Note:

1. Initial premium / payment is NOT mandatory. The principal will issue pending for reminding of premium settlement after underwriting decision.

2. For NB payment, please mark policy owner and insured names on the payment receipt if the policy no. has not been released.

And also state the plan's name if the client applies different plans at the same time.

For renewal payment, please state the policy no. on the payment receipt clearly. (Updated: 14 Aug 2018)

For the payment method, please refer to Payment Method Guideline. (Updated: 12 Aug 2019)

**For Heritage Builder U Life, only Telegraphic Transfer (TT), Cheque and Unionpay are acceptable, while the TT details and Cheque details are different from other life and ILAS plan, please click here for more details (Updated: 27 Jul 2016)

Payment Frequency: Monthly, Semi-annual and Annual Mode

Method of Payment: DDA, Cheque and Credit Card, Telegraphic Transfer, Cash in Cashier office, Bank-in and E-Cheque.

The exchange rate is not fixed and can only be confirmed after AXA has received the payment. If there is excess premium, AXA will deposit the amount to the client’s Future Premium Deposit Account or refund to the client. AXA will absorb the shortage of premium below HK$10. (Updated: 10 Oct 2018)

Payment Method – Visa Master credit card transaction principle: Please refer to Broker Bulletin No 2017-32: Payment Method – Visa Master Credit Card Transaction Principle (Updated: 21 Apr 2017)

Increase the Number of Transactions per Credit Card/Debit Card: Please refer to Part C of Broker Bulletin No 2017 – 86: Updates on Payment Option and Premium Payment Guidelines. (Updated: 27 Sept 2017) Undertaking Form ([U2])

Initial Premium & Lump Sum Payment (Updated: 26 Jun 2015)

| Monthly mode initial payment | 2 months installment |

| Semi-annual mode initial payment | 6 months installment |

| Annual mode initial payment | 12 months installment |

1. Cheque, Bank Draft, Cashier Order & Banker’s Order: (Applicable for New Application & Renewal) (Banked-in cheque/bank draft is NOT accepted.) (Updated: 19 May 2020)

- Payable to: AXA China Region Insurance Company (Bermuda) Limited (For New Application Only)

- Payable to: AXA China Region Insurance Company (Bermuda) Limited or AXA China Region Insurance Company Limited (For Renewal Only)

- For Bank Draft payment (Applicable for New Application & Renewal): (Updated: 29 Sept 2017)

| Scenario | Action |

| USD 25K or less(or equivalent to HKD 200K ) | Provide bank draft purchase advice

OR Provide a Bank Draft Source of Funds - Policy Owner Declaration & Insurance Broker Declaration ([B1]) |

| More than USD 25K (or equivalent to HKD 200K ) | Must provide bank draft purchase advice |

2. Cash Payment / Deposit or Transfer to Company Account via Bank Counter Service (Applicable for New Application and Renewal)

For Cash Payment

- Must submit to AXA’s Cashier Counter

- Original Bank-in Slip with stated policy number at the back must be submitted to AXA for every transaction.

- Maximum limit for cash deposit is either HKD200,000, USD25,600 or equivalent per policy on the same deposit date. (Updated: 31 Oct 2018)

- HKD Currency

HSBC: 004-499-000966-006 or Bank of China: 012-87500317977 or ICBC: 868-502-01338-4

or Citibank Account name: AXA CHINA REGION INSURANCE COMPANY (BERMUDA) LIMITED Citibank Account number: 006-391-08489513

- USD Currency

HSBC: 004-499-000966201 or Bank of China: 012-875-08006336 or ICBC: 868-506-00358-1

or Citibank Account name: AXA CHINA REGION INSURANCE CO. LIMITED Citibank Account number: 006-391-08632499

- Individual bank may charge “Notes Deposit Handling Fee”, please refer to the relevant bank for reference

3. Telegraphic Transfer (Applicable for New Application/Renewal)

- Please submit telegraphic transfer transaction advice slip copy

4. ATM, Online Banking & PPS(For New Application/Renewal)

- Original Bank-in Slip with stated policy number at the back must be submitted to AXA for every transaction (For PPS, Client can keep payment record and NOT required to submit to AXA)

- HSBC (HKD) Account no. : 004-499-000966006

- HSBC (USD) Account no. : 004-499-000966201

- BOC (HKD) Account no. : 012-875-00317977

- BOC (USD) Account no. : 012-875-08006336

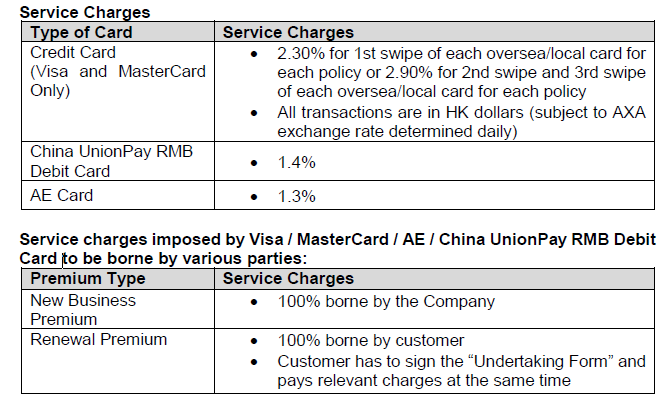

5. Credit Card and China Union Pay (For New Application/Renewal)

- For China Union Card, client must arrange transaction at AXA's Cashier office

- For credit card and CUP functions cardholder is required to swipe card at AXA’s authorized office

