Broker Code: 8068

Product List:

| Traditional Life Plan | Prosperity Booster Whole Life Plan (Closed on 8 Mar 2019) |

| Prosperity Booster Whole Life Plan 2 (Closed on 1 Sep 2021) | |

| Brilliant Wealth Whole Life Plan (Closed on 17 Apr 2021) | |

| Tomorrow Whole Life Plan (Closed on 3 Jul 2018) | |

| Tomorrow Whole Life Plan 2(Closed on 5 Jul 2019) | |

| Wealth Successor Whole Life Plan (Closed on 3 Jul 2018) | |

| Wealth Successor Whole Life Plan 2 (Closed on 5 Jul 2019) | |

| ABSOLUTE Annuity | |

| Universal Life Plan | Prime Fortune Universal Life Plan (Closed on 27 Dec 2017) |

| Wealth Master Universal Life Plan | |

| Coupon |

Power 5 Endowment Plan (Closed on 10 Jul 2021) |

| Fortune Bright Saver (Closed on 11 Jun 2022) | |

| Critical Illness | Fubon Refundable Premium Cancer Protection Plan (Closed on 1 Jun 2021) |

| Endowment |

Wealth Elite Saver (Closed on 01 Sep 2021) |

| Wealth Power 6 Endowment Plan (Closed on 01 Aug 2021) | |

| Prosperity Booster Whole Life Plan 3 (5-year pay) (Closed on 01 February 2023) | |

| Wealth Elite Saver 2 (Closed on 11 Jun 2022) | |

| Treasure Prestige Insurance Plan (Launched on 21 Jan 2026) |

|

| Savings |

Wealth Elite Saver 3 (Launched on 02 Nov 2022) |

| Wealth Elite Saver 3 - Golden Years (Launched on 10 Feb 2023) | |

| Prosperity Booster Whole Life Plan 5 (Closed on 01 Oct 2024) | |

| Prosperity Booster Multi-Currency Insurance Plan (Launched on 10 Oct 2024) | |

| Wealth Horizon Multi-Currency Insurance Plan (Launched on 6 Nov 2025) |

|

| Life Protection | Fortune Elite Protector (Closed on 01 Oct 2024) |

Important Notice

- For corporate application, please refer to Customer Due Diligence on Corporate Clients for detailed requirements of OnePlatform. (Updated: 02 Jul 2020)

- Standard Illustration must be signed within 30 days from print date of it.

- Life Insurance Application Form and related documents must be submitted to Fubon Life within 30 calendar days from the sign date

- For application from MCV, it must be submitted within 7 working days from application sign date in order to fulfill regulatory requirement.

- If the application is consultant him / herself, consultant cannot be the witness of it. (Updated: 27 Mar 2019)

- Applicant should be Hong Kong / Macau / Taiwan / China residents. People from countries other than aforesaid will be on individual consideration ONLY.

- If requirements are not fulfilled within 60 calendar days from first underwriting decision date, the application will be treated as Incomplete Cases and cancelled. All initial premium will be refunded to payor instead of proposed policyowner.

- Beneficiary is not accepted as a payor.

- For Premium Financing of Universal Life, please refer Fubon Life Universal Life Premium Financing Process Flow. (Updated: 22 Nov 2016)

- All samples provided in OnePortal are for REFERENCE only, consultant must fill in all forms with client’s latest information provided. The reference products recommended should be on OnePlatform’s shelf by the time you make the recommendation. No same provider’s products should be recommended unless there are no other suitable products from other providers. (Updated: 19 Nov 2019)

Checklist

(OnePlatformInternal Document and Principal Document are required to be submitted)

Internal Document

1. Client Data Form

2. Client Agreement (CA form)

3. Financial Needs Analysis Form - [Product Mapping Table]

Sample of Wealth Elite Saver 3 (Updated: 16 Feb 2023)

Sample of Wealth Elite Saver 3 - Golden Years (Updated: 21 Feb 2023)

Sample of Prosperity Booster Multi-Currency Insurance Plan (Updated: 10 Oct 2024)

Sample of Wealth Horizon Multi-Currency Insurance Plan (Updated: 6 Nov 2025)

