Broker Code: 32866

NF2F Update: Hong Kong Insurance Authority(IA) announced that the non-face-to-face sales process has ceased after 30 April 2023, a one month transitional period (e.g. 1 May to 31 May 2023, subject to provider) will therefore be provided to allow sufficient time for provider to complete the underwriting process. (Updated: 03 May 2023)

Product List

| Traditional Life Insurance | Smart Jumbo Saver III | Smart Saver III | Smart (Elite) Term |

| LifeDelight Insurance Plan (Shelved on 1 Jul 2022) | |||

| Whole Life | Grand Heritage II (Launch Date: 17 Jun 2020) | Fortune Protector Life Insurance (Launch Date: 09 Mar 2023) | |

| Coupon | Prime Harvest Income Plan (Shelved on 15 Feb 2020) | Ever Harvest Income Plan (Shelved on 15 Feb 2020) | Wealth Genius Income Plan (Launch Date: 19 Feb 2020) |

| Accident & Disability | Child Accident Protector | Disability Income Protection Plan | |

| Critical Illness |

HealthVital II Major Illness Plan (Launch Date: 15 Jun 2017) | HealthSelect II Major Illness Plan (Launch Date: 15 Jun 2017) | Health Elite CI Insurance (Shelved on 27 Aug 2019) |

| Precious Mom and Child (Updated: 25 Jun 2015) | CritiPartner Critical Illness Plan (Shelved on 10 Jul 2021) | CritiPartner Plus Critical Illness Plan (Shelved on 10 Jul 2021) | |

| MultiPro Critical Illness Plan (Launch Date: 8 Sep 2020) | MultiPro Plus Critical Illness Plan (Launch Date: 8 Sep 2020) | CareForAll Critical Illness Plan (Launch Date: 28 Feb 2024) | |

| LoveAssure Critical Illness Plan (Launch Date: 9 Aug 2021) | LoveAssure Plus Critical Illness Plan (Launch Date: 9 Aug 2021) | TotalAssure Series:(Launch Date: 19 Jul 2024)

|

|

| Medical |

MediPartner Health Plan | Global Elite II Health Plan (Shelved on 9 Sep 2024) | Smart Medicare / Smart Medimoney |

| AXA WiseGuard Medical Insurance Plan (Launch Date: 17 Apr 2019) |

Smart Medicare (Launch Date: 17 Apr 2019) |

Smart Start Medical Insurance (Launch Date: 18 Apr 2019) |

|

| AXA WiseGuard Pro Medical Insurance Plan (Launch Date: 14 Aug 2019) |

Pink Medical Insurance Plan (Launch Date: 9 Oct 2020) | SurgiCare Surgical Insurance Plan (Launch Date: 2 Aug 2021) | |

| CareForAll Hospital Cash Plan (Launch Date: 02 Sep 2024) | Global Reach Medical Insurance Plan (Launch Date: 23 Oct 2024) | ||

| Universal Life | Heritage Builder Universal Life Plan (Updated: 14 Jul 2016) | ||

| Disability Income | Lifelong Care Partner Insurance (Launch Date: 2 May 2017) | ||

| Retirement | IncomePartner Deferred Annuity Plan (Shelved on 15 Apr 2020) | IncomeEnrich Deferred Annuity Plan (Shelved on 30 Mar 2024) | |

| Endowment | Flexi Power Saver (Launch Date: 27 Feb 2019) | MAXX II (Shelved on 27 Aug 2019) | Wealth Advance Savings Plan (Shelved on 13 May 2019) |

| Wealth Advance Savings Series II (Launch Date: 02 Apr 2019) |

Wealth Ultra Savings Plan (Launch Date: 21 Jul 2020) | FortuneXtra Savings Plan (Shelved on 1 Jul 2022) | |

| Savings | Max Goal Insurance Plan (Shelved on 1 Jul 2025) / Max Wealth Insurance Plan (Launch Date: 16 Aug 2022) | WealthAhead Savings Plan (Shelved on 31 March 2025) | WealthAhead II Savings Insurance - Supreme (Launch Date: 23 Oct 2025) |

| Annuity |

JoyAhead Immediate Annuity Plan (Launch Date: 15 Aug 2023) | IncomeBliss Deferred Annuity Plan (Launch Date: 13 Jun 2024) |

Important Notice

Customer Due Diligence on Corporate Clients

LCD has issued the directive of customer due diligence on corporate clients on 01-Apr-2016. For details and its requirement, please refer to the FAQ > Customer Due Diligence on Corporate Clients.

