Note: Initial premium / payment is NOT mandatory. The principal will issue pending for reminding of premium settlement after underwriting decision.

Important Note: (Updated: 12 June 2017)

- Each transaction/ cheque/ cashier’s order(bank draft) is paid for SINGLE policy only

- FWD Life only accept payments from Applicant, Proposed Insured, or Beneficiary for initial and subsequent payment. Otherwise need to submit ‘Third party payment declaration from’ for FWD Life’s approval.

- The payment date shall be the date on which the payment transaction is completed by FWD Life.

- If the payment amount is over HKD1,000,000.00/ USD 128,500.00 per transaction, copies of the valid ID/ passport/ travel document for both payor and policyowner must be submitted to FWD Life.

For the payment method, please refer to Payment Method Guideline. (Updated:13 Dec 2021)

Exchange Rate: USD/HKD for premium collection is 7.8 (USD cheque payment NOT applicable for Easy Term Life Insurance)

- Personal Cheque (HKD/USD) (Updated: 31 Jul 2017)

- 1. FWD Life accepts HKD/USD cheque only by Policyowner, Insured or Beneficiary of the Policy for initial and subsequent payment.

- 2. Cheque should be made payable to “FWD Life (Hong Kong) Limited”

- Credit Card (Visa, Master or American Express (AMEX)or Union Pay)) (Applicable both of initial premium & renewal premium)

- Accept Hong Kong Dollar (HKD) only.

- Accept either card present or non-card present, but not applicable to direct debit.

a. For card present: Cardholder must present card at Customer Service Counter and submit signed "Credit Card Administration Charge Payment Instructions”.

b. For non-card present: submit signed "Credit Card Administration Charge Payment Instructions” (version = CS-CCAC-0619, formerly known as “Initial Premium and Administration Charge Payment Instructions”) into drop-in box located at Customer Service Counter.

- "Credit Card Administration Charge Payment Instructions” must be signed by Cardholder & Policyowner/Applicant.

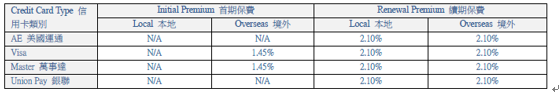

1. The Administration Charge applies to all products and will be collected with the premium payment by the same card simultaneously. Please be noted that the Administration Charge is non-refundable.

The Administration Charge details as shown below: (Updated: 12 Jul 2019)

2. American Express (AMEX) (all types of AMEX cards including AMEX co-branded cards) (Updated: 11 Jul 2019)

- Applicable to initial premium & renewal premium

- Applicable to non-Investment-Linked products only

- Bank Autopay

- UnionPay

**With immediate effect, only accept single payment by Union Pay in maximum of USD5,000 per credit/ debit card (issued from Mainland China) per policy for pure insurance products mentioned below: (Update: 16 Mar 2016)

1. Term Life Insurance

2. Medical Insurance

3. Personal Accident Insurance

1. Rules and Guidelines for Using UnionPay Card

- The mobile terminal is used for UnionPay only. For Visa/Master, please fill in credit card information on application form.

- Card information (e.g. card issuing company, card no., name of cardholder, expiry date, etc.) are required to fill in application form.

- Receipt copy is required to submit together with application. (Application will NOT be processed if there is NO receipt is attached. Original receipt must be pass to FWD Life dedicated manager for consolidation.)

- Make sure UnionPay receipt is signed by Cardholder.

- Please write policyowner name, policyowner ID / Passport no. on the receipt to avoid application / receipt mix-up.

- Application must be submitted to FWD Life within 48 working hours.

- Please make appointment with FWD Life dedicated manager or contact sales hotline (2199 1373) for mobile terminal arrangement.

PPS (Updated: 23 Mar 2017)

a. Applicable to both initial and renewal premium

b. Applicable to PPS via tone phone or internet with the following details:

PPS website: www.ppshk.com

Bill registration hotline: 18013 (Chinese) / 18011 (English)

Payment hotline: 18033 (Chinese) / 18031 (English)

Merchant code: 6500 (FWD Life (Hong Kong) Limited)

c. The e-banking reference number has been renamed to Bill Number (12 digits) which is displayed in premium notices (annual mode only), overdue letters, e-Service and e-Partner, regardless of the payment methods and payment modes of the policies.

d. 3 working days are required for processing payments via this channel

e. Daily limit HKD100,000 per day per client

f. HKD bank accounts of the following 20 banks are accepted by PPS:

| HSBC | Wing Lung Bank | Nanyang Commercial Bank |

| Hang Seng Bank | China Citic Bank Int'l Ltd | China Merchants Bank |

| Bank of China | China Construction Bank (Asia) | Chiyu Banking |

| DBS Bank | ICBC (Asia) | Dah Shing Bank |

| Bank of East Asia | Bank of Communications | Shanghai Commercial Bank |

| Citibank | Fubon Bank | OCBC Wing Hang Bank |

| Standard Chartered Bank | Chong Hing Bank |

- e-Banking (Updated: 23 Mar 2017)

a. The availability of service will vary according to the launch schedules of the different banks.

b. Applicable to both initial and renewal premium (HKD)

c. 3 working days are required for processing payments via this channel

d. Daily limit HKD100,000 per day per client

e. Acceptance of bank accounts or credit cards via e-banking services of 17 banks

| HKD bank account | Credit card | |

| 1. HSBC | Existing

(RMB is accepted for RMB policies only) |

√ |

| 2. Hang Seng Bank | × | √ |

| 3. DBS Bank | √ | √ |

| 4. Bank of East Asia | √ | √ |

| 5. Citibank | √ | √ |

| 6. Standard Chartered Bank | √ | √ |

| 7. Dah Sing Bank | √ | √ |

| 8. Shanghai Commercial Bank | √ | √ |

| 9. OCBC Wing Hang Bank | √ | × |

| 10. Wing Lung Bank | √ | √ |

| 11. China Citic Bank International Limited | √ | √ |

| 12. China Construction Bank (Asia) | √ | √ |

| 13. Bank of Communications | √ | √ |

| 14. Fubon Bank | √ | √ |

| 15. Chong Hing Bank | √ | √ |

| 16. Bank of China | × | √ |

| 17. Aeon Credit Service (Asia) | × | √ |

- Bank Transfer (Updated: 12 June 2017)

ATM/ Bank Counter

a. Original payment slip or receipt

b. Application For Self Payment Form ([A2])

Notes: Original payment slip or receipt and Application For Self Payment Form should be submitted to FWD Life immediately or within 5 working days. Please submit to SOD at least 2 working days before FWD Life’s deadline. (Updated: 04 Oct 2017)

- Telegraphic Transfer/ CHATS (Updated: 12 June 2017)

Bank counter

a. A copy of Remittance Advice issued by bank, with payor account number and name printed on it must be provided. We may request for supporting proof before processing the payment. Remarks: a bank charges (both sides) are borne by the payor

- Cash (Updated: 12 June 2017)

(overall maximum limit HKD78,000 / USD 10,000 per modal premium per policy)

Bank counter/ multi function machine/ cash deposit machine

a. Original payment slip or receipt

b. Application For Self Payment Form ([A2])

Notes: Original payment slip or receipt and Application for Self Payment Form should be submitted to FWD Life immediately or within 5 working days. Please submit to SOD at least 2 working days before FWD Life’s deadline. (Updated: 04 Oct 2017)

FWD Life Customer Hotline:21991000