Sample of Treasure Prestige Insurance Plan (Updated: 26 Jan 2026)

4. Special Case Disclaimer (if applicable)

Principal Document

For Hong Kong Resident:

- Life Insurance Application Form: MUST write English Address on Application Form

A. For Simplified Underwriting Product (Pictorial Guide of Application Form) (Updated: 28 Aug 2024)

B. For Full Underwriting Product only (Pictorial Guide of Application Form (full-underwriting products only)) (Updated: 12 Feb 2025)

Please make use of the “Application Number” auto-generated by the Illustration Proposal System and mark on the upper right corner of the softcopy application form. For details, please refer to Application Number. (Updated: 3 Jan 2018)

- [Sample - Application Form for Premium Financing] (Updated: 1 Feb 2017)

- [Sample - Application Form for Wealth Master Universal Life Plan] (Updated: 10 Jan 2018)

C. Life Insurance Application Form (Wealth Elite Saver 3 - Golden Years) (Pictorial Guide of Application Form (Wealth Elite Saver 3 - Golden Years)) For Simplified Underwriting Product (Updated: 14 Feb 2025)

2. ORIGINAL of signed Standard Illustration;

3. ORIGINAL of Supplementary Note ([S2]) (if applicable);

4. Important Facts Statement – Policy Replacement (if applicable) (Eng)(Chi)

5. Important Facts Statement – Premium Financing (Eng)(Chi)

6. COPY of pay-in slip of initial premium amount or evidence of other payment methods allowed by Fubon Life

7. CERTIFIED TRUE COPY of HK Permanent ID card of the Proposed Owner & Proposed Insured (if other than the Proposed Owner);

8. CERTIFIED TRUE COPY of birth certificate of the Insured child (if applicable)

For HK Residents (Non-Permanent)(Additional Documents)

- CERTIFIED TRUE COPY of HKID card of the Proposed Owner & Proposed Insured (if other than the Proposed Owner);

- CERTIFIED TRUE COPY of birth certificate of the Insured child (if applicable);

- CERTIFIED TRUE COPY of travel document (e.g. passport) of Proposed Owner & Proposed Insured (if other than the Proposed Owner)

- ORIGINAL of completed IFS-MP Simplified Chinese (IFS-MP) ([I1]) if the client is a Chinese national.

*For MCV, certified true copy of all documents must be done by Fubon Life authorized staff

For Non HK Resident (Additional Documents)

- CERTIFIED TRUE COPY of travel document (e.g. passport) with entry proof (e.g. landing slip) of the Proposed Owner & Proposed Insured (if other than the Proposed Owner); (entry proof document should be certified by insurance intermediary with company chop of broker.)

- CERTIFIED TRUE COPY of ID card (if any)

- CERTIFIED TRUE COPY of birth certificate of the Insured child (if applicable)

*Upon policy issuance, an SMS message will be sent to policy owners who are non-HK residents.

For Mainland Chinese Visitors (MCV) (Additional Documents)

- CERTIFIED TRUE COPY of travel document (e.g. entry permit) with entry proof (e.g. landing slip) of the Proposed Owner & Proposed Insured (if other than the Proposed Owner);

- CERTIFIED TRUE COPY of the China ID card of the Proposed Owner & Proposed Insured (if other than the Proposed Owner);

- CERTIFIED TRUE COPY of vaccination record (within 6 months) / student book (within 6 months) of the Insured child (if applicable)

- CERTIFIED TRUE COPY of birth certificate of the Insured child (if applicable)

- ORIGINAL of completed IFS-MP Simplified Chinese (IFS-MP) ([I1]) (effective on 1 Sept 2016)

*For MCV, certified true copy of all documents must be done by Fubon Life authorized staff.