1. Applications can be submitted to OnePlatform within 10 calendar days after sign date of client except *MCV clients. For MCV case, case must be submitted within 2 working days.

2. Application Form must be AXA original pre- printed copy, cannot accept photocopy or printed copy from our own printer.

3. The effective date of the policy will usually be the last document date, i.e. the application signed date or date of last piece of document submitted. In case if the premium is paid after the application is approved, the effective date of the policy will be the premium paid date.

4. If any document is neither in English nor in Chinese, a translation from a suitably qualified person (i.e. local lawyer) must be obtained.

5. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

| 1 | Client Data Form |

| 2 | Client Agreement (CA form) |

| 3 | Financial Needs Analysis Form ** Starting from 22 March 2021 (with reference to AXA Client Needs Analysis (AXA CNA) & Application sign date), both of OnePlatform FNA and GL30 AXA CNA must be submitted with the application form. (Updated: 19 Mar 2021)

|

Principal Document

HK Applicants - Permanent HKID

** For HK Permanent ID holder with residential / correspondence address in China, client needs to perform MCV and submit all related documents including IFS-MP (Details please refer to PRC / Overseas Applicant (Additional Documents).

1 Insurance Application Form [A7] LFUW079 [Eng] / LFUW108 [Chi]

[Sample application form guideline on Life product]

[Sample for FortuneXtra Savings Plan] (Update: 22 Jan 2024)

Application Form (Heritage Builder/Grand Heritage II/Max Goal Insurance Application Form (Insurance Broker Version) [Chi] [Eng] [H4] Form version : HNWENGBR-2410/ HNWCHIBR-2410] (Updated: 30 Oct 2024)

**For Grand Heritage II, AXA accept print out version application form, and client only need to sign on Page 7

For Universal Life product:

Universal Life Insurance Application Form [Insurance Broker version] ENG version / CHI version ( [U1])

Broker Code: 32866

- Must write the address in English

- Must provide mobile number on application form (Updated: 5 May 2020)

- Must write FULL Basic Plan name with plan term same as the name printed on illustration (Updated: 5 May 2020)

- Beneficiary information MUST state a person / stated "Own Estate"

- Insurance in force and amount in force, please write N/A or Nil if the client does not own any insurance in force.

- Signature of Witness / Signature of Agent = consultant signature on application form.

- Please kindly note that Underwriting Notification language is driven by the instruction in the last page of application form. Please kindly specify your requirement where suit your/client needs.

- Individual Insurance Products - Reference Table for Completing Health-Related Information (Updated: 19 Nov 2021)

2 Illustration Document (Proposal)

- Illustration must type the FULL NAME of Applicant/Life Insured

- For all HKID holder (including Temp ID & Permanent ID) who lives in Mainland China more than 6 months per annual will follow MCV rating.

3 Important Facts Statement – Policy Replacement ([I11])

- It’s mandatory to complete & submit IFS-PR for all new business

4 HKID/Passport Copy Certified true copy by consultant 5 Residential Address Proof

(issued within the past 3 months)

(Updated: 16 Sep 2020)

Certified true copy by consultant

Below please find the list of examples: [Memo]

- Recent documents issued within the last three months:

- utility bill

- correspondence from a government department or agency

- statement issued by an authorized institution (banks), a licensed corporation or an authorized insurer in Hong Kong or equivalent jurisdiction

- mobile phone or pay TV statement

- Letter from an immediate family member at which the individual resides confirming that the customer/beneficial owner lives at the address, setting out the relationship, together with the immediate family member’s address proof

- Letter from a university or college that confirms residence at a stated address

- Tenancy agreement duly stamped by the Inland Revenue Department or equivalent authority

- Letter from employer with proof of employment that confirms residence at a stated address

- Government-issued photographic driving license or national identity card containing the current residential address

- Medical card with address stated

8. Property management fee receipt with address stated

6 Copy of Birth Certificate if Child under age 18 years Certified true copy by consultant 7 GL30 Client Needs Analysis ([C6]) (Updated: 02 Feb 2026)

- Client signature on each pages (included of p.4) is required (print out version)

** Starting from 22 March 2021 (with reference to AXA Client Needs Analysis (AXA CNA) & Application sign date), both of OnePlatform FNA and GL30 AXA CNA must be submitted with the application form. [New Guidelines issued by the Insurance Authority <GL 25, 27 –31>] (Updated: 1 Apr 2021)