- For ICBC AXA Co-brand Card (without any charge) ICBC AXA Credit Card Payment Authorisation ([I10])

- How to apply an ICBC AXA Co-Brand Card (Updated:27 Feb 2017)

- With immediate effect from 26 Feb 2020, American Express (“AE”) Card at Cashier counters will be accepted by AXA, more details please refer to Launch of New Payment Service – American Express Card. (Updated: 26 Feb 2020)

- AXA has reduced some credit card payment fees from 30 Jul 2020, more details, please refer to [Broker Bulletin No 2020 - 101 Payment Services Upgrade at Cashier](Updated: 31 Jul 2020)

6. Autopay (For Renewal Only)

- Direct Debit Authorization Form

- For autopay amount > HK$100,000, if the account holder is not contract parties or direct family members of policy owner / insured, “Third Party Payment Declaration” is required.

7. E-Cheque (Updated: 27 Sep 2023)

- Payment can be made by either the policyowner, insured, beneficiary or direct family members (i.e. spouse, brothers, sisters, parents, children, grandparents, grandchildren, father-in-law or mother-in- law) of the policyowner/insured.

- HKD, USD and RMB E-Cheque payment are accepted

- E-Cheuqe should be issued by and drawn on a bank in Hong Kong.

- For E-Cheque verification payment process, it is similar to Telegraphic Transfer/ Online payment. Please provide the e E-Cheque advice and supplement if the following information is not shown in the advice

- Payor name and the relationship with policyowner

- Transaction Date

- Cheque No

- Which AXA bank account deposited to

- Transaction amount

- Deposit reference

8. Summary for submission of payment record: (Updated: 30 May 2016)

| Payment Method Submission of payment record to AXA | Submission of payment record to AXA |

| Cash Deposit via Bank Counter Service | Required original bank-in slip |

| Transfer payment via Bank Counter Service | Required original bank-in slip |

| Transfer Payment by ATM | Required original ATM slip |

| Transfer Payment by Online Banking | Required online payment record |

| Bill Payment by ATM | Client can keep ATM slip and NOT required to submit to AXA |

| Bill Payment by Online Banking | Client can keep payment record and NOT required to submit to AXA |

| PPS | Client can keep payment record and NOT required to submit to AXA |

| E-Cheque | Required E-Cheque Advice and supplementary information (refer to Pt.7 above) |

9. The following payments can be used to settle New Business premium upon request: (Updated: 27 Sept 2017)

- Cash Withdrawal Payment

- Surrender Payment

- Claims Payment

Note:

Customer has to submit cash withdrawal or claim application with clear written instruction, indicating transfer of payment to settle New Business premium with policy number provided.

Points to Note: (Updated: 13 Nov 2015)

I. Payment Related

a) For USD currency policy, please remit to USD bank account and for HKD currency policy, please remit to HKD bank account. Otherwise payment will be subject to exchange rate charge

b) TT charges to be borne by payer. Customer should ensure TT charges imposed from both banks (where appropriate) are catered to avoid shortfall. Otherwise, premium will not be update due to shortfall

c) Only above bank accounts will be accepted for TT payment. Remittance to other AXA account will lead to non reconciliation and premium refund

d) All payments must comply with anti-money laundering policy (details refer to Anti-money Laundering Guideline)

II. Required Information when making TT Advice

a) Policy number

b) Policy owner name

c) Purpose e.g. new business or renewal

III. Required Information when Submit TT Payment to AXA [Guideline and Sample]

a) Complete payment slip

b) Attach a copy of the TT advice

Subsequent Payment

1. Direct Debit

2. Payment-by-Phone Service (PPS)

Payment via telephone (18033 for Cantonese or 18031 for English) or via internet http://www.ppshk.com

Merchant Code: 61

Bill Type :

- 01 Renewal

- 02 Deposit for Change

- 03 Loan Repayment

3. Faster Payment System (FPS)

Client can scan the QR code provided by AXA via Premium Notice and Premium Reminder or find the QR code directly via MyAXA eServices. Please refer to Bulletin: Launch of Faster Payment System for Renewal Premium for details. (Updated: 18 Dec 2018)

4. Cheque

5. Direct Bank-in for Cash Payment

6. TT Payment to AXA

7. Cash payment at AXA Cashier

8. For ICBC AXA Co-brand Card (without any charge) ICBC AXA Credit Card Payment Authorisation ([I10])

- How to apply an ICBC AXA Co-Brand Card (Updated:27 Feb 2017)

9. ATM (Automatic Teller Machine) Service

HSBC ATM Card holder

Bill Payment: Merchant Type: Insurances: AXA(CR) / AXA Wealth Mgt

Bill Account Number: Please use 10-digit payment number.

