Notice

For corporate application, please refer to Customer Due Diligence on Corporate Clients for detailed requirements of OnePlatform. (Updated: 02 Jul 2020)

1. Proposed policyholder vs. proposed insured

- Proposed policyholder and proposed insured are the same person

- They are spouse

- Proposed policyholder is the parent of proposed insured

2. Original application form must be submitted to SOD within 25 calendar days from the signing date; For PRC cases, NB documents must be submitted to SOD within 5 working days.

3. Witness

- Must be the consultant himself/ herself

- In case the consultant buys the plan, another consultant must be assigned to be the witness

4. All copies must be Certified True Copies

5. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

Checklist

(OnePlatformInternal Document and Principal Document are required to be submitted)

Internal Document

| 1 | Client Data Form |

| 2 | Client Agreement (CA form) |

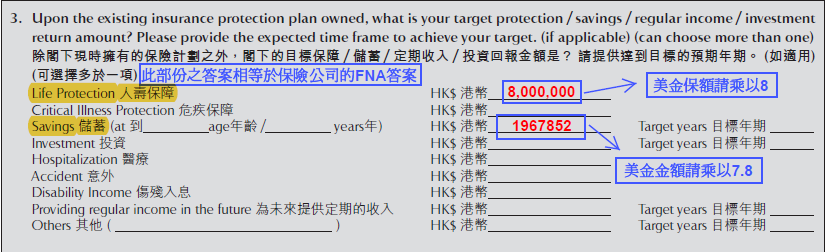

| 3 | Financial Needs Analysis Form

FNA sample for Generali (Updated: 21 Aug 2025)

|

Principal Document

Hong Kong Resident

| 1. | Application Form:

For New Application or Policy no. 8700xxxx - UW/GLHK/eAF ([L1]) For New Application of Lion Master - GLHK_HNW_ver_202409

|

|

| 2. | Financial Needs Analysis Form:

|

As OnePlatform FNA is a must form for new application and it is also accepted by Generali, so it’s not a must to submit Generali FNA form at the same time.(Updated: 16 Apr 2021)

[Product Mapping Table](The product mapping table is for reference only. Please only recommend products which are on shelf at the time you make the recommendations.) (Updated: 12 Apr 2021) |

| 3. | HKID Card Copy | |

| 4. | Certified Address Proof | The address proof is not necessary by Generali if the applicant is a HK or PRC tax resident.

Generali may require to collect (additional) information or document on address verification from a customer for other purposes (e.g. group requirements, other local or overseas legal and regulatory requirements.)Client needs to fulfill both principal and OWM address proof requirement, for details, please refer to:OWM address proof requirement Generali - only accepting government bills/ statements, utility bills, credit card statement, bills of fixed line showing phone number and bank statements, Chinese ID card(both sides); all are required to be dated within 3 months prior to the date arrived at Generali (Updated: 30 Oct 2015) |

| 5. | Illustration |

|

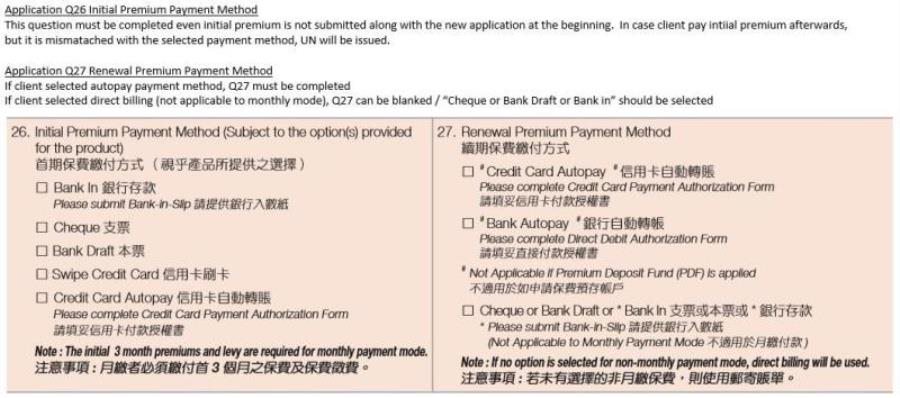

| 6. | Payment | (please refer to Section 13.1 of the attached UW Manual – Retail Life Business GLHK |

| 7. | Credit Card Payment Authorization Form: PS/GEN/CCAF ([C2]) | If applicable