- [Product Mapping Table]The product mapping table is for reference only. Please only recommend products which are on shelf at the time you make the recommendations.) (Updated: 1 Jun 2018)

8 Payment Method

- Optional: AXA Payment Form [A5] with payment attached (Updated: 26 Sep 2025)

- For Heritage Builder U Life, only TT, Cheque and Union pay could be use, please click here for more details (Updated: 18 Jul 2016)

- Form [F2] First-Year Premium Special Payment Mode Application Form [Memo] Policy applications submitted to AXA between 28 September 2020 and 31 December 2021 can apply for the Special Payment Mode (Updated: 15 Jan 2021)

9 Supplement to Application AXA "Tender Care" Programme ([S9]) If applicable 10 Supplement to Application - For General Information ([S1]) If applicable; For client to submit further information requested by AXA 11 Supplement to Application - For Plan Detail Changes ([S4]) If applicable; For client to submit further information requested by AXA 12 Supplement to Application for Precious Mom and Child Insurance ([S11]) If applicable

13 Supplement to Application for Lifelong Care Partner Insurance ([S17]) It’s not required if client completes the health questions in the application form.

Please refer to Bulletin 2017-20 Launch of new form-Supplement to Application for Lifelong Care Partner Insurance (Updated: 2 May 2017)

14 Supplement to Application - Declaration of VHIS application ([S20]) Required if the insured is

- Spouse ; OR

- Applicant’s child and < age 18 ; OR

- Applicant’s sibling(s), ≥ age 18 but < age 25 and a full time student ; OR

Parent / Parent-in-law / Grand Parent / Grand Parent-in-law’s ≥ age 55

15 Supplement to Application - Letter of Consent from Proposed Insured’s Parent Or Guardian ([S19]) Required if

- Insured is < age 18 OR

- The applicant is not insured’s parents

16 Financial Questionnaire

([F1])Required for Total sum insured (including all pending and inforce coverage in AXA and other companies) ≥ USD1,500,000OR

Premium financing case of Heritage Builder U-Life, Grand Heritage II and Max Goal Insurance Plan (Updated: 04 Jan 2023

17 Large Amount Supplement Form ([L1]) LAS (Full Version) if annualized contribution is HKD 1,000,000 or above (Income Proof may require) 18 Broker/ Agent letter Required for Heritage Builder U-Life only 19 MultiPro Critical Illness Plan Series Simplified Underwriting Campaign Form ([M6]) The application for a Designated Plan on the proposed insured shall be submitted successfully between 26 August 2020 and 31 December 2020 (both dates inclusive) (the “Campaign Period” (Updated: 05 Nov 2020) 20 Health Declarations Form (Applicable to Designated Plan/Campaign) [H1] Required for Pink Medical Insurance Plan only 21 Supplement to Application – Supplementary Health Information [S5]

- If the answer to any of the questions under Health-Related Information (Part I) and (Part II) is “Yes” stated on application form, it is required to complete this form.

- This form should be completed (if applicable) and submitted together with the application / request forms. [MEMO] (Updated: 19 Nov 2021)

22 Health Declaration Form (Applicable to Max Wealth Insurance Plan) [H2] Only applicable to the application with the total premium amount of all policies and applications of Max Wealth Insurance Plan and Max Goal Insurance Plan for the Proposed Insured / Insured is over USD5,000,000 and less than or equal to USD20,000,000. (Updated: 02 Sep 2022) 23 Important Facts Statement – Premium Financing [I2] 24 Supplement to Application - Receive Annuity Payment in Cash [S23] Applicable to JoyAhead Immediate Annuity Plan

Only applicable with selected annuity payment option as Cash, to setup autopay transfer of annuity payment to designated bank account

25 Health Declaration Form (Applicable to JoyAhead Immediate Annuity Plan) [H3] Only applicable to application if the total premium amounts of all policies and applications of JoyAhead Immediate Annuity Plan for the Proposed Insured is over HKD3,000,000 26 Supplement Form (Hong Kong) – Consents to Data Processing Pursuant to AXA’s Privacy Policy [S25] If applicable; provide PIPL consent if the customer missed to provide the consent on the original new business application forms, service forms or claim request forms.