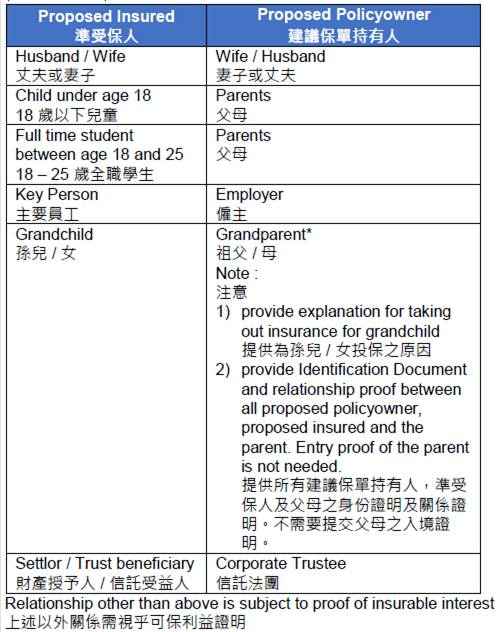

Policy Ownership

- If Proposed Insured is not the Proposed Policyowner, the third party policy will only be issued with an insurable interest is involved at the inception of the policy. Please refer to the below table for accepted relationship

(Updated: 12 Apr 2019)

- For Corporate Owner, the following items are required for reference only, please refer to Fubon Life Operation Manual Section 1.2.1 Part B Entity related documents (applicable to Corporate & Corporate Trustee) for the last updated requirement. (Updated: 19 Apr 2023)

1. Certified True Copy of Certificate of Incorporation

2. Certified True Copy of Business Registration Certificate

3. Certified True Copy of Memorandum and Articles of Association

4. Certified True Copy of Register of Directors

5. List of Directors and Certified True Copy of ID card/passport and address information of all directors by Supplementary Note

6. List of Shareholders and Certified True Copy of ID card/passport and address information of all principal shareholders (10% or above shareholding) by Supplementary Note

7. Detail of the ownership and structure control of the company

8. Certified True Copy of Board Resolution authorizing the entity into insurance contract and conferring authority to entity who can sign the policy (name, position, ID card no & residential address)

9. Certified True Copy of ID card/passport of the authorized person being authorized to sign the policy and address information by Supplementary Note

10. Certified True Copy of Certificate of Incumbency (issued within 6 months of application)

11. Certified True Copy of ID card/passport copy of ultimate principle beneficial owner who is ultimately controls the business and address information by Supplementary Note

12. Supplementary Note to declare type of issued shares (registered or bearer)

13. W9/W8 BEN-E for FATCA

14. Self-Certification Form – Entity/Controlling Person

15. Business Insurance Questionnaire (For Corporate)[B2]

16. Corporate Trustee Questionnaire (For Corporate Trustee) [C3]

17. Any other documents supporting the validity of the application.

Beneficiary Designation

- ŸInsurable interest must exist between the Proposed Insured and the beneficiary(ies). Please refer to the below table.

- Name, relationship, ID no. and share % of the beneficiary(ies) should be provided

- ID card copy is required for Fiancé/ Fiancée beneficiary designation.

| Proposed Insured | Beneficiary | Insurable Interest |

| Husband / Wife | Wife/Husband | Yes |

| Children / Parents | Parents / Children | Yes |

| Brothers / Sisters | Brothers / Sisters | Yes |

| Grandchildren / Grandparents | Grandparents / Grandchildren | Yes |

| Fiancé / Fiancée | Fiancée / Fiancé | Yes |

| Key Person | Employer | Yes |

| Settlor | Corporate Trustee | Yes |

General Rules of Affordability

- FNA is required for every application for new life insurance policy (including rider and top-up) while certain policies are explicitly categorized as exception, please refer details to HKFI Initiative on Financial Needs Analysis

- The premium payment ability should be assessed by customer disposable income and liquid assets.

- Income and/or asset approach can be applicable for regular premium payment (i.e. annual premium x premium term < (annual disposable income x stated percentage of disposable income x premium term**) + total net liquid assets)

- For single premium payment, asset approach to be applicable (i.e. single premium </= total net liquid assets).

** If premium term exceeds customer’s retirement age of 65, (65 – issue age) will be used instead of the original premium term.

FAQ / Supplementary guideline

Fubon Life Operation Manual (Updated: 28 Jul 2025)

Fubon Brokerage Service (For NB/CS/Product Inquiries)

Hotline: 2516-0196

Email: [email protected]