JETCO member banks card holder

Choose Service: Bill Payment

Merchant code: 9255

Bill Account Number: Please use 10-digit payment number.

Bill Types:

01 – Premium Renewal

02 – Deposit for Change

03 – Loan Repayment

10. China UnionPay RMB Debit Card / AE(American Express) Card / Visa / MasterCard (for Renewal Premium) (Updated: 23 Jun 2020)

- Customer presents the credit card/debit card at the Cashier Office, completes a Letter of Undertaking Form ([U2]), and pays the renewal premium and relevant service charges at the same time.

- Premium receipt will show the premium amount (excluding the service charges)

11.E-Cheque (Updated: 27 Sep 2023)

- Payment can be made by either the policyowner, insured, beneficiary or direct family members (i.e. spouse, brothers, sisters, parents, children, grandparents, grandchildren, father-in-law or mother-in- law) of the policyowner/insured.

- HKD, USD and RMB E-Cheque payment are accepted

- E-Cheuqe should be issued by and drawn on a bank in Hong Kong.

- For E-Cheque verification payment process, it is similar to Telegraphic Transfer/ Online payment. Please provide the e E-Cheque advice and supplement if the following information is not shown in the advice

- Payor name and the relationship with policyowner

- Transaction Date

- Cheque No

- Which AXA bank account deposited to T

- Transaction amount

- Deposit reference

12. With immediate effect from 29 March 2018, customers who have registered for MyAXA can pay renewal premium online with VISA/MasterCard/China UnionPay Card. Please refer to Broker Bulletin No 2018-022 Renewal Premium Payment through MyAXA Online Platform for payment arrangements and Appendix 1 for “Guidelines on online payment via MyAXA”. (Updated: 29 Mar 2018)

- With effect from 3 Nov 2018, the service charge on renewal premium payment by VISA/MasterCard via MyAXA online platform, or at AXA Cashier Counters pay by Overseas VISA/MasterCard (only applicable to1st swipe per card per policy) will be adjusted to 2.3%. (Updated: 15 Nov 2018)

For Third-Party Payment

AXA do not accept third party payment unless the payer is “contract parties” or “Direct family member to Policy Owner / Life insured”.

Payment is accepted from ‘Contract Parties’, ‘Direct Family Member to Policy Owner/Life Insured’. Definition of ‘Contract Parties’, ‘Direct Family Member to Policy Owner’ is as below:

Contract Parties (applicable to Non MCV and MCV customer)

- Policyowner

- Life Insured

- Beneficiary

Direct Family Member to Policyowner (applicable to Non MCV and MCV customer)

- Spouse

- Brother

- Sister

- Parents

- Children

- Grandparents

- Grandchildren

- Father-in-law or mother-in-law

For payments made by a corporation owned by policyowner / the insured, the below procedures should be followed:

a. Obtaining supporting documents showing that the policy owner / the insured owns over 50% of share capital or voting rights of the corporation

b. Obtaining the Policy Owner Declaration Form – Corporate Payment ([P6]). In addition, a register log will be maintained by cashier to record all cases requiring the form for status tracking and handling (Updated: 13 Sep 2021)

For Mainland Chinese visitors

AXA only accepts the payment directly from the applicant/policyowner, life insured, beneficiary and immediate family members of the policyowner (spouse, parents or children) with relationship proof. Payments from the sales staff, sales manager or third-party will not be accepted for premium payment.Details refer to the Payment Method Flyer.(Updated: 20 Jan 2017)

For Change of Payment Mode (Updated: 11 Sept 2017)

Checklist

1. Change to Monthly Mode:

1) Submit Policy Service Application Form I ([P1]);

2) Submit Direct Debit Authorisation (DDA) ([D3]) for bank account autopay;

3) Submit 2 months’ premium together with all overdue premium (if any);

4) CS eform

2. Change to Semi-annual or Annual Mode:

1) Submit Policy Service Application Form I ([P1]);

2) Submit 1 modal premium or the pro-rata balance of new modal premium depending on the paid-to-date at time of request submission;

3) CS eform

Notes:

1. The application should be submitted one month before the premium due date, and should be submitted to AXA within 30 days after sign. Please submit the completed application documents to SOD 2 working days before for meeting AXA’s deadline for processing.

2. Change effective date will be the premium due date.

3. For Monthly mode, payment method must be autopay.

4. For Semi-annual or Annual Mode, if not specified, the previous autopay method will NOT be applied to annual or semi-annual mode.

AXA Customer Hotline: 25191133