For non- permanent HK resident (Additional Documents)

1 Photocopy of ID, passport (photo page) & entry proof

- Client need to sign on each page

- verified true copy by consultant and face-to-face verification by AXA authorized staff

2 Declaration for Insurance Application ([D2]) 3 Important Facts Statement for Mainland Policyholder (“IFS-MP”) ([I9]) For Non-permanent HK resident and China ID or passport holder with residential / correspondence address in China, client needs to perform MCV and submit all related documents including IFS-MP (Details please refer to PRC / Overseas Applicant (Additional Documents).

For Non-permanent HK resident and China ID or passport holder with residential / correspondence address in HK, client needs to submit IFS-MP with the application form.

PRC / Overseas Applicant (Additional Documents)

1 Photocopy of ID, passport (photo page) & entry proof

- Client need to sign on each page

- Verified true copy by consultant and face-to-face verification by AXA authorized staff

2 Declaration for Insurance Application ([D2]) 3 Declaration by Intermediary ([D7]) 4 Supplement to Application For Major Illness Insurance/Early Stage Major Illness Benefit/Cancer Therapy Insurance ([S3]) For Mainland Chinese HealthPro Major Illness applicant / HealthPro Vital / Select and / or Cancer Therapy Rider applicant 5 Supplement to Application For Insurance - For LI/CI ([S7]) For Mainland Chinese Living Insurance / Critical Illness applicant 6 Supplement to Application for Precious Mom and Child Insurance (Ref: MCV) ([S12]) For Mainland Chinese Precious Mom and Child Insurance applicant 7 Student handbook or health booklet Effective from 18 May 2015, for proposed insured who is MCV Juvenile (Updated: 23 Apr 2015) 8 Important Facts Statement for Mainland Policyholder (“IFS-MP”) ([I9])

- Effective from 1 Sept 2016, required by OCI. For details of requirement, please refer to Appendix (Updated: 1 Sept 2016)

- Foreign passport holder with residential / correspondence address in China also need to perform MCV and all related documents including IFS-MP (Details please refer to PRC / Overseas Applicant (Additional Documents).

Beneficiary requirement

- For adults’ plan - policy owner must have insurable interest with life insured (For example: Father / Mother => Son/Daughter (under 18 years old), Wife <=> Husband. It also apply to a person who is 18 years old.

- If more than 1 beneficiary is designated, indicate the percentages which should be summed up to 100%. If not specified, the proceeds will be shared equally among beneficiaries

- Plan for children aged below 18 – beneficiary can either be the policy owner or we also allow naming third person as the beneficiary provided insurable interest exists. Example of insurable interest: parents and legal guidance of the minor insured

Medical requirement

- Medical Requirement for Total Sum Insured \ Age and for Disability Income (DIP / DIPP)

- For the Medical & Financial requirement, please refer to AXA Underwriting Guideline Occupation Rating&Quick Quote

- For the Medical examination, please submit Medical Examination / Laboratory Test Request Form ([M1]) (Updated: 11 Nov 2022) and Medical Report Authorization Form ([M2])

- Relaxation of Non-Medical Limit Calculation Restart Rule (Broker Bulletin No 442) (Updated: 31 Dec 2014)

- For the medical examiner's directory information, please refer to Medical Examiner's Directory. (Updated: 24 Dec 2025)

- Backdating is NOT allowed for Global Elite, Wealth Advance or Disability Income Plan.

- Medical Underwriting Guideline for Heritage Builder Universal Life. For the medical examination, please submit Medical Exam Lab Test Request Form (Universal Life) ([M4]) and Medical Examiner’s Report (Universal Life) ([M5]) (Update: 27 Aug 2019)

- Non-medical limit for Heritage Builder Universal Life (Update: 27 Aug 2019)

- Broker Bulletin No 2018-095 Enhancements of Non-Medical Limits & Medical Requirements (Updated: 9 Nov 2018)

- Underwriting Requirement for Common Medical Health Conditions (Updated: 28 Nov 2025)

For Wealth Advance:

Category 1: No Medical Examination - Total First Year Annual Premium of all in-force policies, new and pending applications of Wealth Advance under the same Insured: less than or equal to HKD1,600,000 / USD200,000 / MOP1,600,000 (for Macau only)

- Health underwriting: waived

- Financial underwriting: waived

- Occupational loading: not applicable

- Geographical loading: not applicable

- Financial requirement : follow existing underwriting rules

Category 2: Normal Underwriting - Total First Year Annual Premium of all In-force policies, new and pending applications of Wealth Advance under the same Insured: more than HKD1,600,000 / USD200,000 / MOP1,600,000 (for Macau only)

