Broker Code: 32866

Product List:

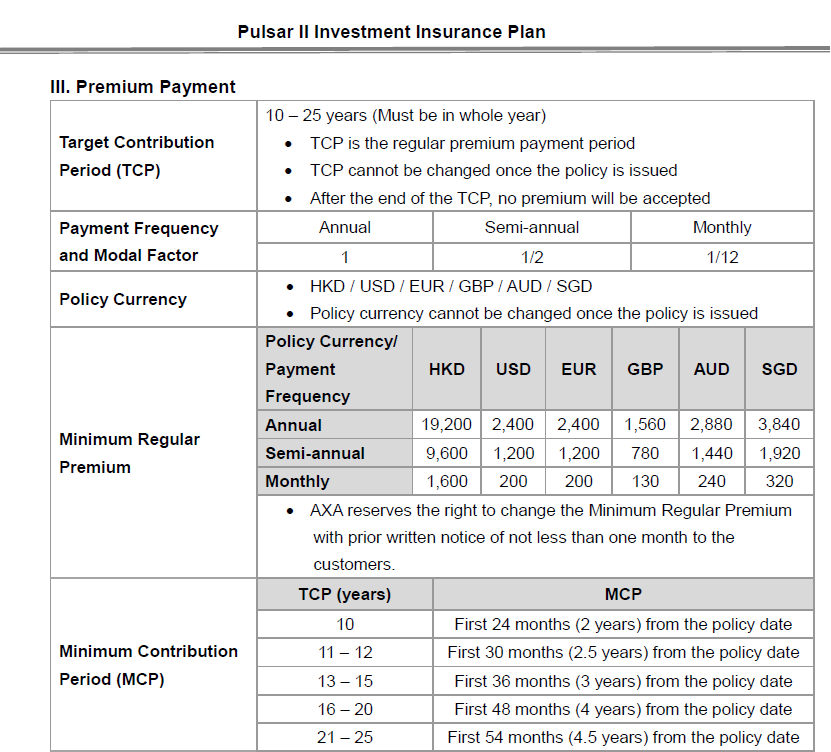

| Regular Savings Plan | Pulsar [Product closure on 31 Dec 2014] | Pulsar II [Product closure on 30 Apr 2023] |

| Regular Savings Plan | Signature II Investment Insurance Plan [Product closure on 13 February 2023] | Signature III Investment Insurance Plan(Launch Date: 20 Feb 2023) |

Important Notice

Customer Due Diligence on Corporate Clients

LCD has issued the directive of customer due diligence on corporate clients on 01-Apr-2016. For details and its requirement, please refer to the FAQ > Customer Due Diligence on Corporate Clients.

1. Illustration document must be submitted within 1 months of illustration print date. The illustration print date must be prior to or equal to the application form sign date. Applications can be submitted to OnePlatform within 10 calendar days after sign date of client except *MCV clients. For MCV case, case must be submitted within 2 working days.

2. AXA only accept AXA's supplement forms. Not accepted client's letter.

3. If any document is neither in English nor in Chinese, a translation from a suitably qualified person (i.e. local lawyer) must be obtained.

4. If clients apply Discretionary Portfolio Management Services (DPMS) , please submit DPMS documents after policy issued. (Updated: 22 June 2017)

5. All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

Checklist

(OnePlatform Internal Document and Principal Document are required to be submitted)

OnePlatform Internal Document

| 1 | Client Data Form |

| 2 | Client Agreement |

| 3 | Financial Needs Analysis Form

** Starting from 22 March 2021 (with reference to AXA Client Needs Analysis (AXA CNA) & Application sign date), both of One Platform FNA and GL30 AXA CNA must be submitted with the application form. (Updated: 19 Mar 2021)

|

| 4 | Risk Profile Questionnaire |

| 5 | Acknowledgement Letter of Specific Services Agreement for Investment-Linked Assurance Scheme Policies |

Principal Document

HK Applicants - Permanent HKID Card

** For HK Permanent ID holder with residential / correspondence address in China, client needs to perform MCV and submit all related documents including IFS-MP (Details please refer to PRC (Additional Documents)).

| 1 | Investment-Linked Assurance Scheme Application Form [A8] LFUW080 [Eng] / LFUW109 [Chi] [Form version : LFUW080-2410/ LFUW109-2410 |

