Product List:

| ILAS | HSBC Wealth Select Protection Linked Plan (Launch Date: 30 Jun 2023) |

Important Notice:

1. A clean case under simplified underwriting and no supplementary information further sought from HSBC Life should take 8-9 working days from receipt of application to policy issuance,

assuming that payment is made successfully upon underwriting greenlight is given.

2. All the new applications ( Applicable for all clients, including HK residents, PRC residents and oversea residents) should be submitted to HSBC Life within 30 days from the application sign date.

3. Underwriting Requirement for HSBC Wealth Select Protection Linked Plan:

| (1)Simplified Underwriting with 1 health question if total Sum Insured is within per life limit | Age 1- 18: USD 250,000 / HKD2,000,000Age 19 – 50: USD500,000 / HKD4,000,000Age 51 – 65: USD 75,000 / HKD600,000 |

| (2)Simplified Underwriting with 4 health questions if total Sum Insured is greater than condition (1) above but within the per life limit | Age 1- 18: USD 750,000 / HKD6,000,000Age 19 – 50: USD1,250,000 / HKD10,000,000 Age 51 – 65: USD 750,000 / HKD6,000,000 |

| (3)Full Underwriting if total Sum Insured^ is greater than condition (2) above | ^ Total Sum Insured refers to sum of all sum insured from the applicant |

5. Please ensure that the fill in format of the submitted documents are consistent. If handwriting and computer input exist within the same document, it was not accepted by HSBC. Client’s countersign is required beside every inconsistent field. (Updated: 24 Aug 2023)

Checklist:

(Internal Document and Principal Document are required to be submitted)

Internal Document:

| 1 | Client Data Form |

| 2 | Client Agreement (CA Form) |

| 3 | Financial Needs Analysis Form When calculating the affordability, Q3, Q4d and Q4f, the exchange rate of HKD:USD is 1:8 (Updated: 07 Aug 2023) Sample of HSBC Wealth Select Protection Linked Plan (Updated: 05 Jul 2023) Sample of HSBC Wealth Select Protection Linked Plan (Single Premium) (Updated: 03 Aug 2023) |

| 4 | Risk Profile Questionnaire |

| 5 | Acknowledgement Letter of Specific Services Agreement for Investment-Linked Assurance Scheme Policies |

Principal Document:

HK Applicants - Permanent HKID

1.Application Form (Simplified underwriting ([H1]) [Sample] (Updated: 13 Jul 2023) / Full underwriting ([H2]) [Sample] (Updated: 13 Jul 2023))

- HSBC will only apply simplified underwriting if either Declaration 1 or Declaration 2 - 5 are answered "No" on P.9, otherwise, please submit Full Underwriting Questionnaire. ([L1]) (Updated: 07 Aug 2023)

- For Q40 initial payment amount after discount, please refer to the latest version of discount calculator (Product library > HSBC - Special Offers) (Updated: 17 Oct 2023)

- Important Facts Statement and Applicant’s Declarations (IFS-AD) (embedded in Application Form)

- Insurance Point of Sales Checklist (embedded in Application Form)

- Individual Tax Residency Self-Certification Form (embedded in Application Form)

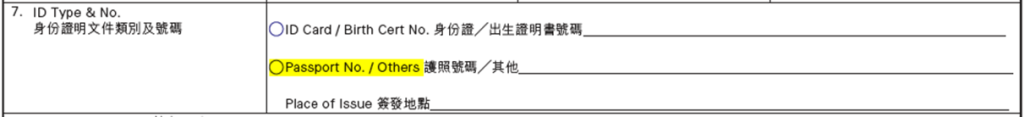

- For PRC or oversea client, please fill in PRC ID no. or Foreign ID no. on the “ID Card / Birth Cert No.” column. Also, please fill in Passport or China Entry Permit no. on the “Passport No. / Others” column. (Updated: 24 Nov 2023)

2. Certified ID copy

3. Illustration

- Illustration must type the FULL NAME of Applicant/Life Insured (Updated: 07 Aug 2023)

- Valid for 30 calendar days from print date or the day right before next birthday (whichever is earlier).

4. Suitability Assessment Form ([S1]) [Sample] (Updated: 05 Jul 2023)

- Customer Declaration (Part 1)

- Risk Profiling Questionnaire (RPQ) (Part 2)

5. Affordability Calculator Print-out (Updated: 04 Oct 2023) [Sample] [Guideline] (Updated: 14 Aug 2023)

- If client is VC, the max. affordability is 40%

- If client is non-VC, the max. affordability is 50%

6. Important Facts Statement – Policy Replacement ([I1])(Applicable for the answer of Application Form - Section N (Policy Replacement) is “Yes” or “Not Yet Decided”)

7. FATCA Documents (if applicable)

8. Customer Source of Wealth Form – Personal Customer ([C1]) (Applicable for EDD cases, below is the definition of EDD)

- Total premium or policy cash value ≥ USD 5,000,000

- High risk rating client (e.g. occupation in high risk industry)

- Former foreign PEP

- resident in high risk third countries

- Client with financial crime risk concerns

9. Supplementary Declaration & Application ([H3]) (If applicable)

10. Nominating Married Partner as Life Insured (For same-sex couple NB submission)

11. Nominating Child (18 years old or above) as Life Insured (For Adult Children (18 years old or above) NB submission)

For PRC client

1. Certified copy of PRC ID/passport/travel permit

2. Entry Proof

3. Important Facts Statement for Mainland Policyholder ([I2])

Manual / FAQ

2. FAQ (Updated: 31 Aug 2023)

3. NB Submission Training & Common Pending underwriting items (Updated: 6 Sep 2023)

4. Medical Requirements Table for Sum insured in Full Underwriting (Updated: 31 Aug 2023)

5. Sales and Control Manual for Distribution of Protection Linked Plan (Updated: 29 Feb 2024)

(Updated: 30 Jun 2023)