Full underwriting includes:

- Health declaration

- Medical requirements include:

- Medical Examination, MU, BTA, CRP, ECG

If attaching any eligible rider(s), normal underwriting is required (except Accident Protector First (1st) Year Free Supplement (APFR)) (Update: 22 Feb 2016)

Financial requirement

- Maximum Sum Insured and Financial Underwriting Requirement for HealthVital / HealthSelect

- For details, please refer to broker bulletin No 304

- Large Amount Supplement Form ([L1]). Guidelines on completing large amount supplement can be found on page 2.

- Financial Underwriting Guideline for Heritage Builder ULife (Update: 27 Aug 2019)

Based on Sum Insured

Total Sum Insured Financial Requirement Local and Overseas Clients PRC Large Amount Supplement

(simplified version)

Large Amount Supplement

(full version)

Income Proof Large Amount Supplement

(full version)

Income Proof USD750,001 – 1,000,000 /HKD6,000,001 – 8,000,000 Yes No No Yes Yes > USD1,000,000 /

> HKD8,000,000

No Yes Yes Yes Yes (Update: 22 Feb 2016)

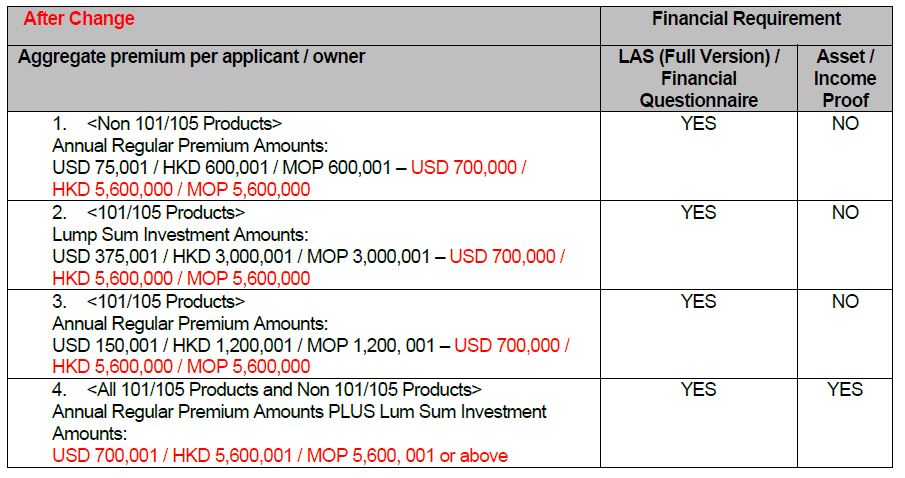

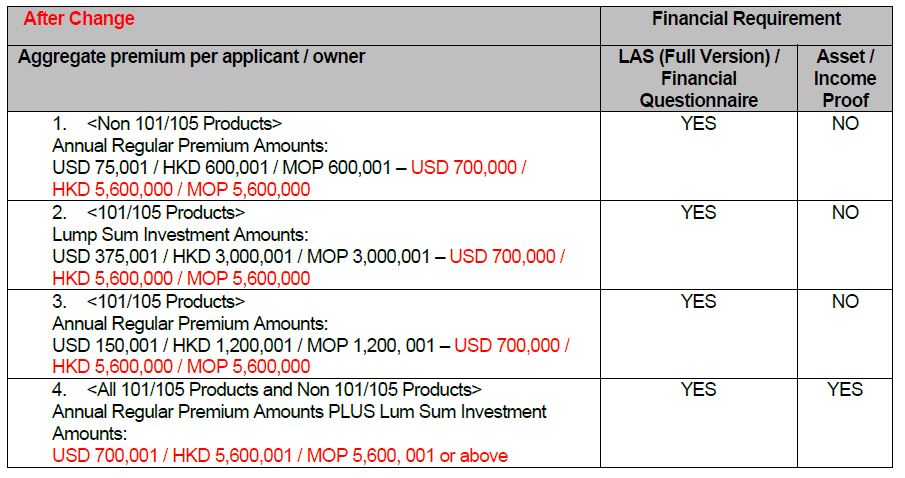

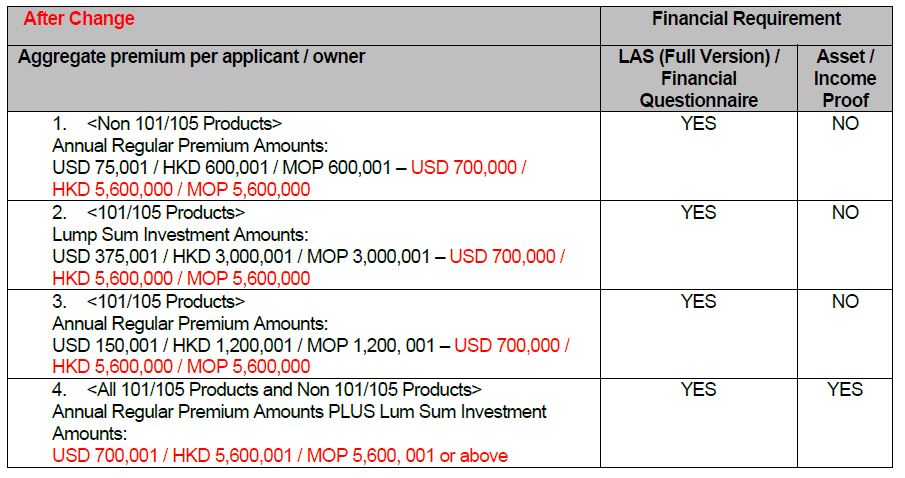

Based on Premium Size (Memo)

Note:

101/105 product types please refer consultant manual

Prepayment is considered as Lump-sum / Single paymentAsset / Income Proof (Financial Evidence) for reference:

•Personal Income Tax Return

•Bank account statements or fixed deposit certificates

•Company Financial Statement for the past 2 years, e.g., Profit & Loss Statement, Balance Sheet (Applicable to business owner)