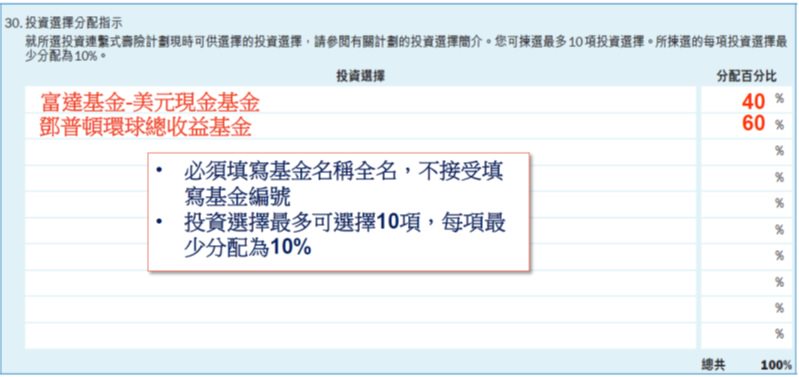

*** (please write down Plan Code next to plan name in Application Form, refer Proposal if applicable) Investment Option

|

| 2 | Personalized Illustration |

|

| 3 | Important Facts Statement – Policy Replacement([I11]) |

|

| 4 | GL30 Client Needs Analysis([C6]) sign date from 22 Mar 2021 (Updated: 19 Mar 2021)

|

** Starting from 22 March 2021 (with reference to AXA Client Needs Analysis (AXA CNA) & Application sign date), both of One OnePlatform FNA and GL30 AXA CNA must be submitted with the application form. [New Guidelines issued by the Insurance Authority <GL 25, 27 –31>] (Updated: 1 Apr 2021)

Important: for AXA ILAS plan: Affordability for Single Premium / Lump Sum Premium ILAS Products: (with effect from 13 February 2023)

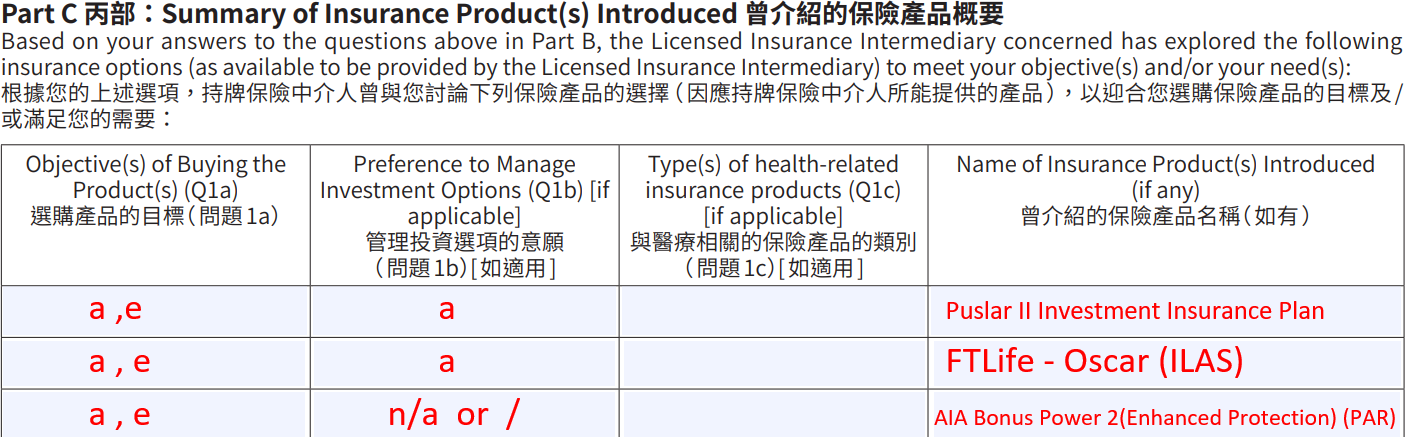

For reference product of PAR plan, answer on “Preference to Manage Investment Options(Q1b)” should be N/A or “ / “ .(Updated: 22 Apr 2021)

|

| 5 | HKID/Passport Copy | Certified true copy by consultant |

| 6 | Residential Address Proof

(issued within the past 3 months)(Updated: 16 Sep 2020) |

Certified true copy by consultant

Below please find the list of examples: [Memo]

|

| 7 | Large Amount Supplement Form ([L1]) |

|

| 8 | Important Facts Statement and Applicant’s Declarations Investment-Linked Assurance Scheme (“ILAS”) Policy - FI05 |

(Updated: 05 May 2023) |

| 9 | Payment Method |

|

| 10 | Copy of Birth CertCopy of Birth Certificate if Child under age 18 years | Certified true copy by consultant |

| 11 | Student Handbook or health booklet | Effective from 18 May 2015, for proposed insured who is MCV Juvenile (Updated: 23 Apr 2015) |

| 12 | Supplement to Application - For General Information ([S1]) | If applicable; for client to submit further information requested by AXA |

| 13 | Supplement Form (Hong Kong) – Consents to Data Processing Pursuant to AXA’s Privacy Policy ([S25]) | If applicable; provide PIPL consent if the customer missed to provide the consent on the original new business application forms, service forms or claim request forms. |

For non-HK permanent resident (Additional Documents)

| 1 | Photocopy of ID, passport (photo page) & entry proof | Client need to sign on each page