Sample (Updated: 17 Apr 2018) |

| 8. | DDA form:

|

(if applicable and please refer to “Direct Debit Authorization Form”) |

| 9. | Important Facts Statement - Policy Replacement UW/GLHK/IFS_PR ([I6]) (Updated: 16 Apr 2021) |

If answer is “Yes’ or “Not yet decided” in Part X Replacement Declaration |

| 10. | Financial Questionnaire | If applicable, details please refer to Section 8.1.2 of the attached UW Manual – Retail Life Business GLHK |

| 11. | Residency and Travel Questionnaire | (if applicable; please refer to Question 41 of application form, and Important Notice point 2)

Residency and travel questionnaire for non-HK permanent residents or Hong Kong resident outside Hong Kong for more than 6 months per year. (Updated: 30 Oct 2015) |

| 12. | Supplementary Form: For New Application - UW/GLHK/SF ([S7]) | If applicable |

| 13. | COVID-19 Questionnaire ([C5]) | Applicable for customer who confirmed of COVID-19 infection (Updated:15 Jul 2022) |

| 14. | Source(s) of Fund/ Wealth Supplementary Information Questionnaire | 1) Requirements for LionAchiever, LionAchiever Elite and LionPrima Application

2) Additional Requirements for Application Requiring Enhanced Due Diligence |

For non- permanent HK resident (Additional Documents)

Copy of identification document of the Applicant and Proposed Insured

For Non-permanent HK resident and China ID or passport holder, client needs to submit “Important Facts Statement for Mainland Policyholder” with the application form. (Updated: 5 Jan 2021) |

Oversea Applicants (Additional documents)

| 1. | Copy of identification document of the Applicant and Proposed insured | |

| 2. | Entry proof | |

PRC Applicants (Additional documents)

| 1. | PRC ID card copy of the sides and/or passport copy |

| 2. | Entry proof

- If the customer has lost the landing slip, “Declaration for Loss of Entry Proof” must be completed by the customer.(Updated: 17 Apr 2023) |

| 3. | Important Facts Statement for Mainland Policyholder: UW/GLHK/IFS_MP ([I3])- required for applications signed on/after 1 Sep 2016

- has to submit to GLHK within 7 working days of sign date - Sample for LionPainter Plan (Updated: 17 Apr 2018) - Sample for LionBooster (Updated: 12 Nov 2018) |

(Additional documents if applicable)

Financial Underwriting Requirements

1.Medical appointment - Medical Financial Requirements (Updated: 19 Oct 2015)

- An “Underwriting Notification” and a “Medical Exam Appointment Form” are sent to Intermediary

- Intermediary/ proposed policyholder/ proposed insured contacts medical service centre to make appointment

- Proposed policyholder / proposed insured brings with the Form and his/ her ID to the centre, which will send the report directly to Generali

- Medical centre: please refer to Section 13.2 of “UW Manual – Retail Life Business GLHK”

- Procedure for Medical Examination in Mainland China: please refer to Section 12 of “UW Manual – Retail Life Business GLHK”

- China Medical Service Appointment Form: For Policy no. 8700xxxx - UW/GLHK/CMSF ([C3])

2. Nationality

- Please refer to UW Manual Section 11 – Geographic Rating "UW Manual – Retail Life Business GLHK”

3. NB submission reminder Noted for Premio – Application checklist (Updated: 26 May 2016)

FAQ / Supplementary guideline

-

- For checklist of Generali, please refer to Personal Insurance - New Business Requirement Checklist for reference. (Updated: 1 Dec 2020)

- For New Application requirement, please refer to UW Manual – Retail Life Business GLHK (Updated: 09 Jul 2025)

- Underwriting Manual – For Mainland China Visitor (“MCV”) (Updated: 09 Jul 2025)

- FAQ [Eng] [Chi] (Updated: 19 Feb 2020)

Generali Customer Hotline:3187 6187