•Proof of ownership of properties (non-residency) or assets

•Other monies or supporting documentationsIt is NOT applicable to pending application.(Update: 01 Jan 2026)

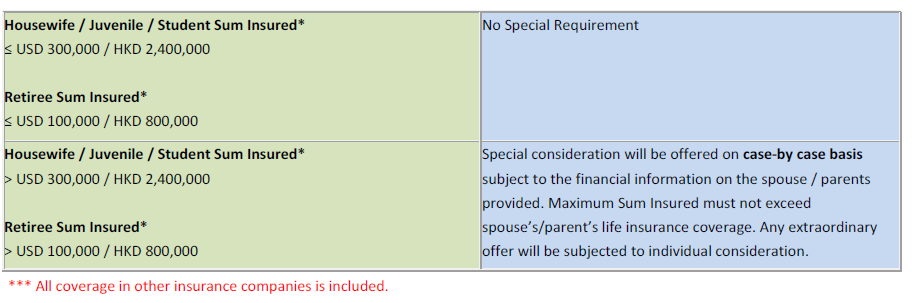

Maximum Sum Insured for Juvenile / Housewife

Underwriting Requirements of Juvenile Application with Grandparent as Trustee

- For More details, please refer to Bulletin 2018-003_Underwriting Requirements of Juvenile Application with Grandparent as Trustee.

- Supplement to Application – Declaration of Trust for Proposed Insured aged below 18 ([S8]

- Supplement to Application – Consent Form for Trust (Applicable to Proposed Insured Aged below 18) ([S18])

(Updated: 17 Jan 2018)

FAQ / Supplementary guideline

- New Guidelines issued by the Insurance Authority <GL 25, 27 –31> (Updated: 29 Mar 2021)

- Consultant Manual (Updated: 05 Feb 2025)

- Revised Initiative on Financial Needs Analysis("FNA") (Updated: 1 Jun 2018)

- For client is PRC Nationals resident in China, please follow the MCV Guideline

- For Verification of Identity and Address Proof, please refer to AXA 核實建議持有人的身份及地址

- Technical guide for High Net Worth Technical Guide [Eng] [Chi] (Updated: 03 Dec 2025)

- Policy Administration Manual [Eng] [Chi] (Updated: 27 Jan 2026)

- AXA - 中國內地訪港旅客(MCV) 新生意 – 常見問題解答 (Updated: 26 Sep 2023)

Special Case

For Policy amendment before issuing policy, please use Supplement to Application - For General Information ([S1]) Supplement to Application - For Plan Detail Changes ([S4])

AXA Customer Hotline: 25191133