Verified true copy by consultant and face-to-face verification by AXA authorized staff |

| 2 | Declaration for Insurance Application ([D2]) | |

| 3 | Important Facts Statement for Mainland Policyholder (“IFS-MP”) ([I9]) | For Non-permanent HK resident and China ID or passport holder with residential / correspondence address in China, client needs to perform MCV and submit all related documents including IFS-MP (Details please refer to PRC (Additional Documents)). For Non-permanent HK resident and China ID or passport holder with residential / correspondence address in HK, client need to submit IFS-MP with the application form |

PRC (Additional Documents)

| 1 | Declaration for Insurance Application ([D2]) | MUST be in Original |

| 2 | Declaration by Intermediary ([D7]) | |

| 3 | Photocopy of ID, passport (photo page) & entry proof | Client need to sign on each page

Verified true copy by consultant and face-to-face verification by AXA authorized staff |

| 4 | Illustration document for premium holiday taken immediately after the first 54 months commencing form the policy date | Apart from standard illustration, client is required to sign on the Illustration document for premium holiday taken immediately after the first 54 months commencing form the policy date to ensure his/her understanding of premium holiday implications staff |

| 5 | Student Handbook or health booklet | Effective from 18 May 2015, for proposed insured who is MCV Juvenile (Updated: 23 Apr 2015) |

| 6 | Important Facts Statement for Mainland Policyholder (“IFS-MP”) ([I9]) | Effective from 1 Sept 2016, required by OCI. For details of requirement, please refer to Appendix (Updated: 1 Sept 2016) |

Overseas Applicant (Additional Documents)

Foreign passport holder with residential / correspondence address in China also need to perform MCV and all related documents including IFS-MP (Details please refer to PRC (Additional Documents)).

| 1 | Declaration for Insurance Application ([D2]) | MUST be in Original |

| 2 | Declaration of Residency Status ([D1]) | (For Japanese living in HK only) |

| 3 | Photocopy of the passport cover (Beginning page to the page after the last entry chop + photo page) |

|

Underwriting Requirement

Follow existing underwriting practice, please note the Nationality that

- US citizens are not accepted

- Japanese citizens are not accepted unless resident outside of Japan with the Declaration of Residency Status is signed

- Non-HK residents residing in Mainland China will be treated as MCV and verification is required. [MCV means All HKID/ non-HKID holders residential in Mainland China over 180 days within one year.] Please refer to Pre-sales Service for Pulsar MCV client

MCV will be invited to visit AXA office at Rm 3403, 34/F, Lee Garden One, 33 Hysan Avenue, Causeway Bay, Hong Kong and Verify entry documents by AXA authorized staff sales supporting staff. The Service is required reservation in advance. (Updated: 25 Oct 2018)

AXA does not accept investment-linked insurance business from US applicants who belong to one of the following :

- Proposed owner and insured who are US citizens or are US residents; or

- hold US passports; or

- hold US green cards; or

- have residential address in US; or

- declare to be US citizen / residents

Japan Applicants

AXA only accepts life insurance business from Japanese persons provided that :

- the proposed owner and / or insured lives outside of Japan; and provides a residential address which is outside of Japan ; and

- makes a written declaration that he / she has no residence or address in Japan now and that he / she understands if he / she has address or residence in Japan in the future, he / she may have to surrender the policy to comply with the Japanese Law; and

- provides HKID card (if available) and / or passport copies (if the person is living in Mainland China, the same MCV verification process will have to be followed)

FAQ / Supplementary Guideline

- New Guidelines issued by the Insurance Authority <GL 25, 27 –31> (Updated: 29 Mar 2021)

- Consultant Manual (Updated: 05 Feb 2025)

- Revised Initiative on Financial Needs Analysis("FNA') (Updated: 1 Jun 2018)

- Non-HK application checklist

- AXA - 中國內地訪港旅客(MCV) 新生意 – 常見問題解答 (Updated: 26 Sep 2023)

Special Cases

AXA “Pulsar Investment Insurance Plan” Enhanced Reward Programme

For details please erfer to Flyer

Scenario 1:

For application of single Pulsar supplementary policies (with existing Pulsar policy already):

Fill Section A of the supplement - Sample 1 (leave “application number” blank if new application without policy #)

The word “MODULARITY” is required to be written on the first page of application forms

Scenario 2:

For applications of more than one Pulsar supplementary policies at the same time (with existing Pulsar policy):

Fill Section A & B of the supplement - Sample 2 (leave “application number” blank if new application without policy #)

Write the word “MOD1”, “MOD2” in the first page of application forms to indicate the priority

Scenario 3:

For applications of more than one Pulsar supplementary policies at the same time (without existing Pulsar policy):

Fill Section B of the supplement - Sample 3 (leave “application number” blank if new application without policy #)

Write the word “MOD1”, “MOD2” in the first page of application forms to indicate the priority

AXA Customer Hotline: 25191133